Signs of de-dollarisation are unfolding in the global economy, strategists at the biggest U.S. bank JPMorgan said on Monday, although the currency should maintain its long-held dominance for the foreseeable future.

The impact of steep U.S. interest rate rises and the use of sanctions that have frozen the likes of Russia out of the global banking system are driving the so-called BRICs nations - Brazil, Russia, India, China and South Africa - toJPMorgan's strategists Meera Chandan and Octavia Popescu at the Wall Street bank laid out that while overall dollar usage remains within its historical range, its usage was more "bifurcated under the hood".

"De-dollarisation is evident in FX reserves where share has declined to a record as share in exports declined, but is still emerging in commodities," the strategists said. In global central bank FX reserves too, the dollar's share is down to a record low of 58%, albeit a level that is still by far the largest globally.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Meta and Broadcom are among the most overbought stocks on Wall StreetWatch these overbought and oversold names on Wall Street for signs of overcrowding and potential bargains.

Meta and Broadcom are among the most overbought stocks on Wall StreetWatch these overbought and oversold names on Wall Street for signs of overcrowding and potential bargains.

Consulte Mais informação »

Economic Chaos: 14th Consecutive Month Of Wall Street Underestimating PayrollsThe strength of the U.S. labor market has flummoxed professional economic forecasters for nearly two years.

Economic Chaos: 14th Consecutive Month Of Wall Street Underestimating PayrollsThe strength of the U.S. labor market has flummoxed professional economic forecasters for nearly two years.

Consulte Mais informação »

Ukraine is ready to launch counteroffensive, Zelensky says in Wall Street Journal interviewUkraine is ready to launch its much-anticipated counteroffensive in the war against Russia, Ukrainian President Volodymyr Zelensky said in an exclusive video interview with The Wall Street Journal.

Ukraine is ready to launch counteroffensive, Zelensky says in Wall Street Journal interviewUkraine is ready to launch its much-anticipated counteroffensive in the war against Russia, Ukrainian President Volodymyr Zelensky said in an exclusive video interview with The Wall Street Journal.

Consulte Mais informação »

Stock market chaotic new normal will screw over Wall Street investorsInsider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

Consulte Mais informação »

Wall Street Backs Off Bets on Fed Rate CutsPersistent strength in the economy has wrong-footed bets that the Fed will make large rate cuts this year, potentially undermining a key element of support for the 2023 stock rally

Wall Street Backs Off Bets on Fed Rate CutsPersistent strength in the economy has wrong-footed bets that the Fed will make large rate cuts this year, potentially undermining a key element of support for the 2023 stock rally

Consulte Mais informação »

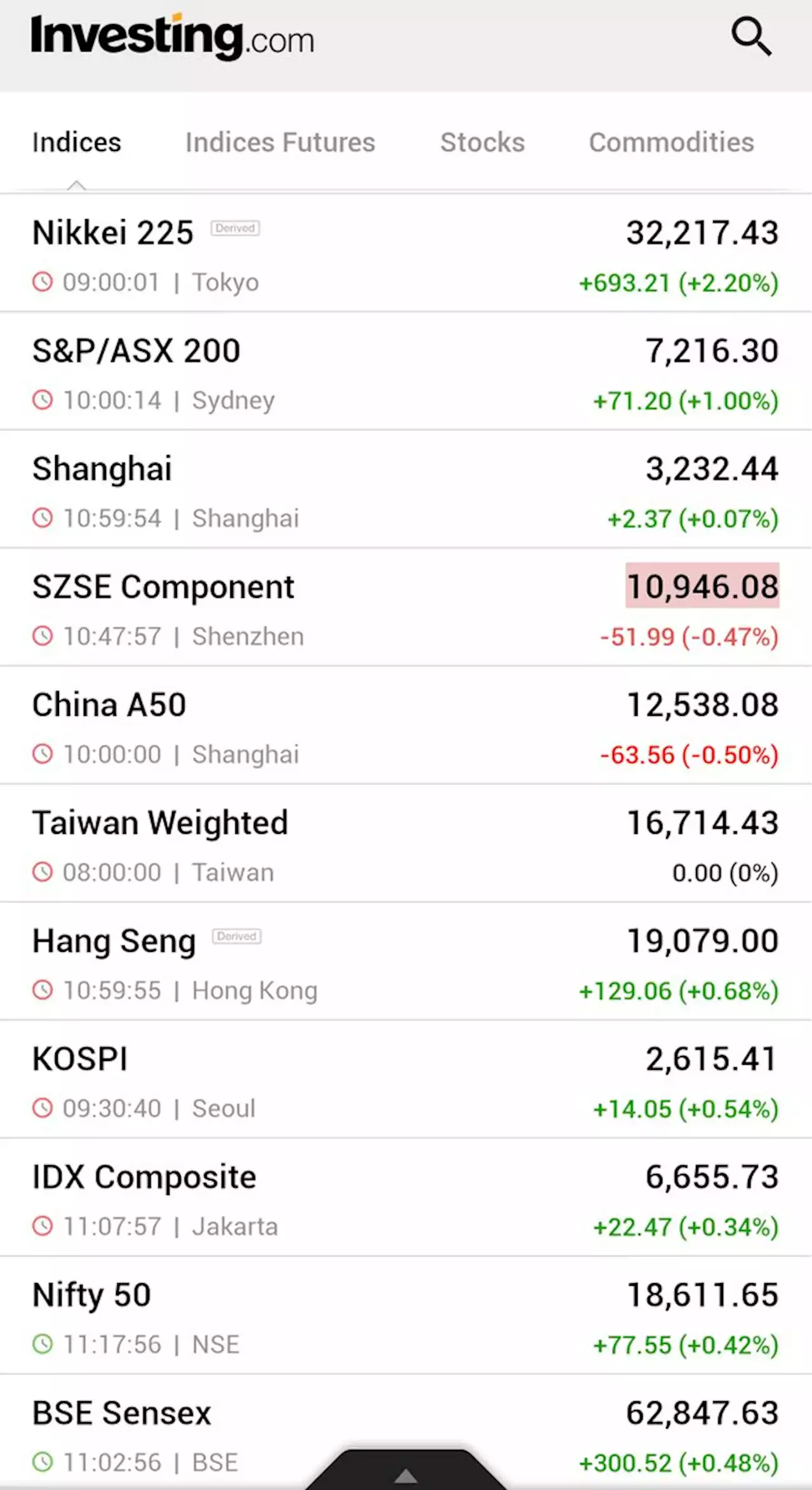

Japan's Nikkei closes at 33-year high; firm Wall Street lifts appetite By Reuters⚠️BREAKING: *ASIA STOCKS MOSTLY HIGHER ACROSS THE REGION TO START THE WEEK AS JAPAN'S NIKKEI CLOSES AT 33-YEAR PEAK 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Japan's Nikkei closes at 33-year high; firm Wall Street lifts appetite By Reuters⚠️BREAKING: *ASIA STOCKS MOSTLY HIGHER ACROSS THE REGION TO START THE WEEK AS JAPAN'S NIKKEI CLOSES AT 33-YEAR PEAK 🇯🇵🇦🇺🇨🇳🇭🇰🇰🇷🇮🇩🇮🇳

Consulte Mais informação »