S&P 500 surges back towards 4500 level as analysts cite month-end buying By Frank_Macro SP500 Equities

indice's on-the-day gains currently stand at roughly 1.4%, taking the two-day run of gains to more than 3.5%. The tech-heavy Nasdaq 100 index is seeing even more impressive gains of over 2.5% on the session and is now up more than 5.0% in the last two sessions. The Dow is up 0.8% and probing its 200-day moving average at the 35K level, up about 2.5% in the last two sessions. The S&P 500 CBOEIndex or VIX saw a sharp 2.

Some analysts put the strong gains, particularly in the hard-hit tech sector, down to month-end factors. “Today's and Friday's bounce is just some of the institutional guys saying Nasdaq was due for end of the month rebalancing… It is simply a little bit of a relief rally after such a sharp sell-off," said an analyst at Ally Invest. But the Nasdaq 100 index was also helped by a more than 9.

Nonetheless, the Nasdaq 100 looks set to close out the month 9.1% lower, the S&P 500 5.6% lower and the Dow 3.7% lower. Fed tightening fears have been the major driver of the downside, with markets now expecting five 25bps rate hikes in 2022 and with Fed speakers so far this weak doing nothing to dampen this speculation. Fed speakers have also done nothing to dampen speculation that the first move, expected in March, could be a 50bps rate hike.

Looking ahead this week, the Fed tightening story will receive further inputs in the form of plenty more Fed speak, as well as key US data releases, most important of which is Friday’s January labour market report. The report will be closely scrutinised for signs of wage inflation and a further tightening of the labour market, given that this is what the Fed is mostly focused on right now.

Another important equity market theme this week is the ongoing Q4 earnings season. Following last week’s decent results from Apple and Microsoft last week, Alphabet , Amazon and Meta Platforms will be reporting. According to Refinitiv data cited by Reuters, 77.4% of S&P 500 companies who have reported earnings thus far have beaten analyst expectations. To shield equity markets from further Fed tightening fears induced downside, this strong run of earnings will need to continue.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

