Insider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

While the macro-geopolitical environment is spurring countries to seek alternative currencies, there's long been uneasiness over the dollar's outsized dominance in global trade and finance.Here are three other reasons countries around the world are attempting to line up plans to possibly move away from a dollar-dominated world. The US is the issuer of the world's reserve currency, which is also the dominant currency in international trade and payments systems.

It also means that countries around the world have to tail US economic and monetary policies closely to avoid a spillover impact on their economies. Some countries, including India, have said that they are sick and tired of US monetary policies holding them hostage — going as far as to say that the US has been an irresponsible issuer of the world's reserve currencies.

is now pushing to use the Indian rupee for trade — a stance that is in with Indian Prime Minister Narendra Modi's vision for the currency.The greenback gaining strength against most currencies around the world is making imports far more expensive for emerging nations. In Argentina, political pressure and a decline in exports contributed to a fall in US-dollar reserves and pressured the Argentinian peso which, in turn,This has spurred Argentina to start paying for Chinese imports using yuan instead of US dollars, the nation's economy minister said on Wednesday,"A stronger USD would weaken its role as reserve currency," economists at Allianz, an international financial-services firm, wrote in...

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

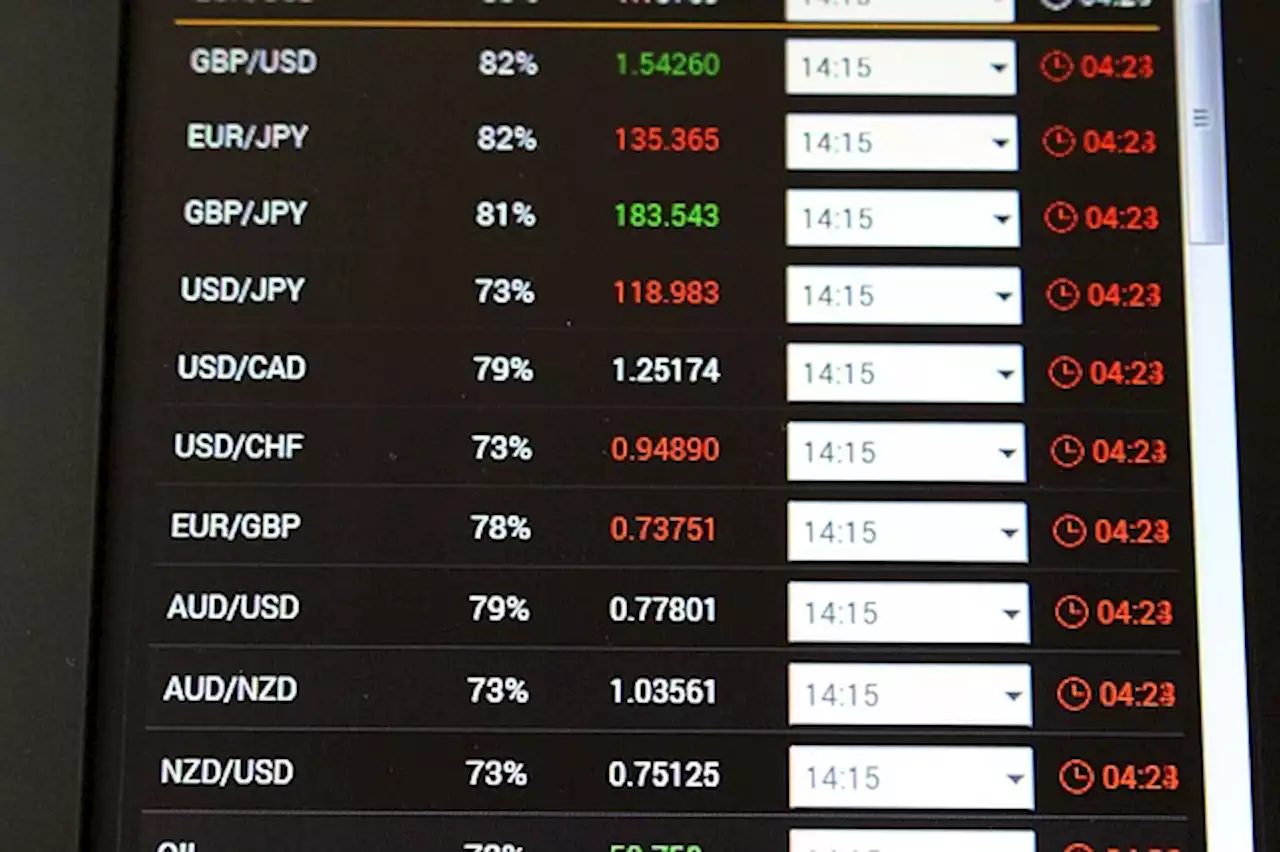

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Silver, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 23rd, 2022 here.

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Silver, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 23rd, 2022 here.

Consulte Mais informação »

Trading Support and Resistance \u2013 EUR/USD, USD/CADThis week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching.

Trading Support and Resistance \u2013 EUR/USD, USD/CADThis week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching.

Consulte Mais informação »

Weekly Forex Forecast \u2013 NASDAQ 100 Index, EUR/USD, USD/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Weekly Forex Forecast \u2013 NASDAQ 100 Index, EUR/USD, USD/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Consulte Mais informação »

GBP/USD: Weekly Forecast 23rd July - 29th JulyThe GBPUSD will begin trading tomorrow near 1.28520, which is a value the currency pair has not traversed in a sustained manner since the 10th of July- Forex Forecast

GBP/USD: Weekly Forecast 23rd July - 29th JulyThe GBPUSD will begin trading tomorrow near 1.28520, which is a value the currency pair has not traversed in a sustained manner since the 10th of July- Forex Forecast

Consulte Mais informação »

EUR/USD: Weekly Forecast 23rd July - 29th JulyThe ability of the EUR/USD to reach a high of nearly 1.12760 last Tuesday touched a value not seen since late February of 2022.

EUR/USD: Weekly Forecast 23rd July - 29th JulyThe ability of the EUR/USD to reach a high of nearly 1.12760 last Tuesday touched a value not seen since late February of 2022.

Consulte Mais informação »

USD/JPY oscillates around the 141.70 area ahead of BoJ, Fed rate decisionsThe USD/JPY pair consolidates in a narrow range in the early Asian session. The pair currently trades near the 141.74 area, down 0.06% on the day. Mar

USD/JPY oscillates around the 141.70 area ahead of BoJ, Fed rate decisionsThe USD/JPY pair consolidates in a narrow range in the early Asian session. The pair currently trades near the 141.74 area, down 0.06% on the day. Mar

Consulte Mais informação »