With steeper tax rates expected in coming decades, traditional advice deserves another look.

Some money management truths are self-evident: Always set aside enough cash for emergencies. Diversify your portfolio. And maximize your contributions to tax-advantaged accounts such as a 401 or IRA.

Experts warn that tax rates will need to increase at some point to plug the federal budget deficit and fund Medicare and Social Security. Pre-retirees who diligently max out on their 401 contributions every year will probably face higher ordinary income tax rates in the future. “For clients in their late 40s and 50s, we sometimes limit the amount they put into their 401,” said JR Gondeck, an adviser in Boca Raton, Fla. “Instead, we shift some of that money into a [stock] index fund within a taxable brokerage account. A lot of people are surprised when we do that. It’s counterintuitive.”

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Why does TikTok hate the 401(k) so much?The social-media site is full of arguments against contributing to workplace plans, mostly in favor of (commissioned) life-insurance products.

Why does TikTok hate the 401(k) so much?The social-media site is full of arguments against contributing to workplace plans, mostly in favor of (commissioned) life-insurance products.

Consulte Mais informação »

46% of 401(k) investors are clueless about their investments, CNBC survey finds. That's not always badMost companies with a 401(k) plan automatically enroll workers, meaning even clueless workers may be saving reasonably well.

46% of 401(k) investors are clueless about their investments, CNBC survey finds. That's not always badMost companies with a 401(k) plan automatically enroll workers, meaning even clueless workers may be saving reasonably well.

Consulte Mais informação »

CEO spent his savings, 401(k) and paychecks to keep his cookware brand afloat—now it brings in $170 million a yearHexClad co-founders Danny Winer and Cole Mecray spent more than $500,000 of their own money to keep their company from going under. The struggle paid off.

CEO spent his savings, 401(k) and paychecks to keep his cookware brand afloat—now it brings in $170 million a yearHexClad co-founders Danny Winer and Cole Mecray spent more than $500,000 of their own money to keep their company from going under. The struggle paid off.

Consulte Mais informação »

CEO spent his savings, 401(k) and paychecks to keep his cookware brand afloat—now it brings in over $170 million a yearHexClad co-founders Danny Winer and Cole Mecray spent more than $500,000 of their own money to keep their company from going under. The struggle paid off.

CEO spent his savings, 401(k) and paychecks to keep his cookware brand afloat—now it brings in over $170 million a yearHexClad co-founders Danny Winer and Cole Mecray spent more than $500,000 of their own money to keep their company from going under. The struggle paid off.

Consulte Mais informação »

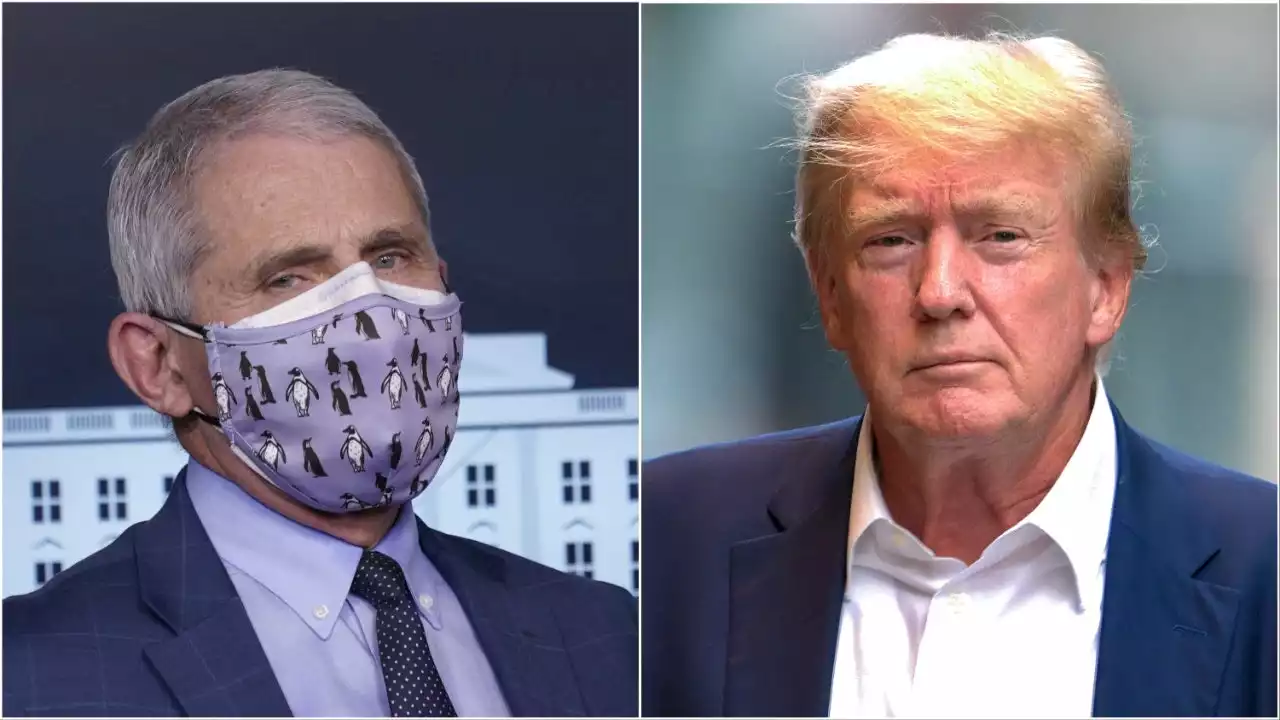

Trump: Fauci was not 'big player' in my administration, 'not allowed' to fire himFormer President Donald Trump said Wednesday that Dr. Anthony Fauci, the head of his COVID-19 response team, was not a 'big player' in his administration.

Trump: Fauci was not 'big player' in my administration, 'not allowed' to fire himFormer President Donald Trump said Wednesday that Dr. Anthony Fauci, the head of his COVID-19 response team, was not a 'big player' in his administration.

Consulte Mais informação »

Is financial stress hurting retirement savings? 4 in 10 workers with a 401(k) don't contribute, CNBC survey findsA CNBC Your Money Survey found 74% of Americans feel financial stress, up from 70% in April. Financial strain makes it hard for many to fund a retirement plan.

Is financial stress hurting retirement savings? 4 in 10 workers with a 401(k) don't contribute, CNBC survey findsA CNBC Your Money Survey found 74% of Americans feel financial stress, up from 70% in April. Financial strain makes it hard for many to fund a retirement plan.

Consulte Mais informação »