This week's inflation report will spark a big rally in the stock market, Fundstrat says

Lee believes a cooler-than-expected July CPI report would be more than enough for a stock market rally that recovers all of the losses since the start of the month. Such a rally would equate to at least a 2% move higher in the S&P 500.

Part of Lee's confidence in a cooler CPI report stems from the fact that since the end of 2019, auto and shelter prices accounted for 66% of the increase in inflation. But now those price increases in cars and shelter are moderating considerably. "Investors overlook that used cars and housing are such outsized contributors to inflation. And as these components cool, the remaining components will not necessarily lead to a renewed surge in overall core inflation," Lee said.

Also helping the potential for a stock market rally following the July CPI report is the fact that investor sentiment has soured amid the one-week stock market decline. "Investors seem to have already become far more wary and that is a good thing from a sentiment perspective. Equities seem oversold as well. So, we think the probability for stocks to rally strongly after CPI is very high," Lee said.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Asian Stock Market: Trades mixed, investors await Chinese/ Indian CPI dataAsian stock markets trade mixed on Monday following mixed US employment data. That said, the Nonfarm Payrolls in the US rose 187,000 in July, worse th

Asian Stock Market: Trades mixed, investors await Chinese/ Indian CPI dataAsian stock markets trade mixed on Monday following mixed US employment data. That said, the Nonfarm Payrolls in the US rose 187,000 in July, worse th

Consulte Mais informação »

Stock market news today: Investors look to upcoming CPI inflation dataUS stocks moved higher on Monday as investors turn their attention to upcoming inflation data and whether that will impact the trajectory of the Federal Reserve's current interest rate trajectory. July CPI data will be released later this week on Thursday.

Consulte Mais informação »

CPI Preview: Bitcoin Unlikely to Get Bullish Catalyst From July Inflation DataBitcoin bulls are not likely to find a positive catalyst from the July Consumer Price Index report, as economists expect a 0.2% increase on a monthly basis, the same as June. Year-over-year growth is forecast at 3.3%, up from 3% in June. Markets have already priced in rate cuts for 2024, and the Fed is not expected to make any more rate hikes this year.

CPI Preview: Bitcoin Unlikely to Get Bullish Catalyst From July Inflation DataBitcoin bulls are not likely to find a positive catalyst from the July Consumer Price Index report, as economists expect a 0.2% increase on a monthly basis, the same as June. Year-over-year growth is forecast at 3.3%, up from 3% in June. Markets have already priced in rate cuts for 2024, and the Fed is not expected to make any more rate hikes this year.

Consulte Mais informação »

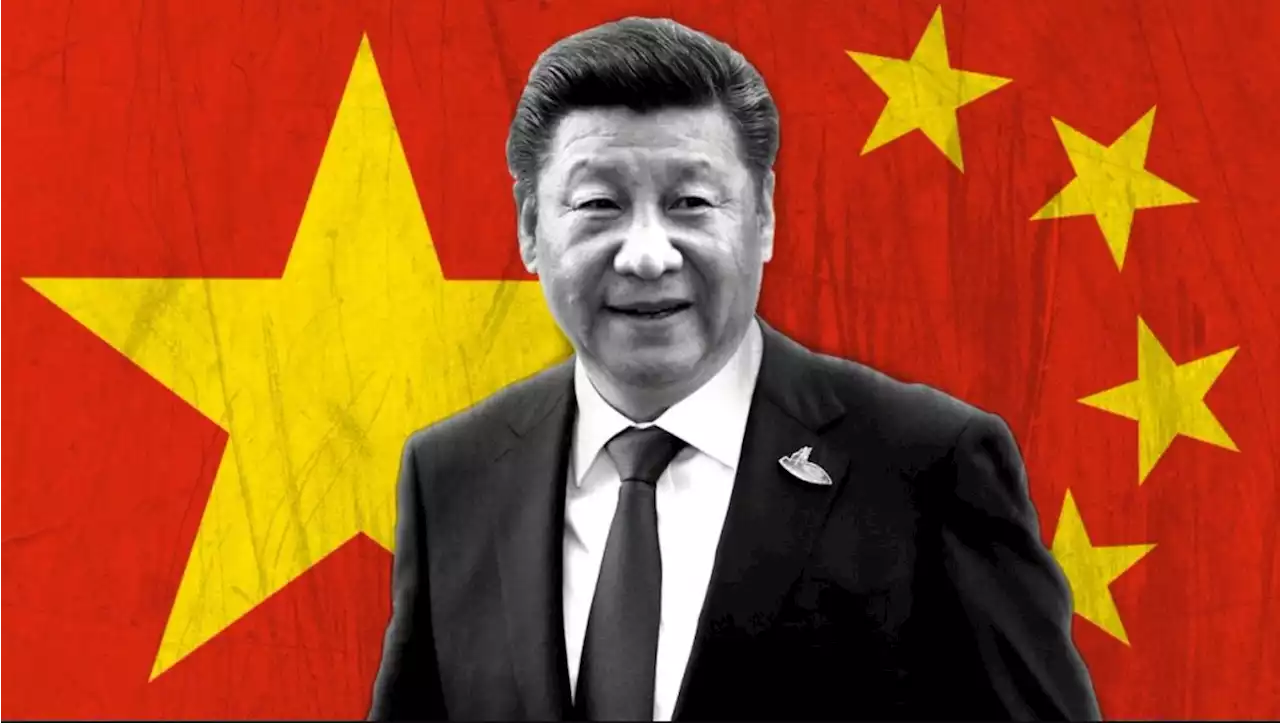

China's CPI Inflation Falls to -0.3% YoY in JulyChina's annual Consumer Price Index (CPI) dropped by 0.3% in July, lower than the expected -0.4%. The data release had no significant impact on the market.

China's CPI Inflation Falls to -0.3% YoY in JulyChina's annual Consumer Price Index (CPI) dropped by 0.3% in July, lower than the expected -0.4%. The data release had no significant impact on the market.

Consulte Mais informação »

Chinese CPI inflation contracts in July, PPI falls more than expectedConsumer price index (CPI) inflation fell 0.3% in the 12 months to July, slightly better than expectations for a drop of 0.4%. This came after a flat reading for June, and marks the first annual contraction in CPI since September 2021. CPI inflation rose 0.2% from the prior month, slightly beating out expectations for growth.

Chinese CPI inflation contracts in July, PPI falls more than expectedConsumer price index (CPI) inflation fell 0.3% in the 12 months to July, slightly better than expectations for a drop of 0.4%. This came after a flat reading for June, and marks the first annual contraction in CPI since September 2021. CPI inflation rose 0.2% from the prior month, slightly beating out expectations for growth.

Consulte Mais informação »

July CPI Expected to Confirm U.S. Inflation on a Rocky RoadTraders anticipate that the release of the consumer price index for July will show a 3.2% annual headline CPI rate, indicating that inflation is on a challenging path towards 2% in the future.

July CPI Expected to Confirm U.S. Inflation on a Rocky RoadTraders anticipate that the release of the consumer price index for July will show a 3.2% annual headline CPI rate, indicating that inflation is on a challenging path towards 2% in the future.

Consulte Mais informação »