Treasury ministers may seek to urge banks to offer long-term fixed rate deals to consumers in a bid to ease the impact of rising borrowing costs 🏠 HugoGye and RichardVaughan1 report

will have on homeowners, with around 1.4m mortgage deals due to expire this year, exposing them to soaring monthly costs.

But the Government is now looking at the idea as a way of providing borrowers with greater certainty over their monthly repayments, in a bid to avoid a repeat of the current crisis that will see homeowners coming to the end of their current deals paying hundreds of pounds more a month.that the proposals are being considered but added there are “no immediate plans” to start pushing for a new long-term fixed rate mortgage market.

He continued: “The constraining factor is consumer demand, and that is not a pattern of behaviour we have seen. Clearly for some mortgage holders such mortgages do offer long-term certainty, and it is certainly my objective for us to see the broadest range of choices for householders and for their own individual patterns in the market.”

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Hunt summons banks to Treasury to tell them they need to do more to help mortgage holdersJeremy Hunt has summoned major banks for a meeting at the Treasury where he will push them to support struggling mortgage borrowers He has ruled out measures such as reintroducing tax breaks for mortgage interest ⬇️ HugoGye RichardVaughan1 report

Hunt summons banks to Treasury to tell them they need to do more to help mortgage holdersJeremy Hunt has summoned major banks for a meeting at the Treasury where he will push them to support struggling mortgage borrowers He has ruled out measures such as reintroducing tax breaks for mortgage interest ⬇️ HugoGye RichardVaughan1 report

Consulte Mais informação »

Mortgage costs to stay high until 2025 as experts warn more interest rate hikes are neededThe squeeze on mortgage costs is set to last until at least 2025 with interest rates expected to rise again this week Treasury insiders believe the financial pain, including higher mortgage payments, is highly unlikely to end before the next election

Mortgage costs to stay high until 2025 as experts warn more interest rate hikes are neededThe squeeze on mortgage costs is set to last until at least 2025 with interest rates expected to rise again this week Treasury insiders believe the financial pain, including higher mortgage payments, is highly unlikely to end before the next election

Consulte Mais informação »

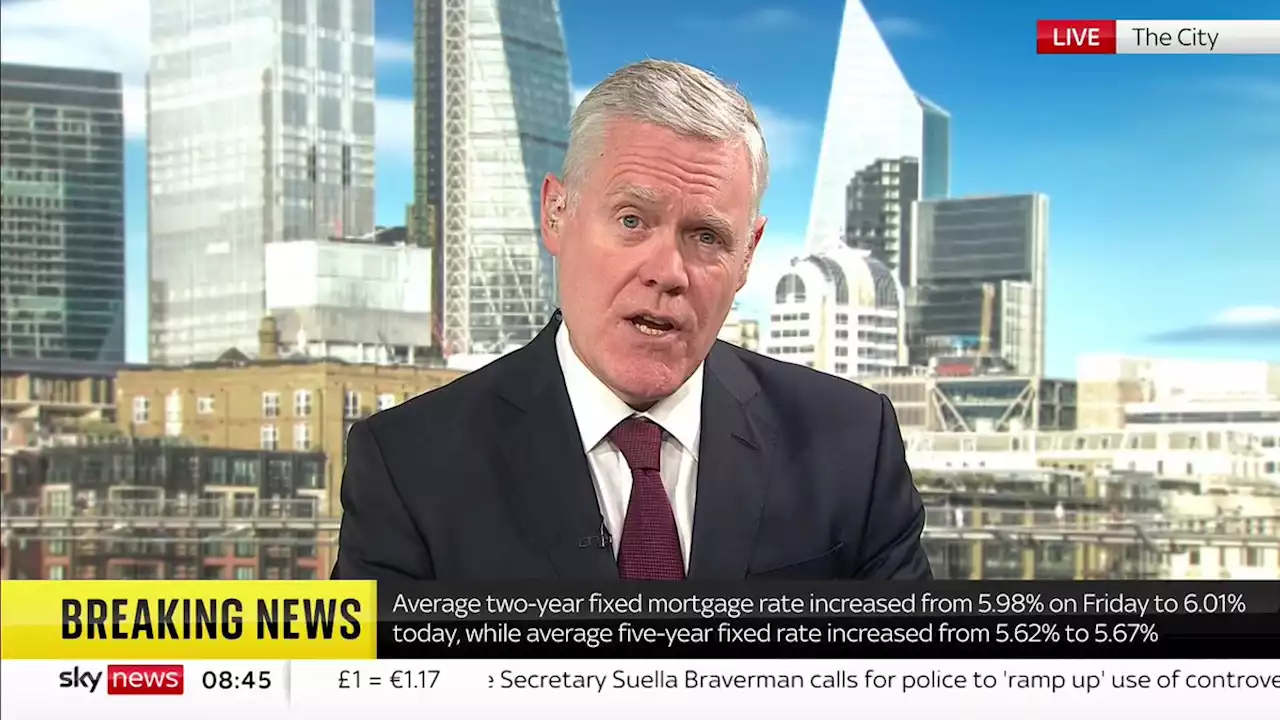

Average mortgage rate rises above 6% for two-year fixed dealThe prime minister has declined to back extra support for mortgage holders despite higher interest rates making payments more expensive.

Average mortgage rate rises above 6% for two-year fixed dealThe prime minister has declined to back extra support for mortgage holders despite higher interest rates making payments more expensive.

Consulte Mais informação »

Mortgage stress hits 1980s levels as average fixed rate deal rises above 6%🏠 The average rate for a two-year fixed-rate mortgage now stands at 6.01% with a five-year deal 5.67% as Rishi Sunak rules out more help for homeowners joeduggan1 reports

Mortgage stress hits 1980s levels as average fixed rate deal rises above 6%🏠 The average rate for a two-year fixed-rate mortgage now stands at 6.01% with a five-year deal 5.67% as Rishi Sunak rules out more help for homeowners joeduggan1 reports

Consulte Mais informação »

Cost of two-year fixed-rate UK mortgage rises above 6%\n\t\t\tKeep abreast of significant corporate, financial and political developments around the world.\n\t\t\tStay informed and spot emerging risks and opportunities with independent global reporting, expert\n\t\t\tcommentary and analysis you can trust.\n\t\t

Consulte Mais informação »

Fixed penalty notices considered for fly-tippers in CalderdaleA council officer says it would speed up the system and save time on preparing cases for court.

Fixed penalty notices considered for fly-tippers in CalderdaleA council officer says it would speed up the system and save time on preparing cases for court.

Consulte Mais informação »