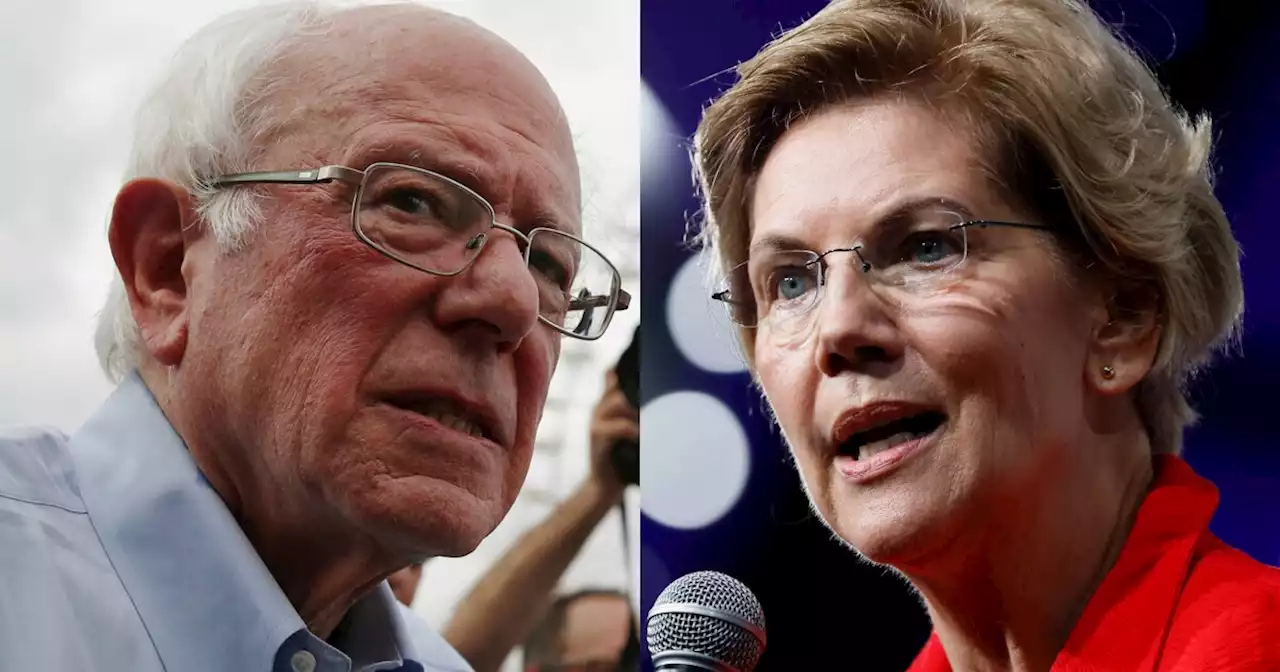

After Silicon Valley Bank collapsed, Sen. Bernie Sanders argued that the culprit was clear: an 'absurd' 2018 law, signed by then-President Donald Trump, that rolled back regulations on banks.

After Silicon Valley Bank collapsed late last week following a run on the bank, Sen. Bernie Sanders of Vermont argued that the culprit was clear: an “absurd” 2018 law, signed by then-President Donald Trump, that rolled back regulations on banks of SVB’s size. President Joe Biden wasn’t as direct as Sanders in blaming the 2018 rollback for SVB’s implosion, but he, too, criticized the Trump law in his Monday comments on the banking system.

The Senate passed the bill 67 to 31. All 50 Republicans who voted were in favor; 31 members of the Democratic caucus voted no, while 17 voted yes. CNN noted at the time that almost all of the Democratic supporters in the Senate were “either up for re-election this fall and/or from red or purple states.” The House passed the bill 258 to 159. Among Republicans, 225 voted yes and just one voted no; the Democratic caucus split 33 yes, 158 no.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

SVB collapse: Progressives blame 2018 rollback of Dodd-Frank for bank failuresProgressive lawmakers are blaming the collapse of two U.S. banks over the weekend on a 2018 bill that rolled back regulations put in place after the 2008 financial crisis.

SVB collapse: Progressives blame 2018 rollback of Dodd-Frank for bank failuresProgressive lawmakers are blaming the collapse of two U.S. banks over the weekend on a 2018 bill that rolled back regulations put in place after the 2008 financial crisis.

Consulte Mais informação »

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

Consulte Mais informação »

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

Consulte Mais informação »

SVB Financial mulls strategic options, hires restructuring veteranDefunct startup-focused lender SVB Financial Group said on Monday that it was planning to explore strategic alternatives for its businesses including the holding company, SVB Capital and SVB Securities.

SVB Financial mulls strategic options, hires restructuring veteranDefunct startup-focused lender SVB Financial Group said on Monday that it was planning to explore strategic alternatives for its businesses including the holding company, SVB Capital and SVB Securities.

Consulte Mais informação »

Biden vows new bank rules after SVB collapse, cites Trump rollbackPresident Joe Biden declared the US banking system 'safe' and vowed stiffer bank regulation, after U.S. regulators were forced to step in with a series of emergency measures after Silicon Valley Bank and Signature Bank collapse, threatening to trigger a broader crisis.

Biden vows new bank rules after SVB collapse, cites Trump rollbackPresident Joe Biden declared the US banking system 'safe' and vowed stiffer bank regulation, after U.S. regulators were forced to step in with a series of emergency measures after Silicon Valley Bank and Signature Bank collapse, threatening to trigger a broader crisis.

Consulte Mais informação »

Joe Biden comes to the rescue of Trump's 'go-to' bank after SVB collapseFollowing the collapse of two banks, Donald Trump said Biden would be the 'Herbert Hoover of the modern age' and predicted a depression worse than that of 1929.

Joe Biden comes to the rescue of Trump's 'go-to' bank after SVB collapseFollowing the collapse of two banks, Donald Trump said Biden would be the 'Herbert Hoover of the modern age' and predicted a depression worse than that of 1929.

Consulte Mais informação »