The latest book by Antti Ilmanen, “Investing Amid Low Expected Returns”, is as invaluable a resource as “Expected Returns”, published a decade ago

Save time by listening to our audio articles as you multitaskThis brings us to the more serious business of investing, and a sequel of a very different kind. Ten years ago Antti Ilmanen, a finance whizz, published “Expected Returns”, a brilliant distillation of investment theory, practice and wisdom. His latest book, “Investing Amid Low Expected Returns”, is an update, taking in a decade’s worth of additional research and data.

Start, though, with a recap of the expected-returns framework. There are two sources of return on an investment: income and capital gain. The income on, for instance, a government bond is the interest paid once or twice a year. Bond prices and yields move inversely. So when interest rates fall, as they did for much of the past four decades, bond investors enjoy a capital gain. In essence a capital gain of this kind brings forward future returns.

What now? As Mr Ilmanen sees it, low expected returns can materialise through either “slow” or “fast” pain. In the slow-pain scenario, assets remain expensive and investors receive desultory bond coupons, equity dividends and rental receipts for years on end. In the fast-pain scenario yields revert to their higher historical averages. This implies a spell of brutal capital losses followed by fairer returns thereafter. The choice is between well-heeled stagnation and a crash.

Mr Ilmanen is too much of an epistemological sceptic to put all his chips on one scenario. He is also too careful an analyst to miss that low inflation made the high-asset-price, low-yield 2010s what they were. Many of the factors that kept a lid on inflation in that decade—globalisation, efficient supply-chain management, tight fiscal policy, an expanding global workforce—are now attenuating or unwinding.

Faced with lower expected returns, investors have three courses of action: they can take more risk to reach for higher returns; they can save more; or they can accept reality and play the hand they have been dealt as well as they can. The first approach may increase returns but also makes them more uncertain. Saving more means sacrificing today for the sake of tomorrow, a highly personal choice. Understandably, Mr Ilmanen’s focus is on the third approach.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Long Covid: Joint pain may signal 'ongoing symptomatic Covid' - other signsSYMPTOMS of long Covid can be varied, and include joint and muscle pain. If you have joint pain for around four weeks following infection, this may be a sign of ongoing symptomatic Covid.

Long Covid: Joint pain may signal 'ongoing symptomatic Covid' - other signsSYMPTOMS of long Covid can be varied, and include joint and muscle pain. If you have joint pain for around four weeks following infection, this may be a sign of ongoing symptomatic Covid.

Consulte Mais informação »

