At the end of Labor Day week, it’s time to retire — that’s what National 401(k) Day is all about.

The Plan Sponsor Council of America created National 401 Day as a way to bring awareness to the employer-sponsored retirement account. The day is celebrated on the Friday after Labor Day in the U.S., because Americans start the week focused on labor and can end it with retirement, according to the council’s website. In recent years, the honorary day has transformed to focus on retirement plan education as well as financial wellness.

The council is celebrating this year’s National 401 Day with a theme called “Invest In You,” dedicated to “personal growth, understanding, and prioritization of financial health,” and has released tools and resources around retirement planning for companies to use with their employees.Not everyone has access to a 401 plan or a similar employer-sponsored retirement account.

These retirement accounts have, since the 1980s, slowly eclipsed the private pensions companies once offered their employees. Even the 401 plan creator, Ted Benna, said he had created “a monster” since they can be complex and come with hidden fees or the possibilities of bad investment management. Americans used to rely heavily on pensions to fund their retirements, but the onus is now on them to save enough and plan accordingly.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Why does TikTok hate the 401(k) so much?The social-media site is full of arguments against contributing to workplace plans, mostly in favor of (commissioned) life-insurance products.

Why does TikTok hate the 401(k) so much?The social-media site is full of arguments against contributing to workplace plans, mostly in favor of (commissioned) life-insurance products.

Consulte Mais informação »

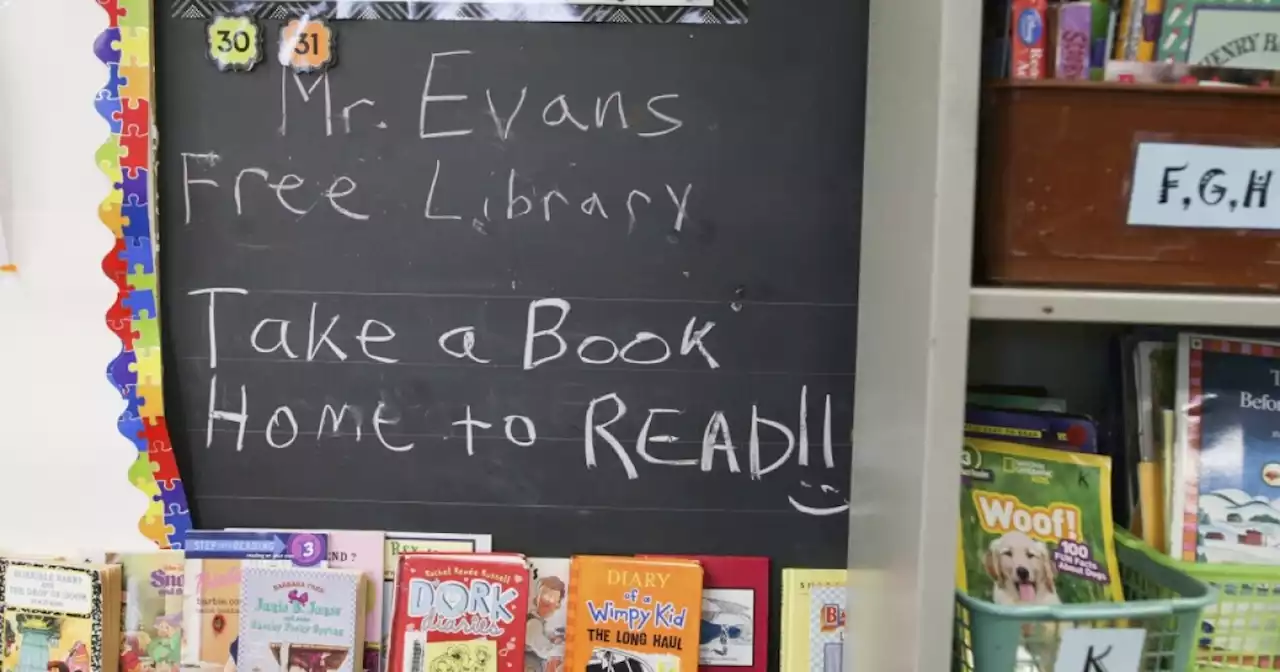

National Read a Book Day, a day to pick up a good bookAt a time when books are being viewed as controversial and libraries are threatened with being shut down, reading is more important than ever.

National Read a Book Day, a day to pick up a good bookAt a time when books are being viewed as controversial and libraries are threatened with being shut down, reading is more important than ever.

Consulte Mais informação »

Venice to launch 30-day trial of $5.40 entrance fee for day visitors in spring 2024Venice will try out an entrance fee for day trippers to the Italian municipality’s Old City for a 30-day period in spring 2024, city officials announced Tuesday.

Venice to launch 30-day trial of $5.40 entrance fee for day visitors in spring 2024Venice will try out an entrance fee for day trippers to the Italian municipality’s Old City for a 30-day period in spring 2024, city officials announced Tuesday.

Consulte Mais informação »

CEO spent his savings, 401(k) and paychecks to keep his cookware brand afloat—now it brings in $170 million a yearHexClad co-founders Danny Winer and Cole Mecray spent more than $500,000 of their own money to keep their company from going under. The struggle paid off.

CEO spent his savings, 401(k) and paychecks to keep his cookware brand afloat—now it brings in $170 million a yearHexClad co-founders Danny Winer and Cole Mecray spent more than $500,000 of their own money to keep their company from going under. The struggle paid off.

Consulte Mais informação »

CEO spent his savings, 401(k) and paychecks to keep his cookware brand afloat—now it brings in over $170 million a yearHexClad co-founders Danny Winer and Cole Mecray spent more than $500,000 of their own money to keep their company from going under. The struggle paid off.

CEO spent his savings, 401(k) and paychecks to keep his cookware brand afloat—now it brings in over $170 million a yearHexClad co-founders Danny Winer and Cole Mecray spent more than $500,000 of their own money to keep their company from going under. The struggle paid off.

Consulte Mais informação »

46% of 401(k) investors are clueless about their investments, CNBC survey finds. That's not always badMost companies with a 401(k) plan automatically enroll workers, meaning even clueless workers may be saving reasonably well.

46% of 401(k) investors are clueless about their investments, CNBC survey finds. That's not always badMost companies with a 401(k) plan automatically enroll workers, meaning even clueless workers may be saving reasonably well.

Consulte Mais informação »