The analysis also points to a lack of affordable child care leading to education proficiency and kindergarten readiness issues

Pointing to last year’s State of the State speech by DeWine, in which he said “there is simply no better place to raise a family than Ohio,” Policy Matters compared the state to others in the country on categories such as health and wellness, learning and growth, connection and community, and dignity and opportunity.

With the current tax system serving the most wealthy, “the same old strategy isn’t working,” the researchers found. Using data from the Institute on Taxation and Economic Policy estimating 2022 incomes, Policy Matters found that the richest 1% of Ohioans receive more than $50,000 annually in tax cuts on average.

“We all benefit from strong, inclusive public schools, a health care system that provides care for all of us and public institutions and programs that connect people to information and resources to live a decent life,” Policy Matters stated. In the newest budget, Ohio could establish a family tax credit, putting the Women, Infants and Children program online and expanding the Supplemental Nutrition Assistance Program would help impoverished families with better health outcomes and more support, according to recommendations from the think tank.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Here are 2023′s tax filing deadlines, late penalties, and tax code changes for PennsylvaniansWhat to know about new tax breaks for eco-friendly Americans, expiration of pandemic tax credits and how much you'll owe if you file late.

Here are 2023′s tax filing deadlines, late penalties, and tax code changes for PennsylvaniansWhat to know about new tax breaks for eco-friendly Americans, expiration of pandemic tax credits and how much you'll owe if you file late.

Consulte Mais informação »

Which Greater Columbus girls basketball teams made third Ohio AP poll of 2022-23 season?See which central Ohio teams are ranked in the latest Ohio Associated Press girls basketball poll.

Which Greater Columbus girls basketball teams made third Ohio AP poll of 2022-23 season?See which central Ohio teams are ranked in the latest Ohio Associated Press girls basketball poll.

Consulte Mais informação »

Which Greater Columbus boys basketball teams made third Ohio AP poll of 2022-23 season?See which central Ohio teams are ranked in the latest Ohio Associated Press boys basketball poll.

Which Greater Columbus boys basketball teams made third Ohio AP poll of 2022-23 season?See which central Ohio teams are ranked in the latest Ohio Associated Press boys basketball poll.

Consulte Mais informação »

Ohio Gov. Mike DeWine proposes new $2,500 tax deduction for parents, exemptions for baby essentialsOhio Gov. Mike DeWine is proposing new tax cuts for parents, he announced Tuesday while rolling out his new two-year state budget plan.

Ohio Gov. Mike DeWine proposes new $2,500 tax deduction for parents, exemptions for baby essentialsOhio Gov. Mike DeWine is proposing new tax cuts for parents, he announced Tuesday while rolling out his new two-year state budget plan.

Consulte Mais informação »

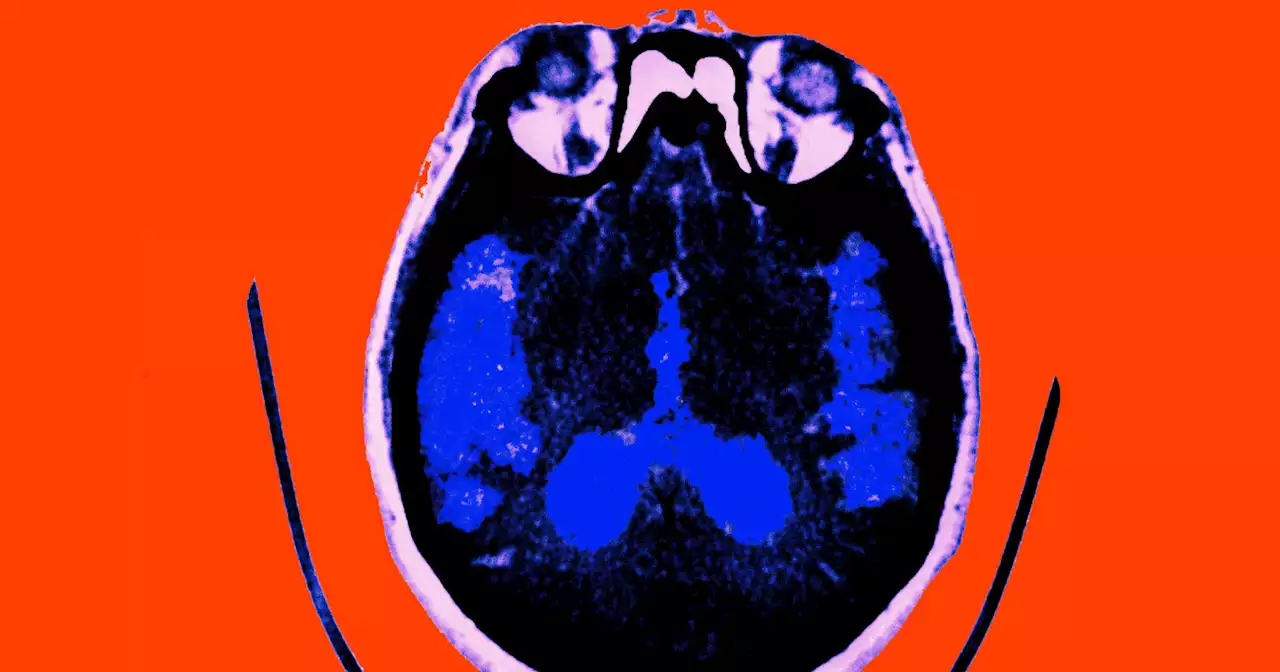

Obesity may cause changes in the brain similar to Alzheimer’s, according to a new studyBrain scans show patterns of shrinkage in regions involved in learning, memory and judgment. Experts hope weight loss may help reverse some of the damage.

Obesity may cause changes in the brain similar to Alzheimer’s, according to a new studyBrain scans show patterns of shrinkage in regions involved in learning, memory and judgment. Experts hope weight loss may help reverse some of the damage.

Consulte Mais informação »

Black Americans Are Much More Likely to Face Tax Audits, Study FindsWASHINGTON — Black taxpayers are at least three times as likely to be audited by the Internal Revenue Service as other taxpayers, even after accounting for the differences in the types of returns each group is most likely to file, a team of economists has concluded in one of the most detailed studies yet on race and the nation’s tax system. The findings do not suggest bias from individual tax enforcement agents, who do not know the race of the people they are auditing. They also do not suggest a

Black Americans Are Much More Likely to Face Tax Audits, Study FindsWASHINGTON — Black taxpayers are at least three times as likely to be audited by the Internal Revenue Service as other taxpayers, even after accounting for the differences in the types of returns each group is most likely to file, a team of economists has concluded in one of the most detailed studies yet on race and the nation’s tax system. The findings do not suggest bias from individual tax enforcement agents, who do not know the race of the people they are auditing. They also do not suggest a

Consulte Mais informação »