🔴 Renters are less than half as likely to feel they had enough money set aside for emergencies compared to outright owners, and a third less likely than mortgagors – with the gap “likely to widen”, according to Bank of England analysis

many of these are actually telling landlords they can up costs by even more than they originally intended to doDan Wilson Craw, deputy chief executive at Generation Rent, warned that renters were under “huge financial pressure” with rents having “shot up” on new tenancies and most renters facing rent increases on existing tenancies in the past year.

He added: “When competition for homes is so tight there’s very little choice but to pay these higher market rents, and that means binning hopes of saving for the future.which will directly help those who are facing the worst difficulties in this cost of living crisis.are in so much debt that they are trying to pass on interest rate rises. There is a cost of renting crisis but it’s primarily a result of a failure to build homes, not interest rates.

The Bank of England analysis concludes by saying that banks are “unlikely to be severely affected if renters come under further stress”.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Interest rates will stay high for three years Bank of England warns, piling on mortgage painHomeowners face three years of sustained mortgage pressure due to years of projected high interest rates, with Chancellor Jeremy Hunt leaving the door open to more support for families

Interest rates will stay high for three years Bank of England warns, piling on mortgage painHomeowners face three years of sustained mortgage pressure due to years of projected high interest rates, with Chancellor Jeremy Hunt leaving the door open to more support for families

Consulte Mais informação »

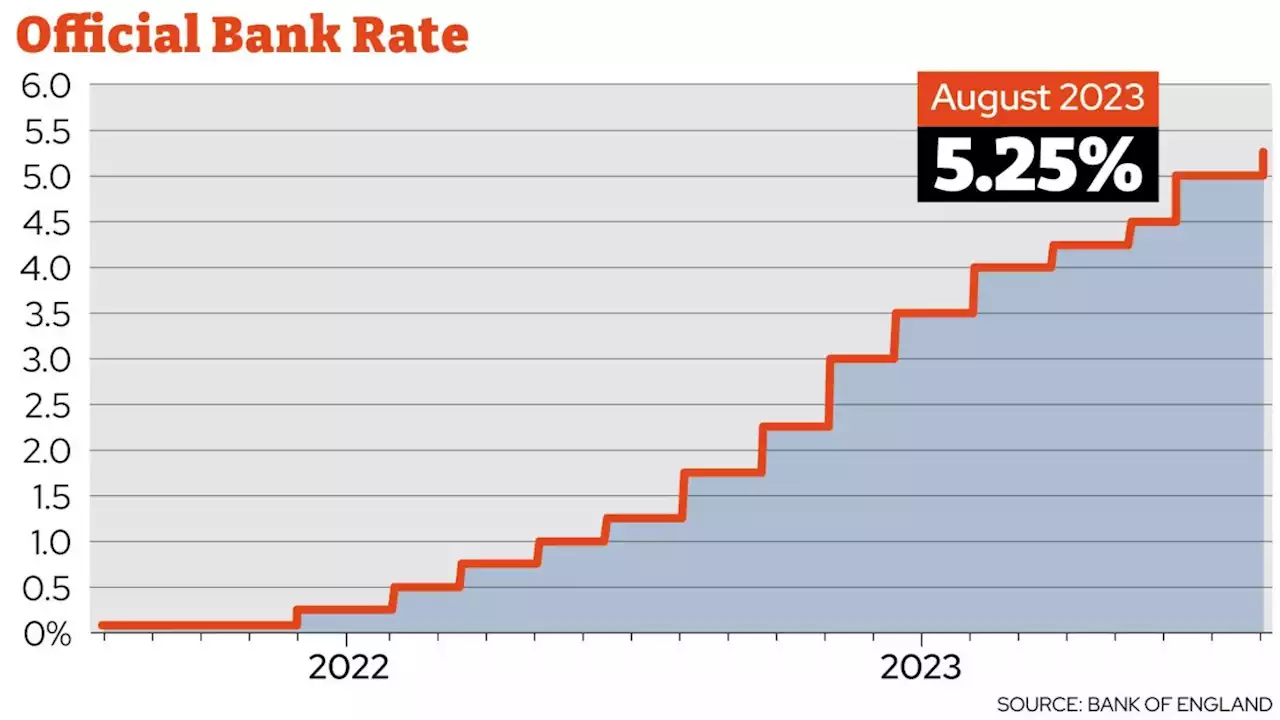

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Bank of England expected to hike interest rate for 14th time in a rowEconomists think a 0.25 percentage point rise to 5.25% is the most likely outcome on Thursday. But there are concerns about the impact of rising rates on many households.

Consulte Mais informação »

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

What time is the Bank of England's August interest rate announcement today?Economists are widely predicting the Bank will raise the base by 0.25 percentage points

Consulte Mais informação »

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Bank of England increases interest rates to 5.25% - what it means for mortgages and savingsThe Bank of England has increased the base rate from 5% to 5.25% this lunchtime, the 14th consecutive rise since December 2021, when rates were just 0.1% Here, CallumCMason examines what a 0.25 percentage point rise means for your money ⬇️

Consulte Mais informação »

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Bank of England increases interest rate for 14th time in a row to 5.25%BREAKING: The Bank of England has increased the base interest rate from 5% to 5.25% in the 14th consecutive hike 📺 Sky 501, Virgin 602, Freeview 233 and YouTube

Consulte Mais informação »

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Mortgage warning for millions as Bank of England hikes interest rates againMILLIONS of homeowners are braced for more mortgage misery as the Bank of England has hiked interest rates to a new 15-year high. The Bank’s Monetary Policy Committee (MPC) has lifted the…

Consulte Mais informação »