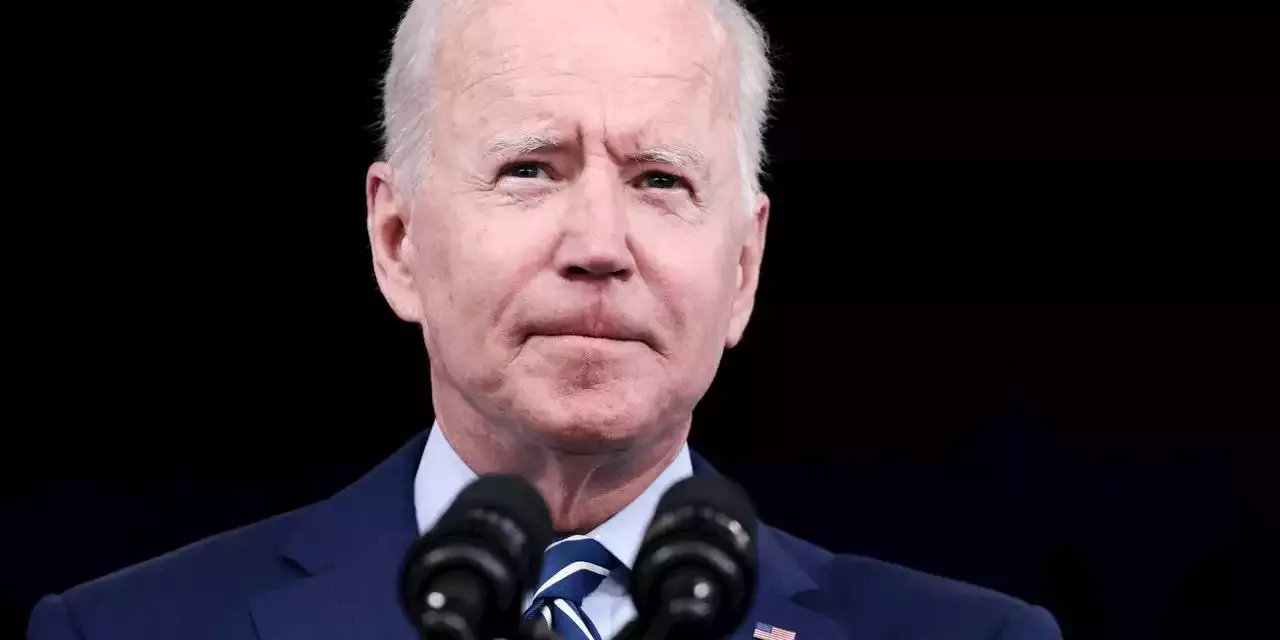

OPINION: A president’s approval rating is often inversely correlated with the stock market. Here’s why.

This question is not as off the wall as it might otherwise appear. Not only have researchers discovered a correlation between the stock market and presidential approval ratings, with one major exception that correlation is inverse. That would mean that what’s bad politically for Biden could be good for Wall Street.

The notion that exaggerated political beliefs might have an impact on the stock market traces to work conducted by Ned Davis Research. The firm has found that, except for when the presidential approval rating is particularly low , there is an inverse relationship between it and the return of the Dow Jones Industrial Average. DJIA, -1.30%

Why would a president’s approval rating be inversely correlated with the stock market? One plausible theory is that a high approval rating is associated with unrealistic expectations generally — not just politically but also in the markets. It’s not just Monday morning quarterbacking for me to point this out.

Today, in contrast, many have an equally exaggerated, but opposite, view of the political and economic environment. This may very well set up the preconditions for surprises to be on the upside in the coming year.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Last Sane Man on Wall StreetNathan Anderson made his name exposing — and betting against — corporate fraud. But short selling in a frothy pandemic economy can be ruinous. riceid reports

Last Sane Man on Wall StreetNathan Anderson made his name exposing — and betting against — corporate fraud. But short selling in a frothy pandemic economy can be ruinous. riceid reports

Consulte Mais informação »

Asia-Pacific markets set to track Wall Street declines; oil prices slip from highsAsia-Pacific markets were set to fall on Friday, tracking declines on Wall Street overnight.

Asia-Pacific markets set to track Wall Street declines; oil prices slip from highsAsia-Pacific markets were set to fall on Friday, tracking declines on Wall Street overnight.

Consulte Mais informação »

Japan's Nikkei Falls 2% as Asia-Pacific Stocks Track Wall Street Declines; Oil Slips From HighsAsia-Pacific Markets Set to Track Wall Street Declines; Oil Prices Slip From Highs

Japan's Nikkei Falls 2% as Asia-Pacific Stocks Track Wall Street Declines; Oil Slips From HighsAsia-Pacific Markets Set to Track Wall Street Declines; Oil Prices Slip From Highs

Consulte Mais informação »

Asian markets slide after more losses on Wall StreetShares were lower in Asia on Friday after a late afternoon sell-off wiped out gains for stocks on Wall Street.

Asian markets slide after more losses on Wall StreetShares were lower in Asia on Friday after a late afternoon sell-off wiped out gains for stocks on Wall Street.

Consulte Mais informação »

European stocks tumble, led by tech stocks, renewables after Wall Street routInvestors tracked losses across Asia and Wall Street, which suffered a late selloff, led by tech.

European stocks tumble, led by tech stocks, renewables after Wall Street routInvestors tracked losses across Asia and Wall Street, which suffered a late selloff, led by tech.

Consulte Mais informação »