The EURUSD went into the weekend near its lows- Forex Forecast

to reach a high of nearly 1.12760 last Tuesday touched a value not seen since late February of 2022.

While day traders who remain bullish regarding the EUR/USD might be disappointed that support levels late last week were vulnerable, the downward movement in the currency pair is also a reminder that Forex is never a one-way avenue. Economic conditions are complex in the European Union where inflation and recessionary pressures are evident via data. The European Central Bank will issue its interest rate decision this coming Thursday, following Wednesday’s U.S Federal Reserve policy statement. Both the ECB and Fed are expected to raise their lending rates by 0.25% this week.

What financial institutions and speculators now want to know is the outlooks of the ECB and Fed. On the surface in consideration of current economic conditions in Europe it appears the European Central Bank will have to remain more aggressive than the U.S Fed over the next six months. This perception could continue to lead to incremental buying of the EUR/USD over the mid-term.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

EUR/USD could dip back towards the 1.1050 area on the Fed event risk – INGEconomists at ING analyze EUR/USD outlook ahead of the Fed meeting. Dollar could get a lift from hawkish Fed script With the market positioning itself

EUR/USD could dip back towards the 1.1050 area on the Fed event risk – INGEconomists at ING analyze EUR/USD outlook ahead of the Fed meeting. Dollar could get a lift from hawkish Fed script With the market positioning itself

Consulte Mais informação »

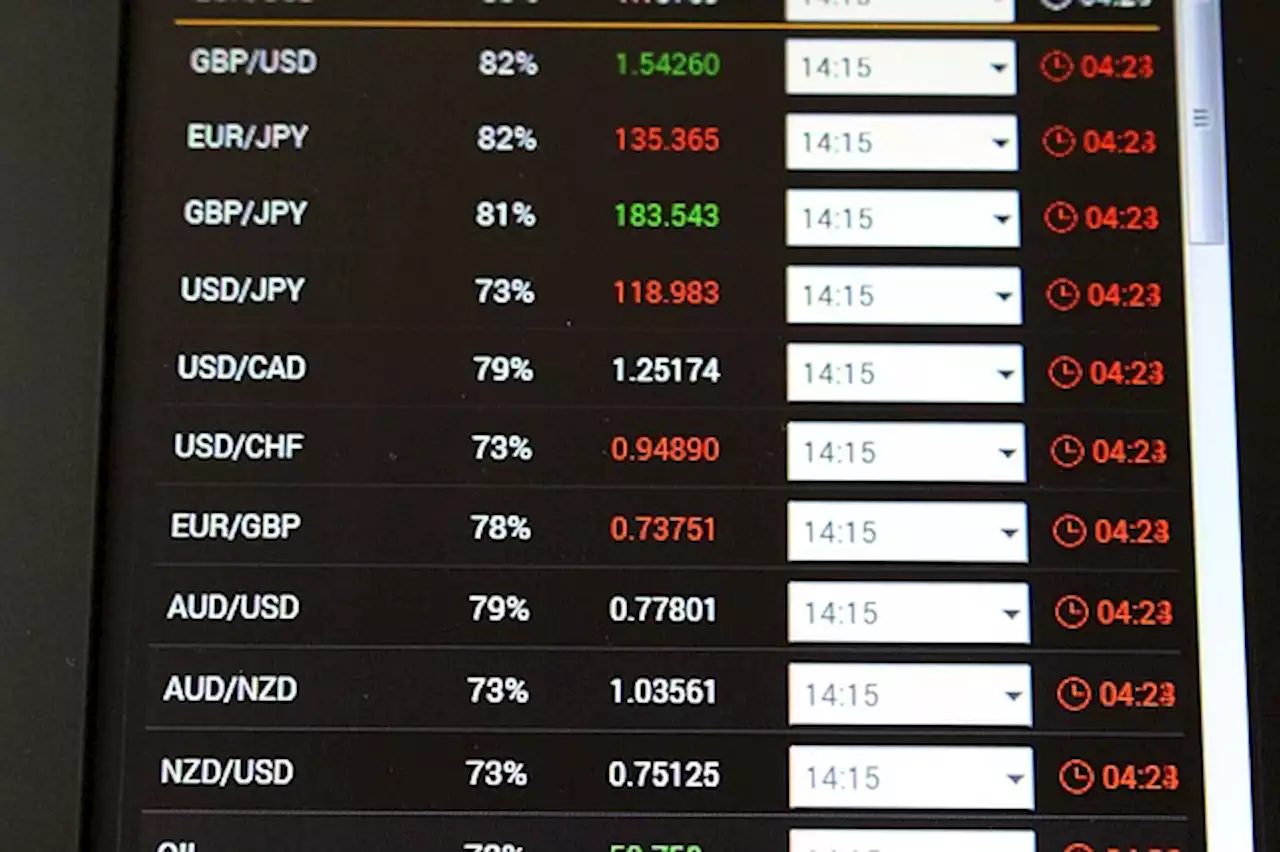

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Silver, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 23rd, 2022 here.

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Silver, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 23rd, 2022 here.

Consulte Mais informação »

Silver Price Analysis: XAG/USD drops amid USD strength, poised for a weekly declineAt the end of the week, the XAG/USD lost ground and is set to close a weekly loss following three weeks of gains. The USD measured by the DXY index, i

Silver Price Analysis: XAG/USD drops amid USD strength, poised for a weekly declineAt the end of the week, the XAG/USD lost ground and is set to close a weekly loss following three weeks of gains. The USD measured by the DXY index, i

Consulte Mais informação »

Euro Technical Outlook – A Retreat from Lofty Levels. Will EUR/USD Reverse?The Euro has pulled back from the 17-month peak seen last week against the US Dollar and could be at a critical juncture to decide if bearishness picks up, or the recent high gets retested.

Euro Technical Outlook – A Retreat from Lofty Levels. Will EUR/USD Reverse?The Euro has pulled back from the 17-month peak seen last week against the US Dollar and could be at a critical juncture to decide if bearishness picks up, or the recent high gets retested.

Consulte Mais informação »

ECB to ask banks to provide weekly liquidity data to monitor their health - EnriaThe European Central Bank (ECB) will ask banks to provide weekly liquidity data from September so that it can carry out more frequent checks on their ability to ward off potential shocks as interest rates rise, the ECB supervisory chief said on Saturday.

ECB to ask banks to provide weekly liquidity data to monitor their health - EnriaThe European Central Bank (ECB) will ask banks to provide weekly liquidity data from September so that it can carry out more frequent checks on their ability to ward off potential shocks as interest rates rise, the ECB supervisory chief said on Saturday.

Consulte Mais informação »