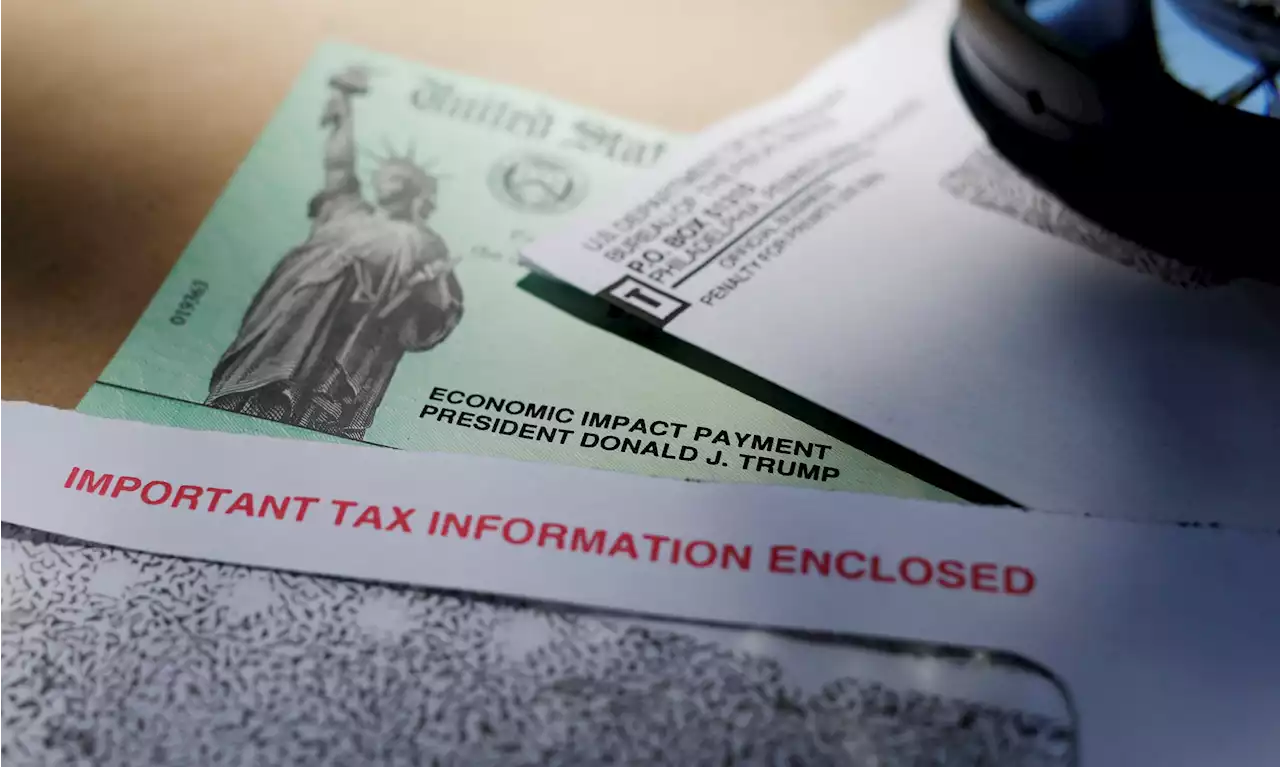

The IRS previously told taxpayers in states that awarded stimulus or tax refund checks to hold off filing tax returns until it could rule on whether the checks were taxable.

Taxpayers in 21 states can move forward with filing their tax returns after the Internal Revenue Service ruled that state stimulus checks are not taxable.

Seventeen of the states provided general welfare and disaster relief payments. Those states include Alaska, California, Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Maine, New Jersey, New Mexico, New York, Oregon, Pennsylvania and Rhode Island.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

IRS clears confusion over state stimulus payments in more than 20 statesThe IRS won't collect federal taxes against state-issued inflation relief payments or tax refunds, a reprieve for tens of millions of taxpayers.

IRS clears confusion over state stimulus payments in more than 20 statesThe IRS won't collect federal taxes against state-issued inflation relief payments or tax refunds, a reprieve for tens of millions of taxpayers.

Consulte Mais informação »

IRS reveals if you owe taxes on government relief checksThe IRS has determined whether state-issued rebate payments will count as taxable income for the 2022 tax season after telling taxpayers to delay filing.

IRS reveals if you owe taxes on government relief checksThe IRS has determined whether state-issued rebate payments will count as taxable income for the 2022 tax season after telling taxpayers to delay filing.

Consulte Mais informação »

IRS free file options: Your 2023 guide to free tax prep servicesThere are plenty of free tax prep services for seniors and low-income taxpayers. These programs include IRS Free File, VITA and TCE.

IRS free file options: Your 2023 guide to free tax prep servicesThere are plenty of free tax prep services for seniors and low-income taxpayers. These programs include IRS Free File, VITA and TCE.

Consulte Mais informação »

IRS won't tax most relief payments made by states last yearThe IRS says most relief checks issued by states last year won't be subject to federal taxes, providing late guidance as taxpayers have begun filing returns.

IRS won't tax most relief payments made by states last yearThe IRS says most relief checks issued by states last year won't be subject to federal taxes, providing late guidance as taxpayers have begun filing returns.

Consulte Mais informação »

IRS Won't Tax Most Relief Payments Made by States Last YearThe IRS announced Friday that most relief checks issued by states last year aren’t subject to federal taxes, providing 11th hour guidance as tax returns start to pour in.

IRS Won't Tax Most Relief Payments Made by States Last YearThe IRS announced Friday that most relief checks issued by states last year aren’t subject to federal taxes, providing 11th hour guidance as tax returns start to pour in.

Consulte Mais informação »

IRS says California's Middle Class Tax Refund will not have to be reported as taxableThe Internal Revenue Service will not require California residents to report a payment from the state as taxable when filing their taxes.

IRS says California's Middle Class Tax Refund will not have to be reported as taxableThe Internal Revenue Service will not require California residents to report a payment from the state as taxable when filing their taxes.

Consulte Mais informação »