Investors flock in droves to the safety of bonds on Monday in a manner not seen since the days that followed the 1987 stock-market crash.

Investors flocked in droves to the safety of Treasurys on Monday in a manner not seen since the days that followed the 1987 stock-market crash, after the sudden closure of two banks and banking regulators stepping in over the weekend to fully protect their deposits.

On Monday, the 2-year rate was also poised for its biggest one-day drop since the 2007-2008 global financial crisis, while the 10-year yield BX:TMUBMUSD10Y headed for its largest three-day decline since that era. According to Buchanan, what had markets so unnerved early on was that regulators’ actions went “a long way” toward protecting depositors, but not equity shareholders or bondholders.

Archives: It’s the 35th anniversary of the 1987 stock-market crash: What investors can learn from ‘Black Monday’

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Celebrate The Ferrari Testarossa With Stunning Collection Of Five 'Black On Black' Examples | CarscoopsCelebrate The Ferrari Testarossa With Stunning Collection Of Five 'Black On Black' Examples | Carscoops carscoops

Celebrate The Ferrari Testarossa With Stunning Collection Of Five 'Black On Black' Examples | CarscoopsCelebrate The Ferrari Testarossa With Stunning Collection Of Five 'Black On Black' Examples | Carscoops carscoops

Consulte Mais informação »

New Black Student Unions in Plano high schools allow ‘true authentic Black self’At Plano Senior High School and Plano West High School, Black students connect with each other over shared experiences.

New Black Student Unions in Plano high schools allow ‘true authentic Black self’At Plano Senior High School and Plano West High School, Black students connect with each other over shared experiences.

Consulte Mais informação »

2-year Treasury yield tumbles as investors assess the state of the economy following SVB falloutU.S Treasury yields declined on Monday as investors assessed the state of the economy after the collapse of Silicon Valley Bank.

2-year Treasury yield tumbles as investors assess the state of the economy following SVB falloutU.S Treasury yields declined on Monday as investors assessed the state of the economy after the collapse of Silicon Valley Bank.

Consulte Mais informação »

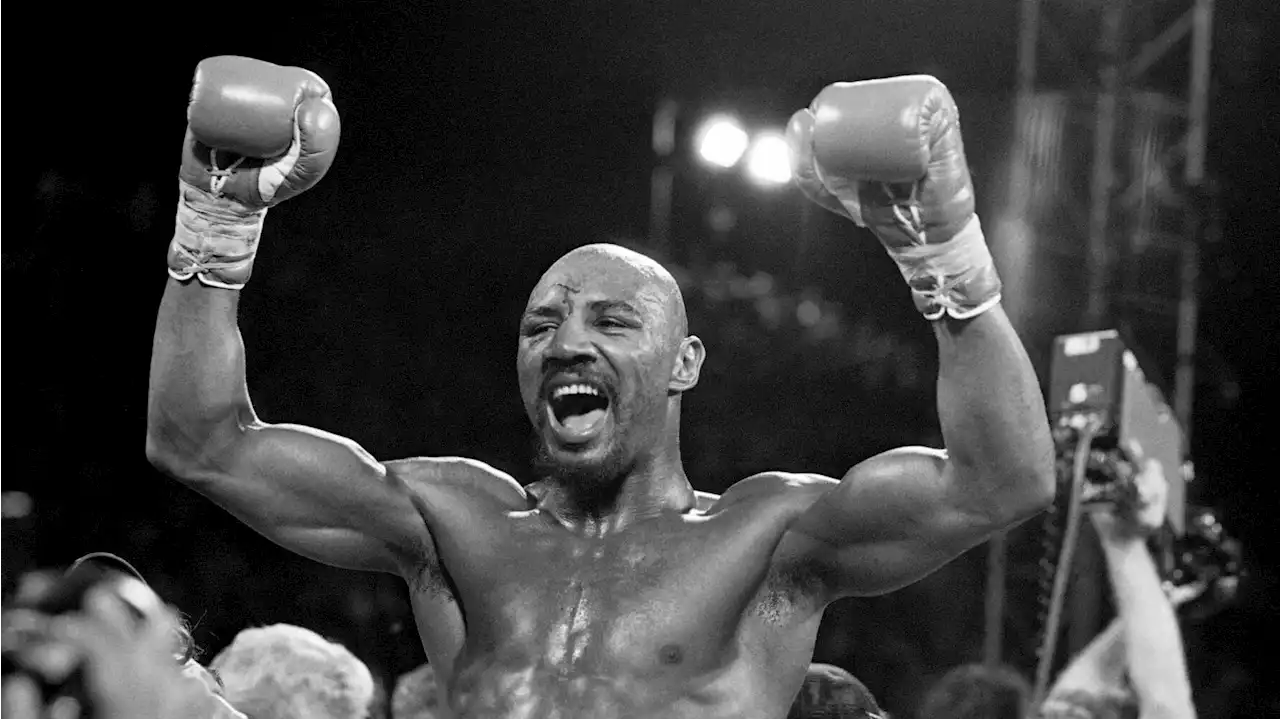

Today in history: March 13One year ago: Marvelous Marvin Hagler, the middleweight boxing great whose title reign and career ended with a split-decision loss to “Sugar” Ray Leonard in 1987, died at age 66 at his New Hampshire home.

Today in history: March 13One year ago: Marvelous Marvin Hagler, the middleweight boxing great whose title reign and career ended with a split-decision loss to “Sugar” Ray Leonard in 1987, died at age 66 at his New Hampshire home.

Consulte Mais informação »

Treasury, FDIC to brief California lawmakers on SVB collapseU.S. Treasury and Federal Deposit Insurance Corp. (FDIC) officials plan to brief members of California's congressional delegation on the collapse of Silicon Valley Bank, Axios has learned.

Treasury, FDIC to brief California lawmakers on SVB collapseU.S. Treasury and Federal Deposit Insurance Corp. (FDIC) officials plan to brief members of California's congressional delegation on the collapse of Silicon Valley Bank, Axios has learned.

Consulte Mais informação »

U.S. Treasury Janet Yellen working on SVB collapse, not at bailout: ReportDuring an interview on March 12, Janet Yellen said that U.S. regulators are working to address Silicon Valley Bank collapse, but not considering a major bailout.

U.S. Treasury Janet Yellen working on SVB collapse, not at bailout: ReportDuring an interview on March 12, Janet Yellen said that U.S. regulators are working to address Silicon Valley Bank collapse, but not considering a major bailout.

Consulte Mais informação »