USD/CAD marches towards 1.3400 as oil bulls take a breather, Fed Minutes eyed – by anilpanchal7 USDCAD Oil Fed RiskAppetite Currencies

ur sentiment, as well as a pause in the WTI crude oil’s recovery moves. However, a cautious mood ahead of the key data/events challenges the pair buyers.fades the previous day’s optimism as headlines suggesting a jump in China’s Covid numbers joined the Reserve Bank of New Zealand’s utterly hawkish move to suggest that the global central banks aren’t out of steam.

While portraying the mood, S&P 500 Futures print mild losses while the US 10-year Treasury yields struggle for clear directions near 3.75%.seesaw around $81.00 after bouncing off a 10-month low the previous day. The black gold rose the previous day amid fears of a supply crunch and talks of the oil price cap, as well as Saudi Arabia’s rejection to support the OPEC+ output increase signals.

On Tuesday, firmer sentiment and recovery in oil prices favored the USD/CAD bears. On the same line could be the upbeat prints of Canada’s Retail Sales for September. In doing so, the Loonie pair ignored firmer US data and hawkish comments from the US Federal Reserve officials.

Moving on, USD/CAD is likely to witness a sluggish day amid the market’s pre-event fears. However, traders will pay major attention to the oil fundamentals and theA clear U-turn from the 21-DMA hurdle of 1.3466, as well as a downside break of the one-week-old ascending trend line, currently around 1.3390, keeps the

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

USD/CAD reaches 1.3495 but drops as Oil price recovers, amidst Fed hawkish rhetoricUSD/CAD reaches 1.3495 but drops as Oil price recovers, amidst Fed hawkish rhetoric – by christianborjon USDCAD Majors Macroeconomics Technical Analysis

USD/CAD reaches 1.3495 but drops as Oil price recovers, amidst Fed hawkish rhetoricUSD/CAD reaches 1.3495 but drops as Oil price recovers, amidst Fed hawkish rhetoric – by christianborjon USDCAD Majors Macroeconomics Technical Analysis

Consulte Mais informação »

NZD/USD marches past 0.6100 amid US Dollar pullback, RBNZ, Fed Minutes eyedNZD/USD refreshes intraday high around 0.6125 as it pares the biggest daily loss in a fortnight during early Wednesday. In doing so, the Kiwi pair ign

NZD/USD marches past 0.6100 amid US Dollar pullback, RBNZ, Fed Minutes eyedNZD/USD refreshes intraday high around 0.6125 as it pares the biggest daily loss in a fortnight during early Wednesday. In doing so, the Kiwi pair ign

Consulte Mais informação »

Retailers disclose earnings, possible rail strike, Fed minutes and more: Tuesday's 5 things to knowEvents to watch heading into Tuesday include 3Q earnings reports by retailers, Wednesday's Federal Reserve minutes release and a possible rail strike update.

Retailers disclose earnings, possible rail strike, Fed minutes and more: Tuesday's 5 things to knowEvents to watch heading into Tuesday include 3Q earnings reports by retailers, Wednesday's Federal Reserve minutes release and a possible rail strike update.

Consulte Mais informação »

What stock-market investors will be looking for in the Fed minutesInvestors want clues on how high the benchmark interest rate needs to go and how long it will stay there.

What stock-market investors will be looking for in the Fed minutesInvestors want clues on how high the benchmark interest rate needs to go and how long it will stay there.

Consulte Mais informação »

Stock futures are little changed as investors look ahead to Fed meeting minutesInvestors are searching for signals the central bank will ease the pace of future interest rate hikes.

Stock futures are little changed as investors look ahead to Fed meeting minutesInvestors are searching for signals the central bank will ease the pace of future interest rate hikes.