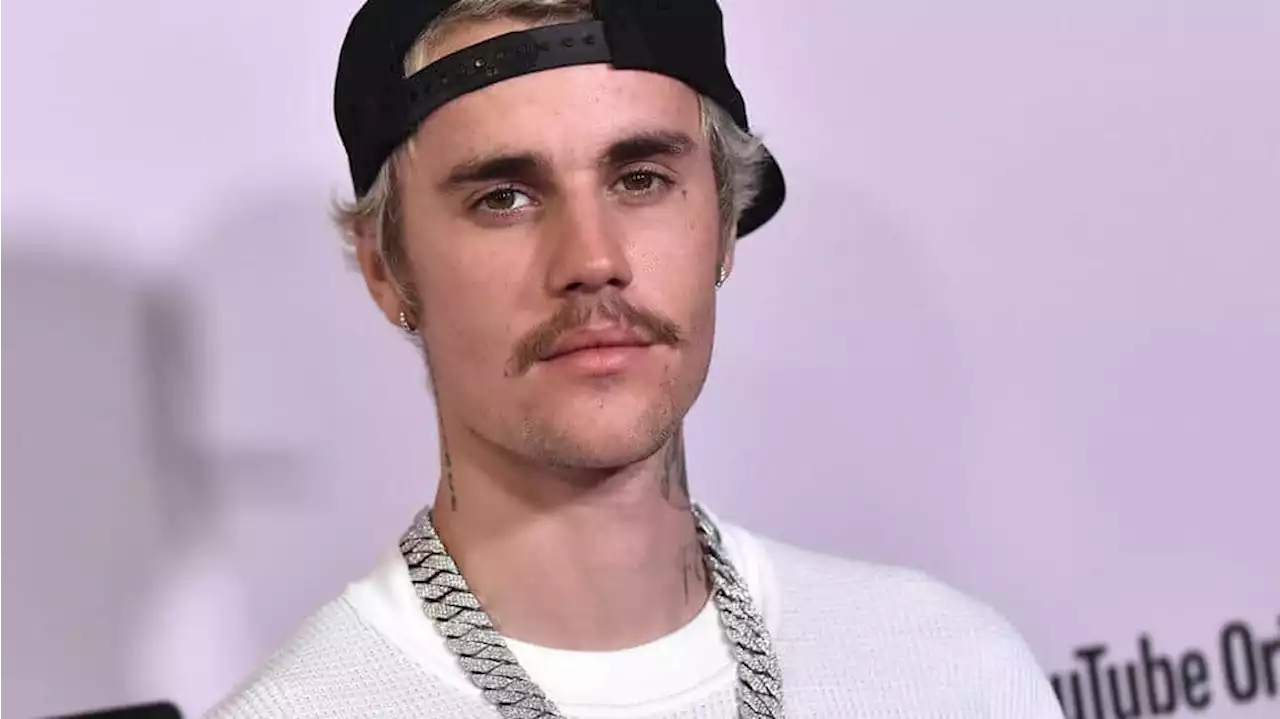

Justin Bieber Buys a Bored Ape NFT for $1.3 Million (500 ETH)Justin Bieber is the latest celebrity to join the Bored Ape Yacht Club. He paid 500 ETH ($1.3M) for the Bored Ape NFT 3001.

Justin Bieber Buys a Bored Ape NFT for $1.3 Million (500 ETH)Justin Bieber is the latest celebrity to join the Bored Ape Yacht Club. He paid 500 ETH ($1.3M) for the Bored Ape NFT 3001.

Consulte Mais informação »

This 500-Year-Old Boticelli Painting of Jesus Just Sold for $45.4 MillionThe work is now the second most expensive piece by the Italian painter ever to be sold.

This 500-Year-Old Boticelli Painting of Jesus Just Sold for $45.4 MillionThe work is now the second most expensive piece by the Italian painter ever to be sold.

Consulte Mais informação »

This Technology Will Help People Drastically Extend Their Lifespan by 500 Years and BeyondFuturist Dr. Ian Pearson believes that if you live to 2050, you may never die. Here is why.

This Technology Will Help People Drastically Extend Their Lifespan by 500 Years and BeyondFuturist Dr. Ian Pearson believes that if you live to 2050, you may never die. Here is why.

Consulte Mais informação »

Goldman Sachs says that 5 stocks on the S&P 500 could rally over 80% this yearGoldman Sachs' list of top stock picks includes a bunch of S&P 500 companies, including five that it says have serious potential upside.

Goldman Sachs says that 5 stocks on the S&P 500 could rally over 80% this yearGoldman Sachs' list of top stock picks includes a bunch of S&P 500 companies, including five that it says have serious potential upside.

Consulte Mais informação »

Over 4,500 flights canceled as blizzard buffets East Coast with deep snow, winds, floodingA nor'easter with hurricane-force wind gusts battered much of the East Coast on Saturday, flinging heavy snow that made travel treacherous or impossible, flooding coastlines, and threatening to leave bitter cold in its wake.

Over 4,500 flights canceled as blizzard buffets East Coast with deep snow, winds, floodingA nor'easter with hurricane-force wind gusts battered much of the East Coast on Saturday, flinging heavy snow that made travel treacherous or impossible, flooding coastlines, and threatening to leave bitter cold in its wake.

Consulte Mais informação »

S&P 500 Index to tank towards a 3,400-3,700 range on escalation of Ukraine-Russia crisis – UBSSince omicron cases spiked in December, fears of slower growth and higher inflation have weighed on equities. Tensions between Russia and Ukraine are

S&P 500 Index to tank towards a 3,400-3,700 range on escalation of Ukraine-Russia crisis – UBSSince omicron cases spiked in December, fears of slower growth and higher inflation have weighed on equities. Tensions between Russia and Ukraine are

Consulte Mais informação »