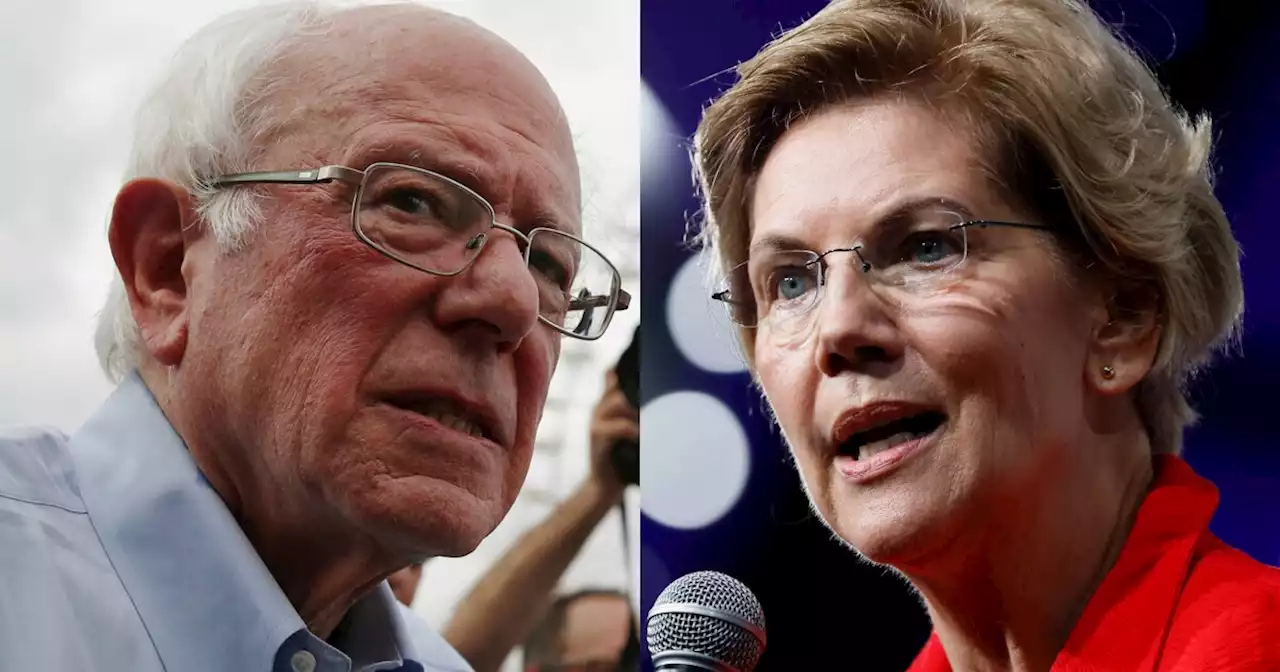

A group of progressive Democrats led by Sen. Elizabeth Warren (D-MA) and Rep. Katie Porter (D-CA) unveiled a bill on Tuesday to revive Dodd-Frank regulations that were rolled back during the Trump administration.

The legislation would resurrect the threshold set for stress tests and capital rules that had been eased for small and mid-sized banks in light of the recent collapse of Silicon Valley Bank and other institutions."President Biden called on Congress and regulators to reverse Trump-era deregulation and 'strengthen the rules on banks to make it less likely that this kind of bank failure will happen again.' Today I’m proposing legislation to do just that," Warren tweeted.

— Elizabeth Warren March 14, 2023 Back in 2018, Congress passed the Economic Growth, Regulatory Relief, and Consumer Protection Act, which upped the Dodd-Frank threshold from $50 billion to $250 billion for banks that were considered"too big to fail." SVB had a balance sheet of roughly $209 billion in assets, making it the 16th-largest federally insured bank in the United States.

Former Rep. Barney Frank , who co-authored the 2010 Dodd-Frank financial reform package and was the director of Signature Bank, another institution that failed over recent days, appeared to back the easing of restrictions as"mostly" reasonable at the time. A handful of Democrats have signaled that they stand by their 2018 vote, including Sens. Mark Warner and Jeanne Shaheen .

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Why Democrats blame Trump, Dodd-Frank rollback in SVB collapseInsider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

Consulte Mais informação »

SVB collapse: Director of failed bank was author of Dodd-Frank reform lawFormer Rep. Barney Frank (D-MA), who famously co-authored the 2010 Dodd-Frank financial reform law in response to the 2008 financial crisis, served as a director of Signature Bank, which failed Sunday.

SVB collapse: Director of failed bank was author of Dodd-Frank reform lawFormer Rep. Barney Frank (D-MA), who famously co-authored the 2010 Dodd-Frank financial reform law in response to the 2008 financial crisis, served as a director of Signature Bank, which failed Sunday.

Consulte Mais informação »

SVB collapse: Progressives blame 2018 rollback of Dodd-Frank for bank failuresProgressive lawmakers are blaming the collapse of two U.S. banks over the weekend on a 2018 bill that rolled back regulations put in place after the 2008 financial crisis.

SVB collapse: Progressives blame 2018 rollback of Dodd-Frank for bank failuresProgressive lawmakers are blaming the collapse of two U.S. banks over the weekend on a 2018 bill that rolled back regulations put in place after the 2008 financial crisis.

Consulte Mais informação »

Dodd-Frank Act’s Barney Frank Was on Failed Signature Bank’s BoardRetired congressman Barney Frank, who helped pass strict financial regulations in the wake of the 2008 crash, was on the board of directors of New York’s Signature Bank, which was shut down over the weekend.

Dodd-Frank Act’s Barney Frank Was on Failed Signature Bank’s BoardRetired congressman Barney Frank, who helped pass strict financial regulations in the wake of the 2008 crash, was on the board of directors of New York’s Signature Bank, which was shut down over the weekend.

Consulte Mais informação »

Signature Bank could have stayed open: Dodd-Frank Act's Barney FrankRegulators didn't have to shutter Signature Bank, says Dodd-Frank Act coauthor Barney Frank, who helped oversee the lender: 'We could've continued'

Consulte Mais informação »