Consulte Mais informação »

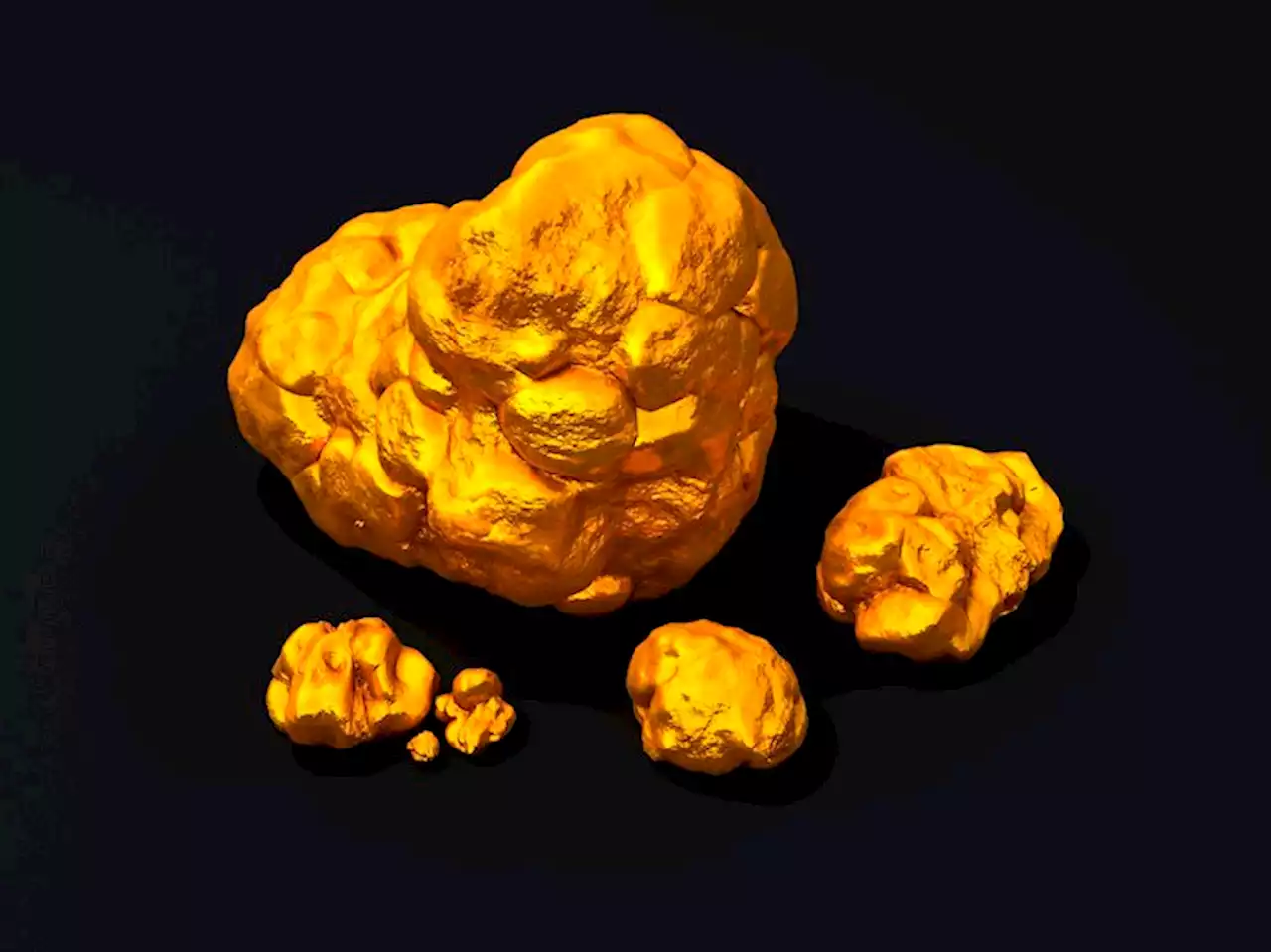

Gold Price Forecast: XAU/USD grinds near $1,750 as key US data, Fed Minutes loomGold price (XAU/USD) steadies around $1,740 after pushing back the bears the previous day. In doing so, the yellow metal portrays the typical pre-even

Gold Price Forecast: XAU/USD grinds near $1,750 as key US data, Fed Minutes loomGold price (XAU/USD) steadies around $1,740 after pushing back the bears the previous day. In doing so, the yellow metal portrays the typical pre-even

Consulte Mais informação »