Global investors fleeing China have one simple message for the country's leadership: put prudence aside for a short while, and start spending big.

As they go from hope to disappointment and now capitulation, investors are losing patience with what they see as incoherent, slow and stingy measures by China to revive its sputtering economy and defuse a deepening property crisis.

"The only way out is to step up fiscal stimulus … because there is a lack of confidence, rate cuts are not doing enough to boost credit demand." Zhao finds the lack of a policy response to the weakening economy an "eerie reprisal of China’s stubborn zero-Covid policy", which lasted three years before being suddenly dismantled last December.

"To have a significant impact, to be a game changer for the economy, I think you will have to raise that by multiples of that amount," Ducrozet said, referring to last year's fundraising. UBS Bank estimates China's total government debt was 111 trillion yuan in 2022, the bulk of which is owed by struggling provincial governments. Yet, overall debt at 92% of what is the world's second-biggest economy is smaller than that in Japan or the United States.

Yan Wang, chief emerging markets and China strategist at Alpine Macro, says housing policies have eased but still aren't stimulative, given high down payment requirements and even interest rates. Commercial banks should be subsidised for lowering mortgage rates, he says.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Analysis: US bond yields surge despite muted inflation as investors look beyond FedA recent spike in U.S. bond yields has come alongside muted expectations for inflation, a sign to some bond fund managers that economic resilience and high bond supply are now playing a larger role than second-guessing the Federal Reserve.

Analysis: US bond yields surge despite muted inflation as investors look beyond FedA recent spike in U.S. bond yields has come alongside muted expectations for inflation, a sign to some bond fund managers that economic resilience and high bond supply are now playing a larger role than second-guessing the Federal Reserve.

Consulte Mais informação »

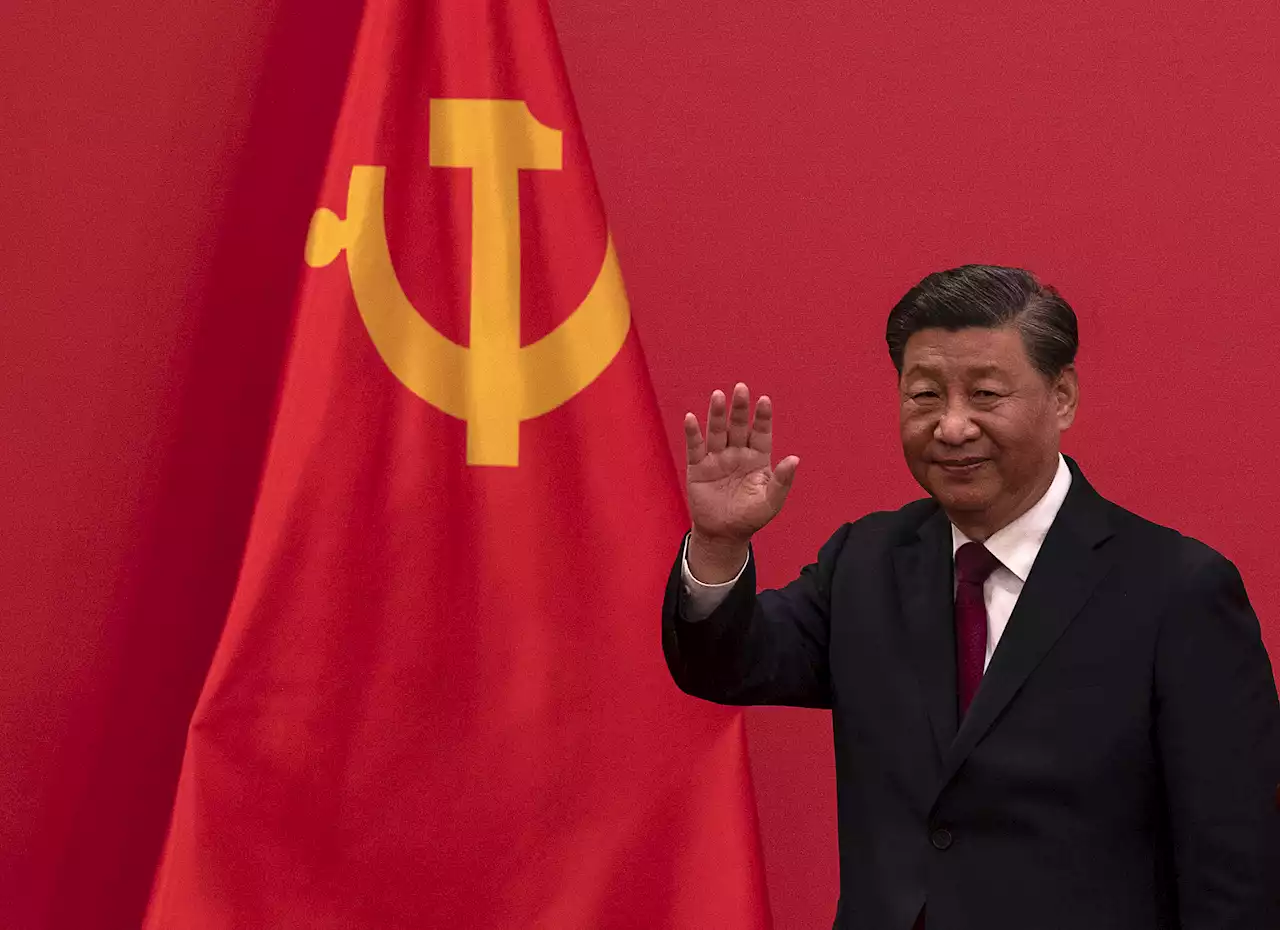

China stock markets down following Xi Jinping's power playInvestors appear to be concerned about Xi's precedent-breaking reappointment as China's leader.

China stock markets down following Xi Jinping's power playInvestors appear to be concerned about Xi's precedent-breaking reappointment as China's leader.

Consulte Mais informação »

CBS News analysis finds fewer Americans are expecting recession nowThe largest drop in pessimism about the economy since summer 2022 has come from Republicans.

CBS News analysis finds fewer Americans are expecting recession nowThe largest drop in pessimism about the economy since summer 2022 has come from Republicans.

Consulte Mais informação »

USD/CAD remains sideways above 1.3500 as investors eye Jackson Hole eventThe USD/CAD pair trades lackluster above 1.3500 as investors have sidelined ahead of the Jackson Hole Economic Symposium, which will start on Thursday

USD/CAD remains sideways above 1.3500 as investors eye Jackson Hole eventThe USD/CAD pair trades lackluster above 1.3500 as investors have sidelined ahead of the Jackson Hole Economic Symposium, which will start on Thursday

Consulte Mais informação »

The Arm IPO Will Test Investors’ AI ConvictionNow that the AI-driven tech rally has cooled slightly, investors will need to put their money where their mouth is.

The Arm IPO Will Test Investors’ AI ConvictionNow that the AI-driven tech rally has cooled slightly, investors will need to put their money where their mouth is.

Consulte Mais informação »

Money market funds hit record as investors jump at 5% returnsThe Fed's interest rate hikes have driven money market fund yields to their highest level in decades with balances at a record high as investors look to beat inflation.

Money market funds hit record as investors jump at 5% returnsThe Fed's interest rate hikes have driven money market fund yields to their highest level in decades with balances at a record high as investors look to beat inflation.

Consulte Mais informação »