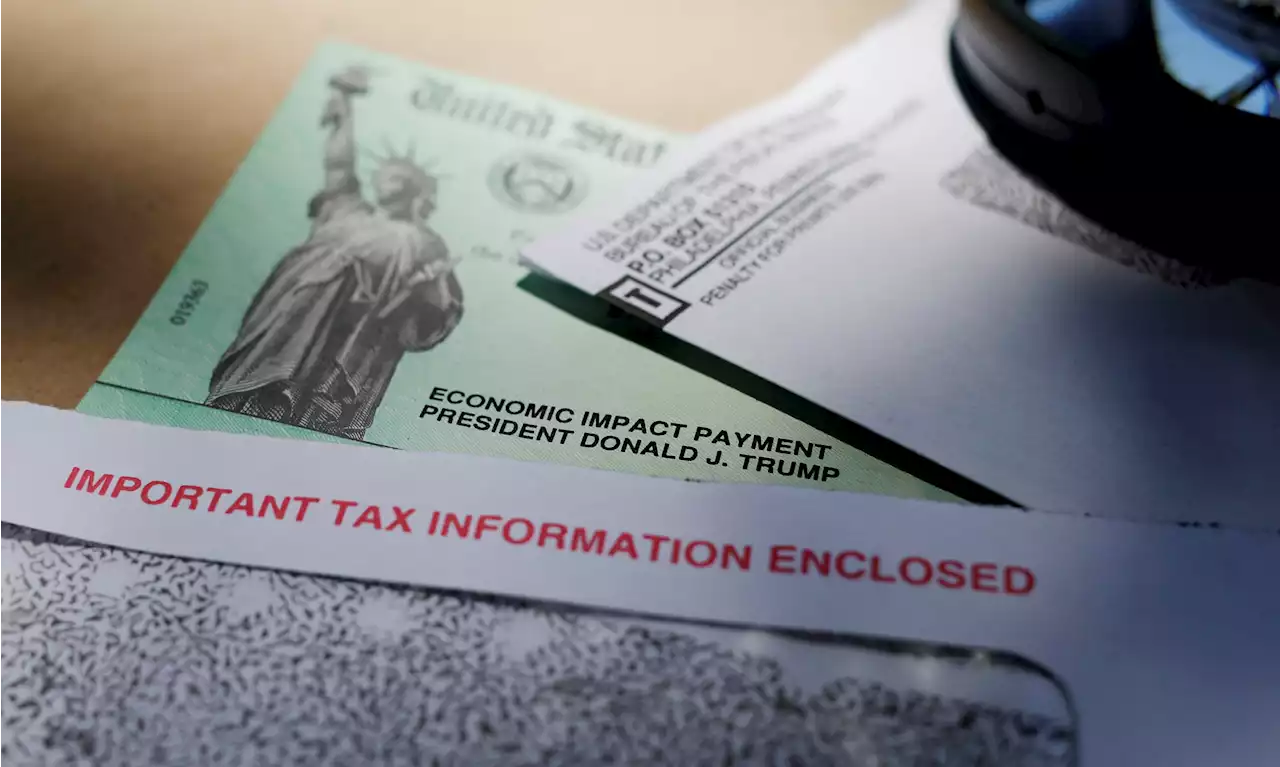

The IRS announced Friday that most relief checks issued by states last year aren’t subject to federal taxes, providing 11th hour guidance as tax returns start to pour in.

In addition, many taxpayers in Georgia, Massachusetts, South Carolina and Virginia also avoid federal taxes on state payments if they meet certain requirements, the IRS said.

A key question was whether the federal government would count those payments as income and require Californians to pay taxes on it. Many California taxpayers had delayed filing their 2022 returns while waiting for an answer. Friday, the IRS said it would not tax the refund.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

IRS won't tax California 'middle class tax relief' paymentsThe IRS announced Friday that most relief checks issued by states last year aren't subject to federal taxes, providing 11th hour guidance as tax returns start to pour in.

IRS won't tax California 'middle class tax relief' paymentsThe IRS announced Friday that most relief checks issued by states last year aren't subject to federal taxes, providing 11th hour guidance as tax returns start to pour in.

Consulte Mais informação »

IRS won’t tax most state inflation relief paymentsThe Internal Revenue Service will not collect federal taxes against state-issued inflation relief payments or tax refunds, the agency announced Friday, a reprieve for tens of millions of taxpayers who received the subsidies.

IRS won’t tax most state inflation relief paymentsThe Internal Revenue Service will not collect federal taxes against state-issued inflation relief payments or tax refunds, the agency announced Friday, a reprieve for tens of millions of taxpayers who received the subsidies.

Consulte Mais informação »

IRS says it won’t tax TABOR refunds after full-court press by Colorado officialsUpdate: The IRS sent an updated guidance Friday afternoon saying it wouldn’t touch TABOR payments — though it classified them as “general welfare and disaster relief payments,” and not state tax refunds.

IRS says it won’t tax TABOR refunds after full-court press by Colorado officialsUpdate: The IRS sent an updated guidance Friday afternoon saying it wouldn’t touch TABOR payments — though it classified them as “general welfare and disaster relief payments,” and not state tax refunds.

Consulte Mais informação »

11th hour guidance: IRS won’t tax most relief payments made by statesThe IRS announced Friday that most relief checks issued by states last year aren’t subject to federal taxes, providing 11th hour guidance as tax returns start to pour in.

11th hour guidance: IRS won’t tax most relief payments made by statesThe IRS announced Friday that most relief checks issued by states last year aren’t subject to federal taxes, providing 11th hour guidance as tax returns start to pour in.

Consulte Mais informação »

IRS won't tax most relief payments made by states last yearThe IRS says most relief checks issued by states last year won't be subject to federal taxes, providing late guidance as taxpayers have begun filing returns.

IRS won't tax most relief payments made by states last yearThe IRS says most relief checks issued by states last year won't be subject to federal taxes, providing late guidance as taxpayers have begun filing returns.

Consulte Mais informação »

IRS won’t tax most relief payments made by states last yearA week after telling payment recipients to delay filing returns, the IRS said it won’t challenge the taxability of payments related to general welfare and disaster. Taxpayers who received those checks won’t have to pay federal taxes on those payments.

IRS won’t tax most relief payments made by states last yearA week after telling payment recipients to delay filing returns, the IRS said it won’t challenge the taxability of payments related to general welfare and disaster. Taxpayers who received those checks won’t have to pay federal taxes on those payments.

Consulte Mais informação »