If 2022 is the 2008 of crypto, how many years has it set back the cryptocurrency industry?

The FTX collapse was bad, but how bad? Almost from the moment that the Bahamas-based exchange suspended cryptocurrency withdrawals in early November — and three days before it filed for bankruptcy — the historic comparisons started flying.on Nov. 8 that FTX was “Lehman’s moment,” referencing the 2008 collapse of investment bank Lehman Brothers, which sparked a global financial panic. This analogy stuck, at least over the past four weeks.

It isn’t entirely clear, either, what is even meant by a “Lehman moment.” Does it refer to a sudden and unexpected financial collapse? Or does it mean a bankruptcy that sets off a domino effect — until an entire industry sector or even the global economy is shaken? Still, “spillover” to the real economy may not be what is meant by “Lehman moment” as currently used, Elvira Sojli, associate professor of finance at the University of New South Wales, told Cointelegraph:

“Enron was doing something plainly against the rules — laws and regulation — and Lehman Brothers was doing things according to laws and regulations, but the rules did not restrict wrongdoing,” said Halaburda. As for FTX, it is “an example of going against the rules that we already have, rather than rules being bad.”

The Sarbanes–Oxley Act of 2002 was passed in the U.S. to crack down on the kinds of accounting fraud that Enron and some of its contemporaries engaged in. Given that FTX’s unraveling followed the May collapse of Terra and later Celsius, it arguably “raises questions about the practices of other major players in the crypto sector,” Werbach suggested. A legislative solution could be coming.

As for the crypto sector post-FTX, “There will be consolidation and a lot of self regulation as well as some push for external regulation to these markets,” predicted Sojli.Why do we draw these historic likenesses — are they even useful?

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Bitcoin Hash Ribbon Metric Fails for the First Time Following FTX CrashThe metric flashed a buy signal a few months back but has failed to capitalize for the first time.

Bitcoin Hash Ribbon Metric Fails for the First Time Following FTX CrashThe metric flashed a buy signal a few months back but has failed to capitalize for the first time.

Consulte Mais informação »

Sam Bankman-Fried says he will testify before Congress on FTX collapseBut he might not make it to next week’s hearing.

Sam Bankman-Fried says he will testify before Congress on FTX collapseBut he might not make it to next week’s hearing.

Consulte Mais informação »

Solana (SOL) Attracts Fund Flows Second Week Straight for First Time Since FTX CollapseInvestors' interest in Solana revives as funds keep flowing into $SOL solana sol solanasol alameda sbf ftx ftt $ftt

Solana (SOL) Attracts Fund Flows Second Week Straight for First Time Since FTX CollapseInvestors' interest in Solana revives as funds keep flowing into $SOL solana sol solanasol alameda sbf ftx ftt $ftt

Consulte Mais informação »

FTX US insurer Relm 'confident' it will remain 'well-capitalized'The CEO of insurance company Relm, which has FTX.US among its clients, said that the firm should remain 'well-capitalized.'

FTX US insurer Relm 'confident' it will remain 'well-capitalized'The CEO of insurance company Relm, which has FTX.US among its clients, said that the firm should remain 'well-capitalized.'

Consulte Mais informação »

The wheels of FTX justice turn slowlyWhy hasn't Sam Bankman-Fried been arrested?

The wheels of FTX justice turn slowlyWhy hasn't Sam Bankman-Fried been arrested?

Consulte Mais informação »

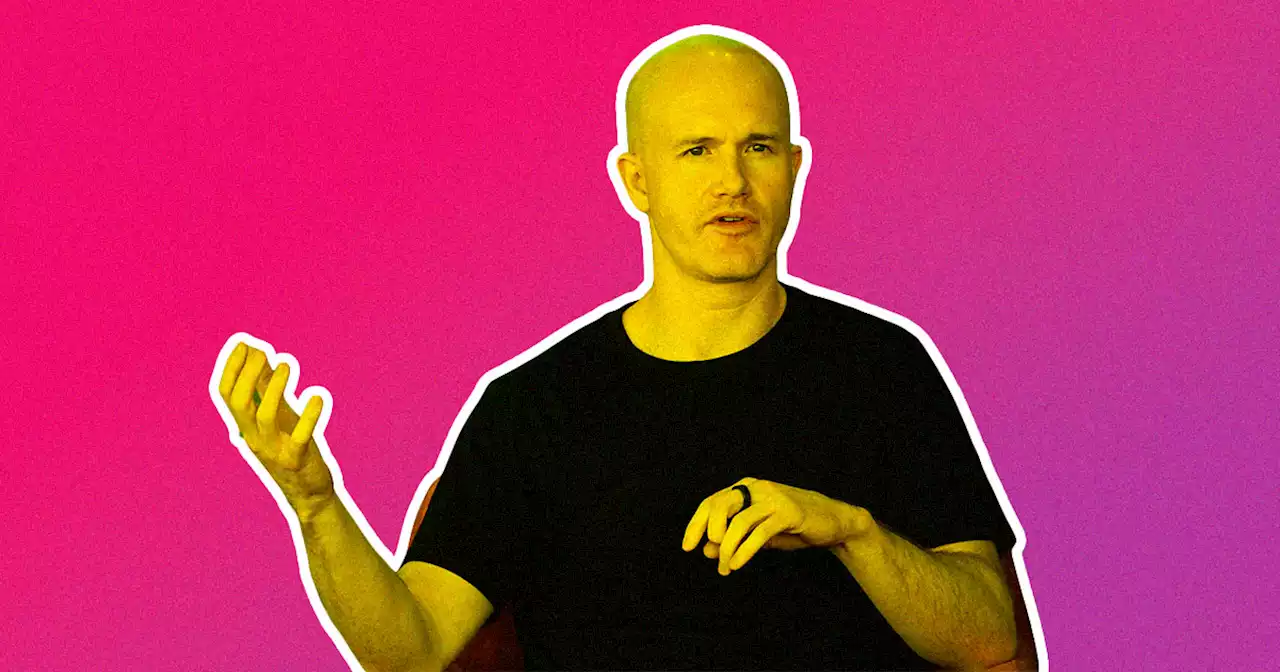

Coinbase CEO Says Only a 'Gullible Person' Wouldn't Think FTX Stole User FundsCoinbase CEO Brian Armstrong says former FTX CEO Sam Bankman-Fried stole 'customer money used in his hedge fund, plain and simple.'

Coinbase CEO Says Only a 'Gullible Person' Wouldn't Think FTX Stole User FundsCoinbase CEO Brian Armstrong says former FTX CEO Sam Bankman-Fried stole 'customer money used in his hedge fund, plain and simple.'

Consulte Mais informação »