In an effort to shore up confidence in the banking system, the Treasury Department, Federal Reserve and FDIC said Sunday that all Silicon Valley Bank clients would be protected and able to access their money.

The Bank of England and U.K. Treasury said early Monday that they had facilitated the sale of a Silicon Valley Bank subsidiary in London to HSBC, Europe’s biggest bank, ensuring the security of 6.7 billion pounds of deposits.

Britain also moved quickly, working throughout the weekend to arrange the sale of Silicon Valley Bank UK Ltd., the California bank’s British arm, for the nominal sum of one pound. “When you have very young companies, very promising companies, they’re also fragile,” Hunt told reporters, explaining the why authorities moved so quickly. “They need to pay their staff and they were worried that as of 8 a.m. this morning, they might literally not be able to access their bank account.”Silicon Valley Bank began its slide into insolvency when it was forced to dump some of its treasuries at at a loss to fund its customers’ withdrawals.

Some prominent Silicon Valley executives feared that if Washington didn’t rescue their failed bank, customers would make runs on other financial institutions in the coming days. Stock prices plunged over the last few days at other banks that cater to technology companies, such as First Republic and PacWest Bank., where many wineries rely on Silicon Valley Bank for loans, and technology startups devoted to combating climate change.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

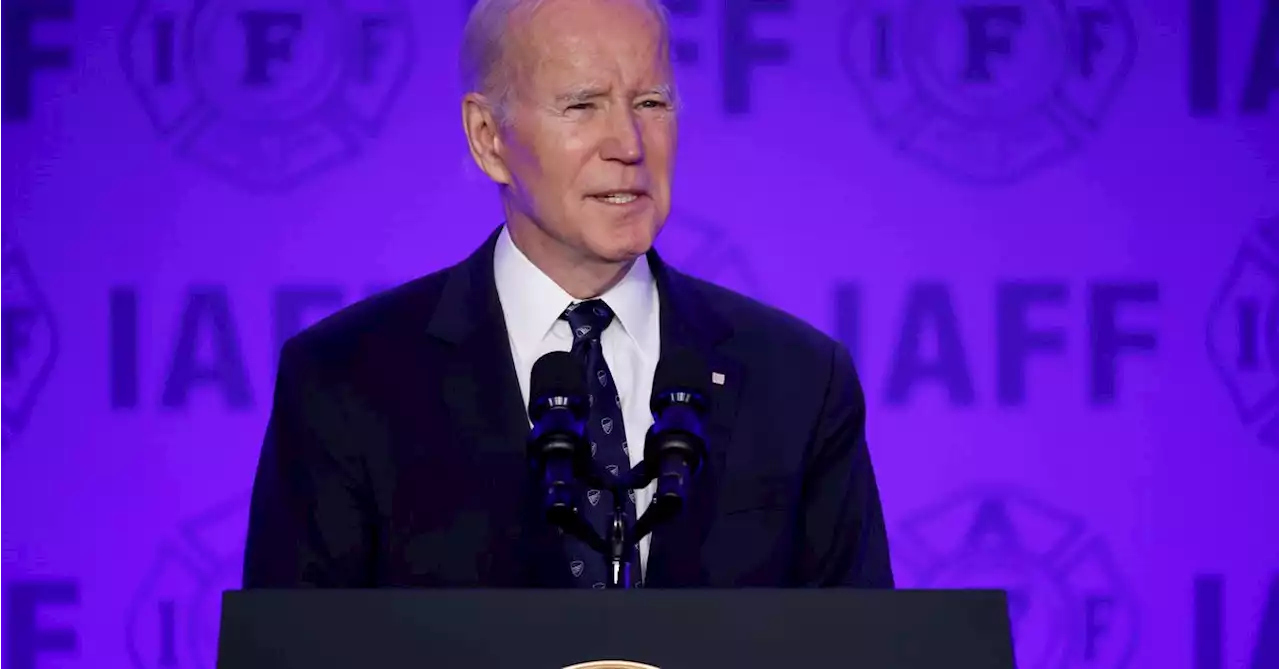

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

Consulte Mais informação »

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

Consulte Mais informação »

Treasury, Fed and FDIC joint statement on SVB and Signature Bank: full text'All depositors of this institution will be made whole ... no losses will be borne by the taxpayer': Read Sunday's full statement from the Treasury, Federal Reserve and Federal Deposit Insurance Corp.

Treasury, Fed and FDIC joint statement on SVB and Signature Bank: full text'All depositors of this institution will be made whole ... no losses will be borne by the taxpayer': Read Sunday's full statement from the Treasury, Federal Reserve and Federal Deposit Insurance Corp.

Consulte Mais informação »

Crypto-friendly Signature Bank shut down by regulators after collapses of SVB, SilvergateState authorities closed New York-based Signature Bank on Sunday, after Silicon Valley Bank was shut down by regulators on Friday in the biggest bank failure...

Crypto-friendly Signature Bank shut down by regulators after collapses of SVB, SilvergateState authorities closed New York-based Signature Bank on Sunday, after Silicon Valley Bank was shut down by regulators on Friday in the biggest bank failure...

Consulte Mais informação »

Regulators close Signature Bank, second shuttered by feds after SVB disasterUS regulators shut down a second bank Sunday in a bid to stem the banking crisis after Silicon Valley Bank went down last week.

Regulators close Signature Bank, second shuttered by feds after SVB disasterUS regulators shut down a second bank Sunday in a bid to stem the banking crisis after Silicon Valley Bank went down last week.

Consulte Mais informação »

US Dollar Index struggles to cheer SVB, Signature Bank news ahead of US inflationUS Dollar Index struggles to cheer SVB, Signature Bank news ahead of US inflation – by anilpanchal7 DollarIndex RiskAppetite YieldCurve Inflation NFP

US Dollar Index struggles to cheer SVB, Signature Bank news ahead of US inflationUS Dollar Index struggles to cheer SVB, Signature Bank news ahead of US inflation – by anilpanchal7 DollarIndex RiskAppetite YieldCurve Inflation NFP

Consulte Mais informação »