Higher funding costs and unrealized bond losses on balance sheets have been effects.

For years, bank investors were itching for higher interest rates. They finally got them but it hasn’t gone as investors hoped.

“It worked because there was no competition on deposit rates,” Ramsey said. Even when rates climbed 2.25 percentage points between 2015 and 2018, banks weren’t pressured to pay their depositors more. That allowed banks to widen the spread between their interest-earning assets and interest paid on liabilities.

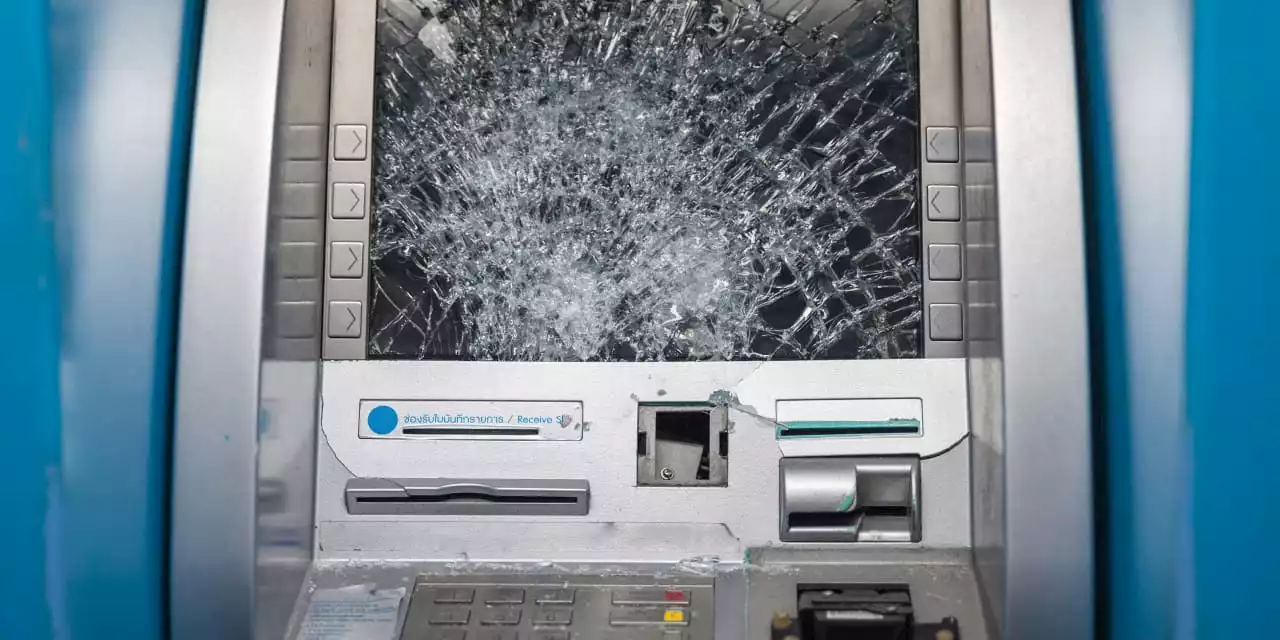

Beyond narrowing net interest income, banks have another problem: $558 billion in unrealized losses sitting on their balance sheets as of the close of the second quarter thanks to rapidly rising rates pushing down the value of their investment securities. If banks don’t pay their depositors more, they risk being forced to realize those paper losses if depositors flee all at once—a fate that led to the demise of Silicon Valley Bank, Signature Bank, and First Republic.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Investor enthusiasm for AI EFTs cools amid concerns over rising interest ratesInvestor interest in AI-focused exchange-traded funds (ETFs) has cooled down in recent months due to concerns about persistently high U.S. interest rates affecting company valuations.

Investor enthusiasm for AI EFTs cools amid concerns over rising interest ratesInvestor interest in AI-focused exchange-traded funds (ETFs) has cooled down in recent months due to concerns about persistently high U.S. interest rates affecting company valuations.

Consulte Mais informação »

Rising Rates Likely Hit Bank Balance Sheets in QuarterLenders need to pay up to keep depositors, pressuring earnings.

Rising Rates Likely Hit Bank Balance Sheets in QuarterLenders need to pay up to keep depositors, pressuring earnings.

Consulte Mais informação »

This week's personal loan interest rates see spike for 5-year loansThe latest trends in interest rates for personal loans from the Credible marketplace, updated weekly.

This week's personal loan interest rates see spike for 5-year loansThe latest trends in interest rates for personal loans from the Credible marketplace, updated weekly.

Consulte Mais informação »

Barr says biggest question for the Fed is how long to keep interest rates highFederal Reserve Gov. Michael Barr on Monday said the biggest challenge for the central bank is to decide how long to keep interest rates high to make sure...

Barr says biggest question for the Fed is how long to keep interest rates highFederal Reserve Gov. Michael Barr on Monday said the biggest challenge for the central bank is to decide how long to keep interest rates high to make sure...

Consulte Mais informação »

Fed's biggest question is how long to keep interest rates high, Barr saysThe central bank must decide how long to keep interest rates high to make sure inflation is tamed.

Fed's biggest question is how long to keep interest rates high, Barr saysThe central bank must decide how long to keep interest rates high to make sure inflation is tamed.

Consulte Mais informação »

Fed's Powell gets an earful about inflation and interest rates from small businessesFederal Reserve officials typically gather many of their insights and observations about the economy from some of the top Ph.D. economists in Washington.

Fed's Powell gets an earful about inflation and interest rates from small businessesFederal Reserve officials typically gather many of their insights and observations about the economy from some of the top Ph.D. economists in Washington.

Consulte Mais informação »