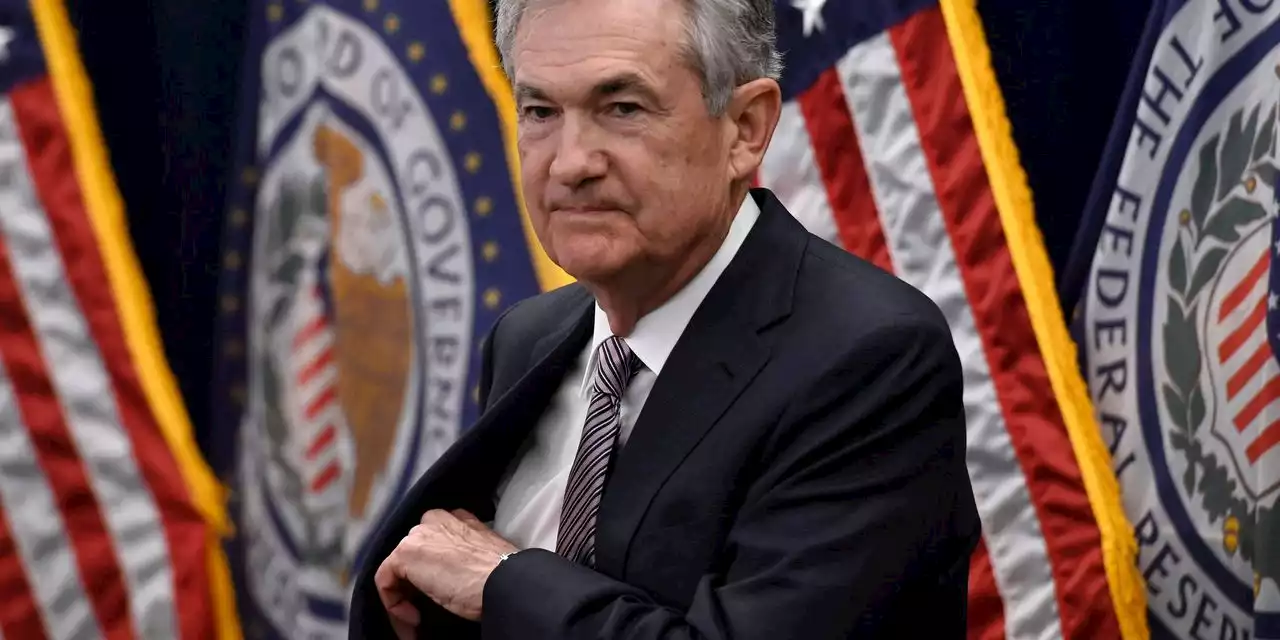

The Federal Reserve may be set to announce the biggest rate hike since the 1990s. Here's how that would impact your wallet.

If the Fed decides on a three-quarter point boost, it would be the first rate hike of that size since 1994. Analysts at Deutsche Bank said in a report on Tuesday that they expect 0.75% hikes at the central bank's meetings both this week and in July, underscoring what they called a"need for speed" in clamping down on inflation.

"It was just a few weeks ago that investors were forecasting the funds rate to be ~2.58% at the end of this year, but that number is now more than 100 [basis points] higher at 3.7%," analyst Adam Crisafulli of Vital Knowledge told clients in a research note."And the 'terminal' funds rate is now seen north of 4%."What will the rate hike cost you?

By early 2023, the federal funds rate could be 3.75% to 4%, according to TD Macro. That implies a rate increase of at least 2.75% higher than the current federal funds rate of 1%. For consumers, that means they could pay an additional $275 in interest for every $10,000 in debt. amid various headwinds, including the impact of high inflation and the Fed's monetary tightening. But a bigger-than-expected interest rate increase on Wednesday"could be welcomed by stocks," Crisafulli said.

Credit with adjustable rates may also see an impact, including home equity lines of credit and adjustable-rate mortgages, which are based on the prime rate. Mortgage rates have already surged in response to the Fed's rate increases this year. The average 30-year mortgage stood at 5.23% on June 9, according to Freddie Mac. That's up from 2.96% a year earlier. of buying a property.

The housing market reflects one part of the economy where the Fed's rate increases are slowing demand. Channel added:"These high rates have significantly dampened borrower desire to refinance current loans, and they're also showing signs of reducing demand for purchase mortgages as well."When it comes to higher interest rates, the bright side for consumers is better yields from savings accounts and certificates of deposit.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Asian stocks slide as Fed hike fears tip Wall St into bear marketAsian shares slid sharply and the safe-haven dollar held near a two-decade peak on Tuesday after Wall Street hit a confirmed bear market milestone on fears aggressive U.S. interest rate hikes would push the world's largest economy into recession.

Asian stocks slide as Fed hike fears tip Wall St into bear marketAsian shares slid sharply and the safe-haven dollar held near a two-decade peak on Tuesday after Wall Street hit a confirmed bear market milestone on fears aggressive U.S. interest rate hikes would push the world's largest economy into recession.

Consulte Mais informação »

Neighbors fed up with Compton street takeovers attend city council meetingA wave of street takeovers in Compton, including a deadly incident that killed two women Sunday has neighbors angry and worried. A crowd showed up at the Compton City Council meeting hoping to put an end to them.

Neighbors fed up with Compton street takeovers attend city council meetingA wave of street takeovers in Compton, including a deadly incident that killed two women Sunday has neighbors angry and worried. A crowd showed up at the Compton City Council meeting hoping to put an end to them.

Consulte Mais informação »

Wall Street Is on a One Way Trip to Misery Until Fed Hikes Stop, Market Forecaster Jim Bianco WarnsUntil inflation peaks and the Federal Reserve stops hiking rates, market forecaster Jim Bianco warns Wall Street is on a one way trip to misery.

Wall Street Is on a One Way Trip to Misery Until Fed Hikes Stop, Market Forecaster Jim Bianco WarnsUntil inflation peaks and the Federal Reserve stops hiking rates, market forecaster Jim Bianco warns Wall Street is on a one way trip to misery.

Consulte Mais informação »

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

Consulte Mais informação »

EUR/USD sees cushion below 1.0400, downside looks likely ahead of Fed and ECB LagardeThe EUR/USD pair is witnessing a minor cushion marginally below 1.0400 in the Asian session, however, more downside is still favored amid broader stre

EUR/USD sees cushion below 1.0400, downside looks likely ahead of Fed and ECB LagardeThe EUR/USD pair is witnessing a minor cushion marginally below 1.0400 in the Asian session, however, more downside is still favored amid broader stre

Consulte Mais informação »

USD/JPY faces barricades around 134.40 as DXY skids, Fed and BOJ in focusThe USD/JPY pair has faced some offers while overstepping the critical resistance of 134.40 in the Asian session. The asset is oscillating in a narrow

USD/JPY faces barricades around 134.40 as DXY skids, Fed and BOJ in focusThe USD/JPY pair has faced some offers while overstepping the critical resistance of 134.40 in the Asian session. The asset is oscillating in a narrow

Consulte Mais informação »