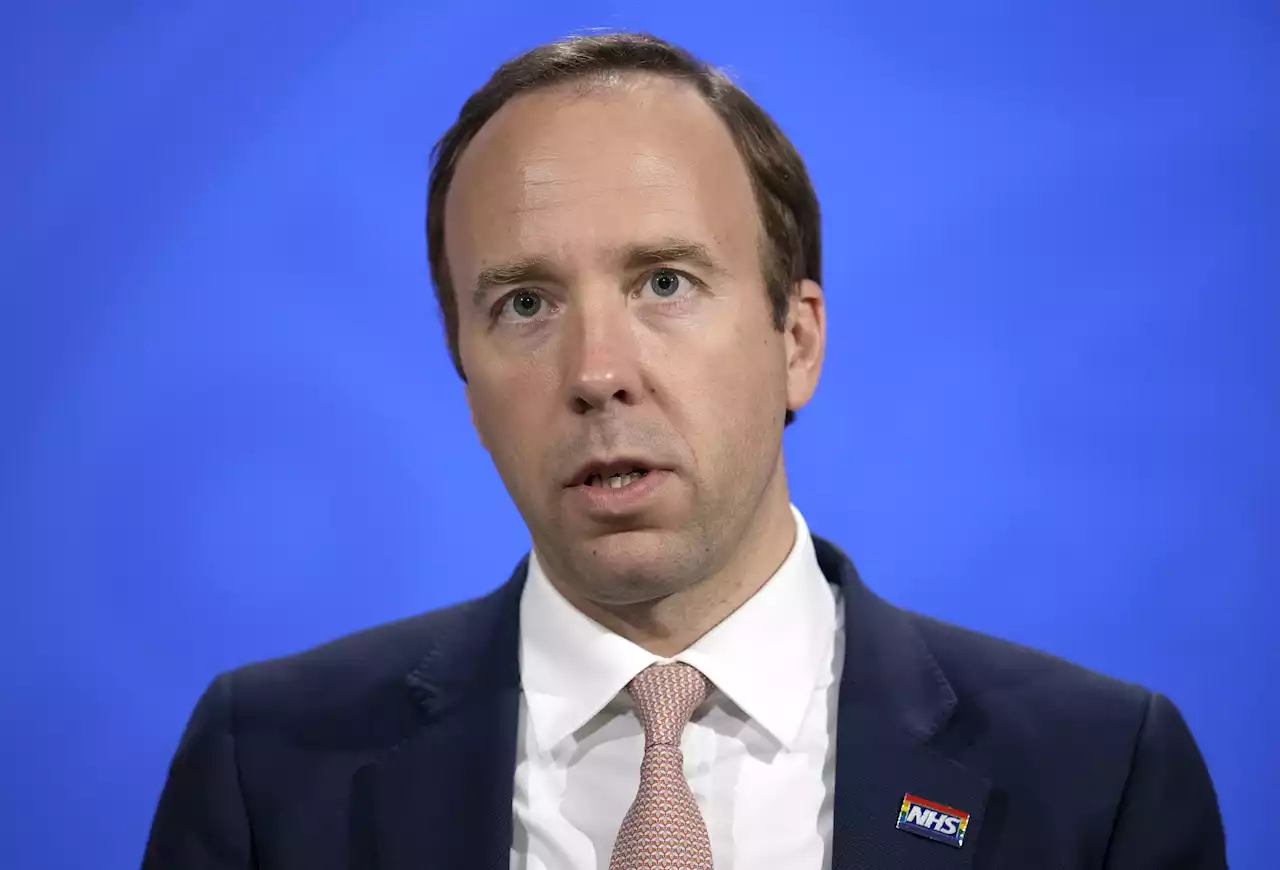

Hancock apologises for pandemic ‘pain and anguish’ after care home rulingEarlier this week the High Court ruled that the Government’s care home discharge policies at the start of the pandemic were “unlawful” .

Hancock apologises for pandemic ‘pain and anguish’ after care home rulingEarlier this week the High Court ruled that the Government’s care home discharge policies at the start of the pandemic were “unlawful” .

Consulte Mais informação »

Exercise instead of taking painkillers, arthritis sufferers toldStarting exercise programmes may initially make the pain worse, but this should settle down, NHS guidance says

Exercise instead of taking painkillers, arthritis sufferers toldStarting exercise programmes may initially make the pain worse, but this should settle down, NHS guidance says

Consulte Mais informação »

Dog behaviour has little to do with breed, study findsResearch shows high degree of variability between individual animals – with implications for owners

Dog behaviour has little to do with breed, study findsResearch shows high degree of variability between individual animals – with implications for owners

Consulte Mais informação »

Europe should levy a high tariff on Russian energyThe case for reducing the flow of cash into Vladimir Putin’s coffers stands. And it is sufficient to justify the economic pain involved

Europe should levy a high tariff on Russian energyThe case for reducing the flow of cash into Vladimir Putin’s coffers stands. And it is sufficient to justify the economic pain involved

Consulte Mais informação »

Debt repayment costs are rising fast for many African countriesDefaults are unlikely in sub-Saharan Africa this year. But the pain is real

Debt repayment costs are rising fast for many African countriesDefaults are unlikely in sub-Saharan Africa this year. But the pain is real

Consulte Mais informação »