So a couple of notable comments Powell made yesterday. He was very positive on the labour market, so much so that he stated “there is quite a bit of room to raise rates without dampening employment”. Get your market update from JMcQueenFX here:

A very hawkish press conference from Chair Powell, perhaps a surprise to some , in light of the recent rout we have seen in the last two weeks, in response to tightening financial conditions, which I believed Powell would take note of, allowing for a hawkish disappointment. Instead, we saw the opposite with the Fed Chair unperturbed by recent market volatility, endorsing the tightening of financial conditions.

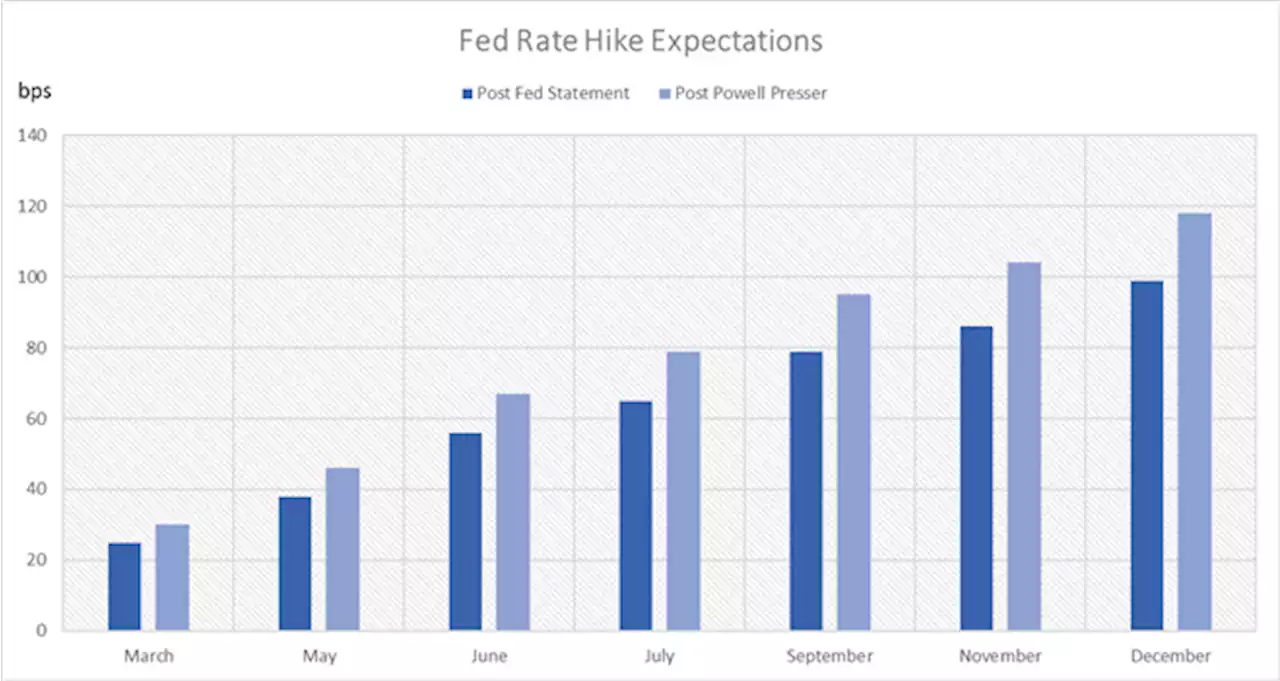

When asked about moving 50bps, the Fed Chair responded by stating that the Fed has not made any decision on the size of rate increases. In other words, not explicitly ruling out a 50bps and thus money markets have priced in 30bps worth of tightening in March. However, for now, I still expect a 25bps rate liftoff.

Elsewhere, the Fed Chair did not rule out a rate hike at every meeting, which in turn has prompted the market to price in near enough 5 rate hikes this year. Very aggressive indeed, emphasising Powell’s uber hawkish presser. The outlook is far from uncertain and will be impacted by upcoming data, which recently soured. Perhaps due to the impact of Omicron, but something to keep an eye out on.

As such, if a UK portfolio manager holds US Dollar-denominated assets and seeks to hedge FX risk, then a monthly rise in the value of those assets will lead to more dollar hedging . For example, if equities are FX hedged and US stocks (

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Fed Preview: Three ways Powell could out-dove markets, dealing a blow to the dollarHas fear of the Fed gone too far? Hints about the next move are even more critical. The Fed is set to refrain from an early end to tapering, in order not to rock the boat. US Preview FX Forex

Fed Preview: Three ways Powell could out-dove markets, dealing a blow to the dollarHas fear of the Fed gone too far? Hints about the next move are even more critical. The Fed is set to refrain from an early end to tapering, in order not to rock the boat. US Preview FX Forex

Consulte Mais informação »

Forex Today: Dollar rallies, global stocks plunge, focus shifts to US GDP dataHere is what you need to know on Thursday, January 27: FOMC Chairman Jerome Powell's hawkish remarks late Wednesday triggered a dollar rally and weigh

Forex Today: Dollar rallies, global stocks plunge, focus shifts to US GDP dataHere is what you need to know on Thursday, January 27: FOMC Chairman Jerome Powell's hawkish remarks late Wednesday triggered a dollar rally and weigh

Consulte Mais informação »

USD/MXN at monthly highs above 20.70 as US dollar jumpsThe USD/MXN soared to 20.80, reaching the highest level in five weeks earlier on Thursday, boosted by a stronger US dollar across the board. The green

USD/MXN at monthly highs above 20.70 as US dollar jumpsThe USD/MXN soared to 20.80, reaching the highest level in five weeks earlier on Thursday, boosted by a stronger US dollar across the board. The green

Consulte Mais informação »

US Dollar Index Forecast, News and Analysis - FXStreetCheck our updated News for US Dollar Index including real time updates, technical analysis forecast and the economic latest events from the best source of Forex trusted News.

US Dollar Index Forecast, News and Analysis - FXStreetCheck our updated News for US Dollar Index including real time updates, technical analysis forecast and the economic latest events from the best source of Forex trusted News.

Consulte Mais informação »

US Dollar Index to reach the 97.00 level on removal of 96.50 – SocGenThe US Dollar Index (DXY) has rebounded after dipping towards interim support of 94.60/94.50 representing the peak of October and has reached its high

US Dollar Index to reach the 97.00 level on removal of 96.50 – SocGenThe US Dollar Index (DXY) has rebounded after dipping towards interim support of 94.60/94.50 representing the peak of October and has reached its high

Consulte Mais informação »