US Dollar Index: DXY extends post-NFP advances past 104.00 ahead of US ISM Services PMI – by anilpanchal7 DollarIndex PMI RiskAversion Fed NFP

by 339K versus 190K expected and 294K prior . It’s worth noting, however, that the Unemployment Rate also rose to 3.7% from 3.4% prior, versus 3.5% market forecasts. It should be noted, that the Average Hourly Earnings eased whereas the Labor Force Participation Rate remain the same as previous.

On the contrary, US President Joe Biden signed the debt-ceiling bill and avoided the ‘catastrophic’ default. Also negative for the DXY were concerns suggesting slower rate hikes from the major central banks. Furthermore, the global rating agencies remain cautious about the US financial market credibility and prod the US Dollar despite the price-positive move on Friday.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

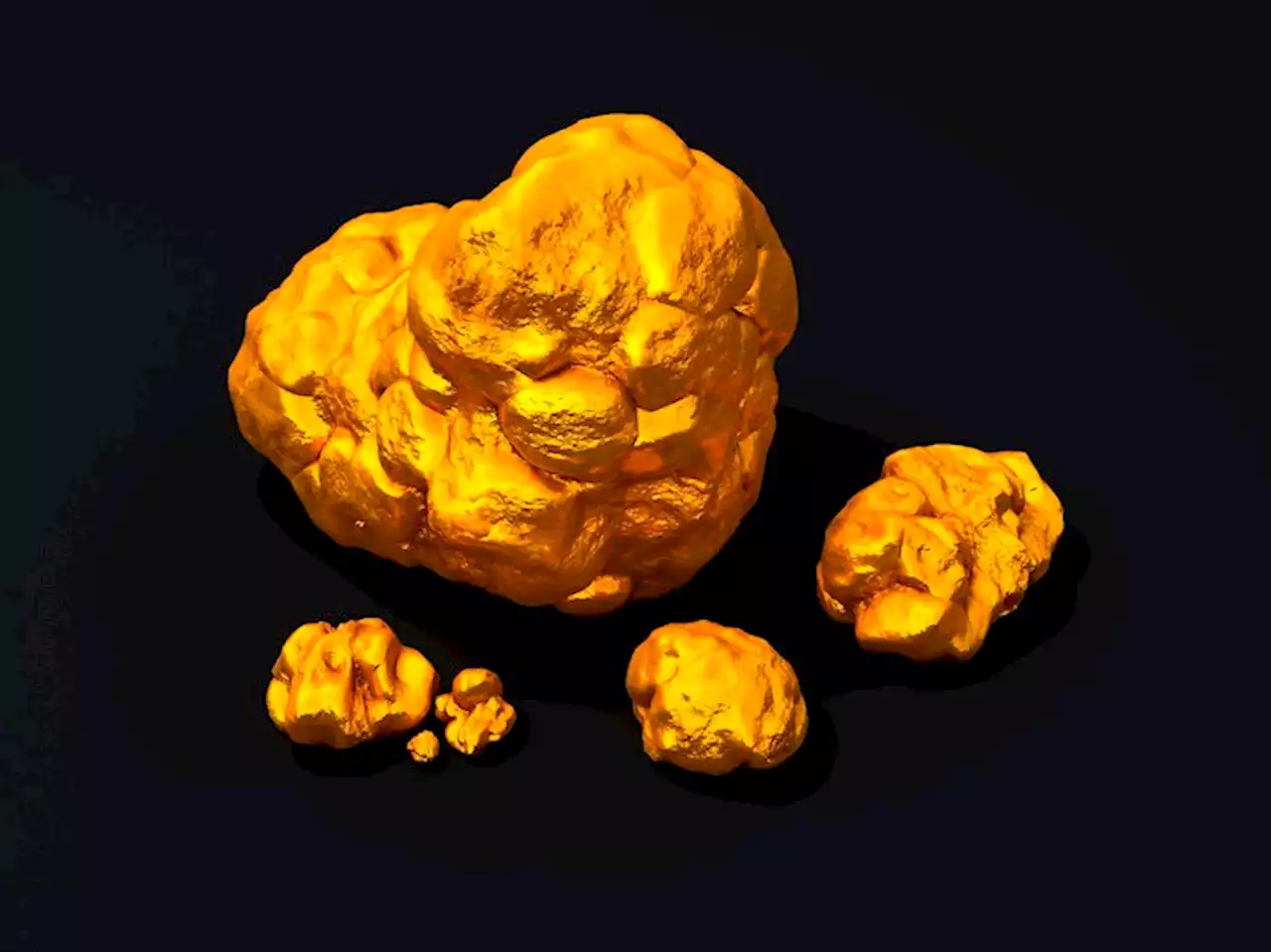

Gold Price Forecast: XAU/USD downside appears difficult even as US NFP favors Fed hawksGold Price (XAU/USD) bears the burden of fresh hawkish Federal Reserve (Fed) calls, especially after the strong United States Nonfarm Payrolls (NFP),

Gold Price Forecast: XAU/USD downside appears difficult even as US NFP favors Fed hawksGold Price (XAU/USD) bears the burden of fresh hawkish Federal Reserve (Fed) calls, especially after the strong United States Nonfarm Payrolls (NFP),

Consulte Mais informação »

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, GBP/USDThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week.

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, GBP/USDThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week.

Consulte Mais informação »

Next recession watch: Dollar General, Macy's cuts show slowing spendingInsider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

Consulte Mais informação »

Cuban President: Ditching US Dollar Frees Countries From Sanctions and Aggression – Economics Bitcoin NewsCuba's president says the dollar's global reserve currency status enables the U.S. to pursue an “aggressive hegemonistic policy.' dedollarization BRICS

Cuban President: Ditching US Dollar Frees Countries From Sanctions and Aggression – Economics Bitcoin NewsCuba's president says the dollar's global reserve currency status enables the U.S. to pursue an “aggressive hegemonistic policy.' dedollarization BRICS

Consulte Mais informação »

Dollar dominance could give way to new a regime with euro, yuan, CBDCsDollar dominance could give way to a new regime that includes the euro, yuan, CBDCs, and maybe something 'we have yet to see'

Consulte Mais informação »