If the U.S. economy falls into a recession next year, that could signal that stocks have further to fall.

Investors hoping that the worst of the bear market has already occurred may be overly optimistic, history shows. Bank of America technical research strategist Stephen Suttmeier said in a note to clients over the weekend that the market could take another leg lower if the U.S. economy falls into a recession, as many expect, because the S & P 500 rarely bottoms out before a recession begins.

Some Federal Reserve officials are holding out hope for a so-called "soft landing," but many economists and investors expect a recession next year. A rapid slowdown in the housing market, tech sector layoffs and a falling savings rate are some of the areas that have raised concern about the direction of the economy. Canaccord Genuity strategist Tony Dwyer is one of the Wall Street pros who sees a recession and a market bottom coming soon.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

S&P 500 Futures snap three-day downtrend, US Treasury yields retreat amid mixed cluesS&P 500 Futures snap three-day downtrend, US Treasury yields retreat amid mixed clues – by anilpanchal7 SP500 Futures YieldCurve Markets RiskAppetite

S&P 500 Futures snap three-day downtrend, US Treasury yields retreat amid mixed cluesS&P 500 Futures snap three-day downtrend, US Treasury yields retreat amid mixed clues – by anilpanchal7 SP500 Futures YieldCurve Markets RiskAppetite

Consulte Mais informação »

S&P 500 could plunge 20% in coming months as recession hits, BofA warnsBank of America analysts said on Monday that the S&P 500 could tumble another 20% from current levels in coming months if the U.S. enters a recession.

S&P 500 could plunge 20% in coming months as recession hits, BofA warnsBank of America analysts said on Monday that the S&P 500 could tumble another 20% from current levels in coming months if the U.S. enters a recession.

Consulte Mais informação »

Bitcoin Underperforms S&P 500 as Stocks Have Overshot Fundamentals, Crypto Trading Firm QCP SaysAs some observers expect bitcoin to catch up with the recent rally in stocks, QCPCapital suggests otherwise, saying the S&P 500 has overshot fundamentals. By godbole17

Bitcoin Underperforms S&P 500 as Stocks Have Overshot Fundamentals, Crypto Trading Firm QCP SaysAs some observers expect bitcoin to catch up with the recent rally in stocks, QCPCapital suggests otherwise, saying the S&P 500 has overshot fundamentals. By godbole17

Consulte Mais informação »

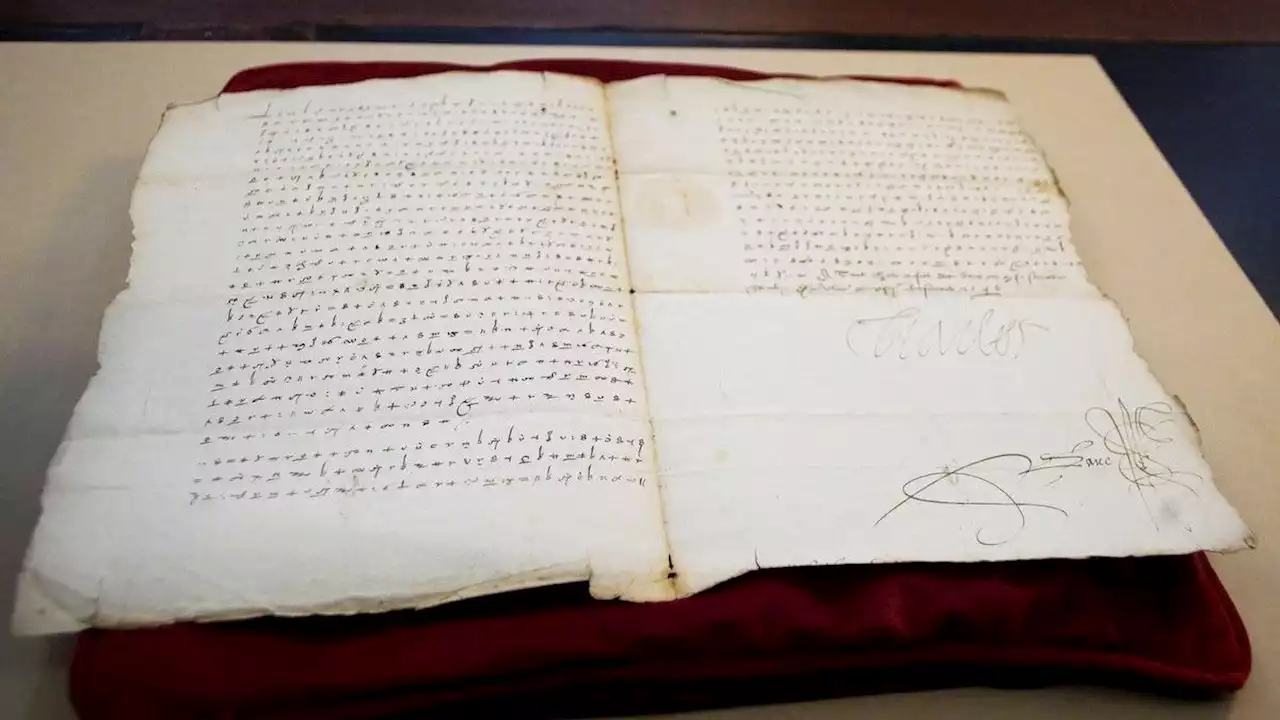

Emperor king's top secret assassination letter finally decrypted after 500 yearsHarry is a U.K.-based staff writer at Live Science. He studied Marine Biology at the University of Exeter (Penryn campus) and after graduating started his own blog site 'Marine Madness,' which he continues to run with other ocean enthusiasts. He is also interested in evolution, climate change, robots, space exploration, environmental conservation and anything that's been fossilized. When not at work he can be found watching sci-fi films, playing old Pokemon games or running (probably slower than he'd like).

