$USDJPY - The US Holiday Weakens the Appetite of Investors

Overall the Japanese economy is doing well. Its stock market has become one of the best-performing in the world. Its major indices such as the Topix and Nikkei 225 jumped to the highest level in more than three decades as foreign investors piled on. Additional data shows that the Japanese economy is recovering. The latest figures showed that Japanese retail sales jumped 5.7% in May after rising 5.15% in the previous month.

More data showed that household confidence in the country improved to 36.2 from 36 previously. This is an important figure because consumer spending is an important component of the Japanese economy. There are signs that the Bank of Japan will begin to tighten in the near term. In a soon-to-be-announced statement, New Bank of Japan Governor Kazuo Ueda said the bank could begin to normalize policy in the near term if it becomes confident that inflation will pick up in 2024. Inflation remains below 2% but is on the rise.

The USD/JPY currency pair also jumped after signs that the Japanese government will intervene if the Japanese currency continues to decline. For his part, the Finance Minister said in a statement that the government is closely monitoring the currency. In another statement, Masanda Kato, the country's currency diplomat, said the government would not rule out interventions.

It started the year at 126 and has now risen to 145 resistance. Recently, the pair moved above the important resistance at 138, the high of March 7th.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

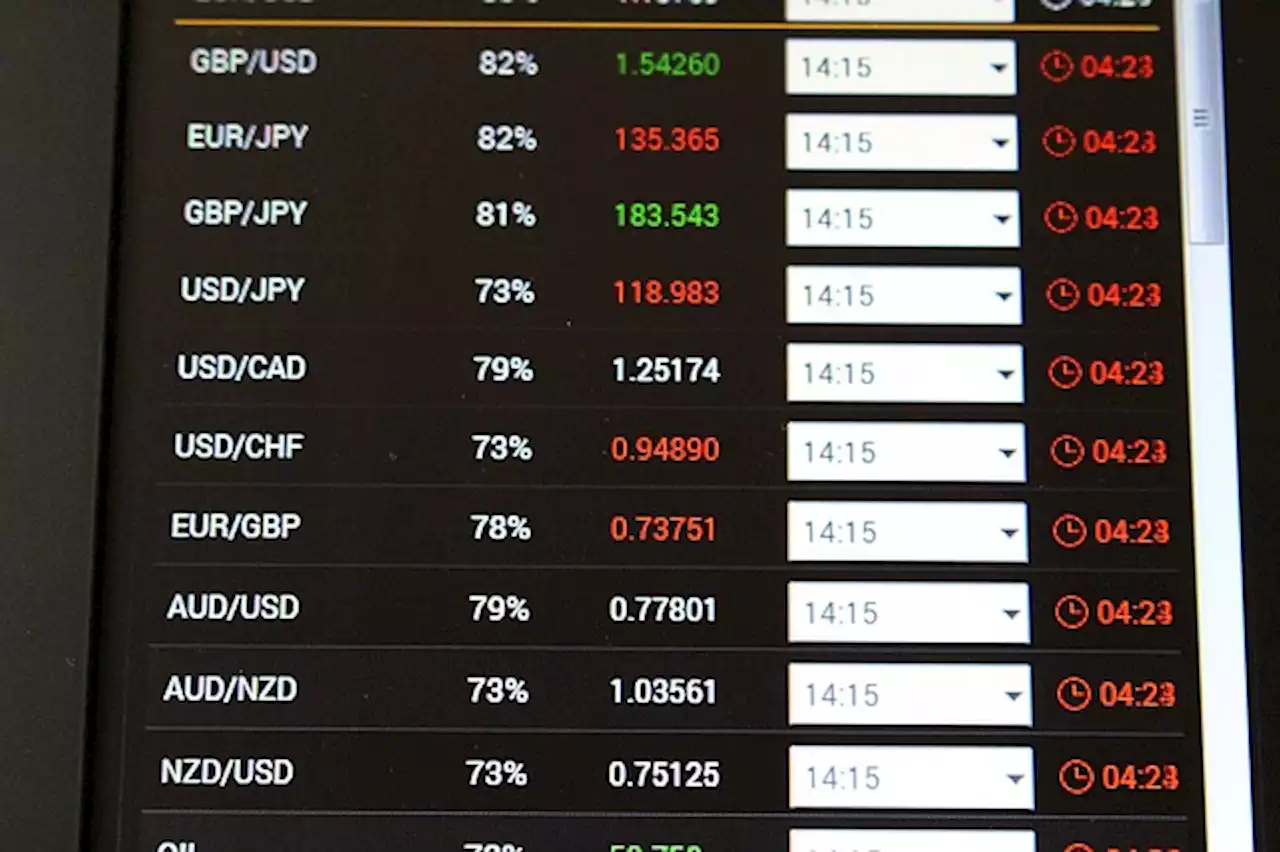

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, EUR/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, EUR/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Consulte Mais informação »

Pairs in Focus This Week\u2013 EUR/USD, GBP/USD, USD/CAD, USD/JPYGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 2nd, 2022 here.

Pairs in Focus This Week\u2013 EUR/USD, GBP/USD, USD/CAD, USD/JPYGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 2nd, 2022 here.

Consulte Mais informação »

USD/JPY Signal: Potential Buying Opportunity TodayThe US dollar initially attempted to rally during Friday, but profit-taking activities dominated the market as traders sought to capitalize on recent gains.

USD/JPY Signal: Potential Buying Opportunity TodayThe US dollar initially attempted to rally during Friday, but profit-taking activities dominated the market as traders sought to capitalize on recent gains.

Consulte Mais informação »

USD/JPY sticks to strong intraday gains, remains below 145.00/YTD top set on FridayThe USD/JPY pair regains strong positive traction on the first day of a new week and reverses a major part of Friday's pullback from its highest level

USD/JPY sticks to strong intraday gains, remains below 145.00/YTD top set on FridayThe USD/JPY pair regains strong positive traction on the first day of a new week and reverses a major part of Friday's pullback from its highest level

Consulte Mais informação »

USD/JPY aims to recapture 145.00 as US Manufacturing PMI hogs limelightThe USD/JPY pair is looking to recapture the previous week’s high of 145.00 in the early London session. The asset is broadly having strength despite

USD/JPY aims to recapture 145.00 as US Manufacturing PMI hogs limelightThe USD/JPY pair is looking to recapture the previous week’s high of 145.00 in the early London session. The asset is broadly having strength despite

Consulte Mais informação »

USD/JPY remains on the defensive, below mid-144.00s on Japan intervention fearsThe USD/JPY pair comes under some selling pressure on Tuesday and reverses a major part of the previous day's positive move back closer to the 145.00

USD/JPY remains on the defensive, below mid-144.00s on Japan intervention fearsThe USD/JPY pair comes under some selling pressure on Tuesday and reverses a major part of the previous day's positive move back closer to the 145.00

Consulte Mais informação »