More than 100 U.S. banks with $10 billion or more in assets would be required to have their executive compensation revoked for three years following a bank’s failure or FDIC resolution – if this bipartisan bill is passed.

A bipartisan group of lawmakers on the powerful Senate Banking Committee are coalescing around a bill that would have the government claw back executive pay at failed banks to encourage better risk management.

It would apply to bank directors, controlling shareholders and “other high-level persons involved in decision making of banks,” according to a summary of the bill. Read more: CFPB chief Chopra calls for clawbacks, stricter regulation of banker pay after SVB collapse The proposals followed outrage over Silicon Valley Bank CEO Greg Becker’s $10 million annual payout in the years leading up to its collapse. In a congressional hearing last month, Becker wouldn’t commit to giving any of that money up, even after the federal government was forced bailout uninsured depositors at the bank following years of poor risk management.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

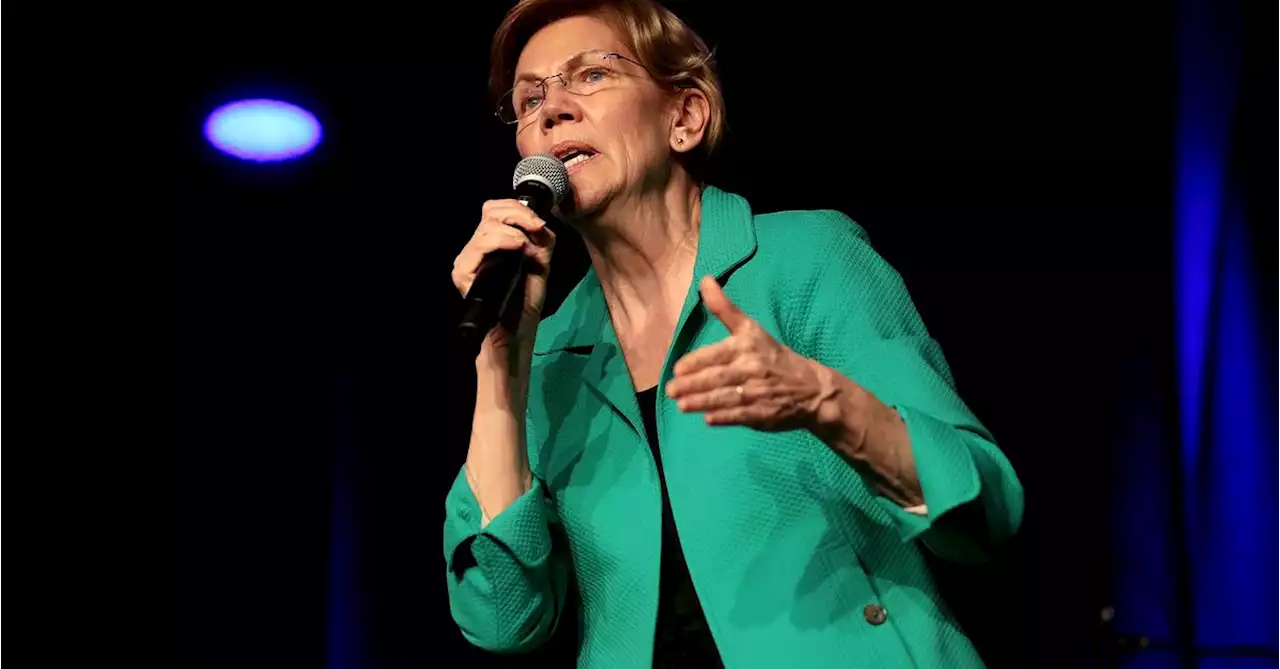

Elizabeth Warren, J.D. Vance team up on bank CEO crackdownWarren, a Massachusetts Democrat, and Vance, an Ohio Republican, worked hand-in-hand to craft the latest iteration of the bill and assemble key co-sponsors.

Elizabeth Warren, J.D. Vance team up on bank CEO crackdownWarren, a Massachusetts Democrat, and Vance, an Ohio Republican, worked hand-in-hand to craft the latest iteration of the bill and assemble key co-sponsors.

Consulte Mais informação »

Warren teams up with Vance on bill to claw back earnings from CEOs of failed banks.SenWarren and Sen JDVance1 have teamed up on a bill to punish executives of big banks that fail. Both say the legislation will help prevent future failures, like that of SVB, by incentivizing bank CEOs to prevent their institutions from collapsing.

Warren teams up with Vance on bill to claw back earnings from CEOs of failed banks.SenWarren and Sen JDVance1 have teamed up on a bill to punish executives of big banks that fail. Both say the legislation will help prevent future failures, like that of SVB, by incentivizing bank CEOs to prevent their institutions from collapsing.

Consulte Mais informação »

U.S. Sen. Elizabeth Warren Calls for Shutdown of Crypto Funding for Fentanyl.SenWarren wants to shut off the pipeline of crypto-funded fentanyl chemicals from China, and Treasury’s RosenbergEliz says Chinese companies like crypto for the same reasons criminal cartels do. jesseahamilton reports

U.S. Sen. Elizabeth Warren Calls for Shutdown of Crypto Funding for Fentanyl.SenWarren wants to shut off the pipeline of crypto-funded fentanyl chemicals from China, and Treasury’s RosenbergEliz says Chinese companies like crypto for the same reasons criminal cartels do. jesseahamilton reports

Consulte Mais informação »

Sen. Elizabeth Warren points to crypto payments as facilitating fentanyl trade in ChinaImagine using crypto not for buying digital art, but for fentanyl. Sen. Warren spots the trend, citing a 450% jump in transactions from an Elliptic report. Fasten your seatbelts, regulation is reloading.

Sen. Elizabeth Warren points to crypto payments as facilitating fentanyl trade in ChinaImagine using crypto not for buying digital art, but for fentanyl. Sen. Warren spots the trend, citing a 450% jump in transactions from an Elliptic report. Fasten your seatbelts, regulation is reloading.

Consulte Mais informação »

Why Elizabeth Warren Is Wrong About Crypto and the Fentanyl EpidemicChainalysis and Elliptic have found that crypto is useful for crime, but that’s hardly an argument for banning it, danielgkuhn writes. Opinion

Why Elizabeth Warren Is Wrong About Crypto and the Fentanyl EpidemicChainalysis and Elliptic have found that crypto is useful for crime, but that’s hardly an argument for banning it, danielgkuhn writes. Opinion

Consulte Mais informação »

Crypto helps fund fentanyl trade, says Sen. Elizabeth Warren, calling for strict regulationA study found that crypto payments to the wallets of some China-based fentanyl precursor suppliers totaled enough to produce pills with a street value of approximately $54 billion, Senator Elizabeth Warren said.

Crypto helps fund fentanyl trade, says Sen. Elizabeth Warren, calling for strict regulationA study found that crypto payments to the wallets of some China-based fentanyl precursor suppliers totaled enough to produce pills with a street value of approximately $54 billion, Senator Elizabeth Warren said.

Consulte Mais informação »