Emperor king's top secret assassination letter finally decrypted after 500 yearsHarry is a U.K.-based staff writer at Live Science. He studied Marine Biology at the University of Exeter (Penryn campus) and after graduating started his own blog site 'Marine Madness,' which he continues to run with other ocean enthusiasts. He is also interested in evolution, climate change, robots, space exploration, environmental conservation and anything that's been fossilized. When not at work he can be found watching sci-fi films, playing old Pokemon games or running (probably slower than he'd like).

Consulte Mais informação »

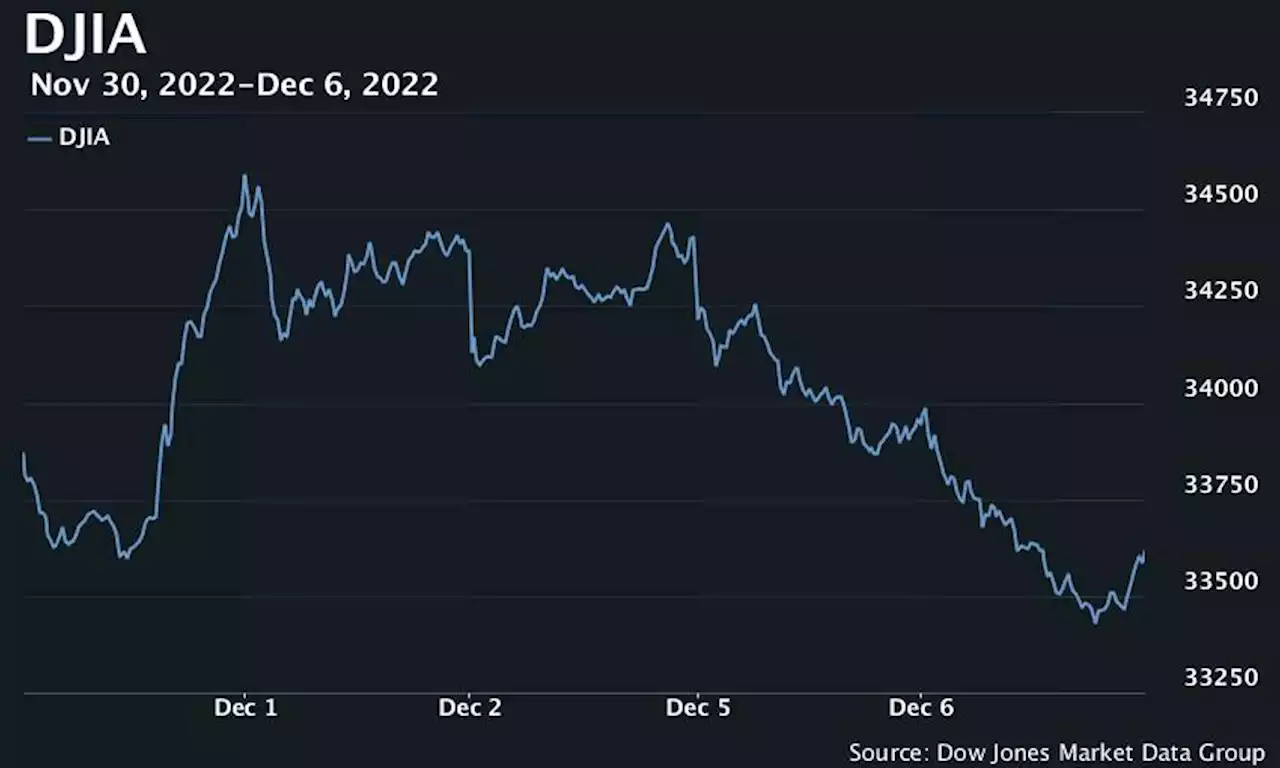

S&P 500 books fourth straight day of losses as U.S. stocks close sharply lowerU.S. stocks ended sharply lower Tuesday as investors sought safe-haven assets amid recession concerns and increased market volatility. The Dow Jones Industrial Average dropped around 350 points to close 1% lower:

S&P 500 books fourth straight day of losses as U.S. stocks close sharply lowerU.S. stocks ended sharply lower Tuesday as investors sought safe-haven assets amid recession concerns and increased market volatility. The Dow Jones Industrial Average dropped around 350 points to close 1% lower:

Consulte Mais informação »

S&P 500 Index: Sustained move below 3938 to trigger a fall to 3868/58 – Credit SuisseS&P 500 is starting to turn more decisively lower. Analysts at Credit Suisse now look for a closing break below 3938 to complete a short-term top. Ini

S&P 500 Index: Sustained move below 3938 to trigger a fall to 3868/58 – Credit SuisseS&P 500 is starting to turn more decisively lower. Analysts at Credit Suisse now look for a closing break below 3938 to complete a short-term top. Ini

Consulte Mais informação »