NZD/USD struggles to capitalize on modest intraday gains, remains below mid-0.6300s – by hareshmenghani NZDUSD RiskAppetite Recession Fed Currencies

he pair is currently placed just below mid-0.6300s, though remains well within a familiar trading band held over the past week or so.

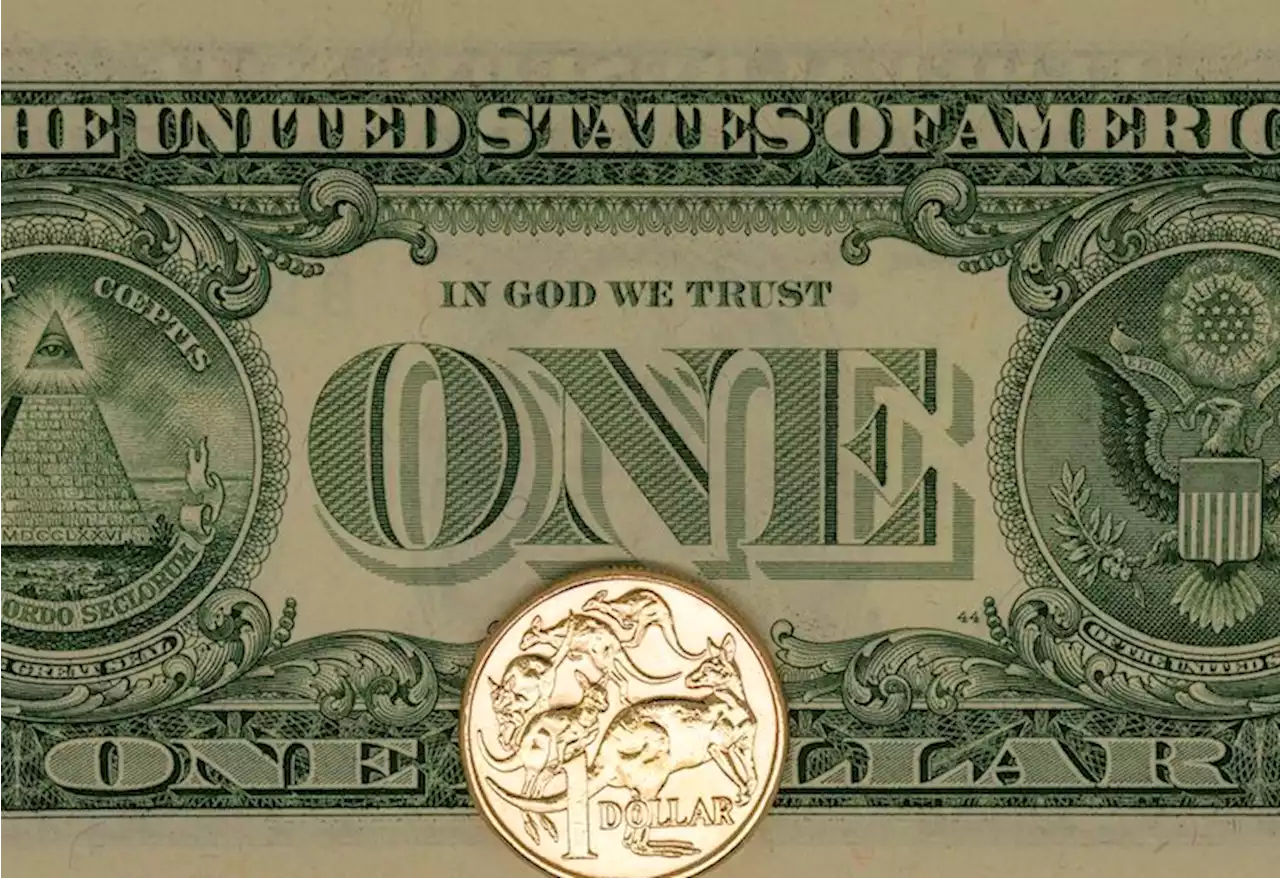

The US Dollar fails to capitalise on its modest intraday gains and turns out to be a key factor lending some support to the NZD/USD pair. A softer tone surrounding the US Treasury bond yields acts as a headwind for the greenback. Apart from this, an intraday recovery in the US equity markets further undermines the safe-haven buck and benefits the risk-sensitiveThat said, worries about a deeper global economic downturn should keep a lid on any optimism in the markets.

Investors now seem convinced that the Fed will stick to its hawkish stance. The bets were reaffirmed by the Labor Department's annual revisions of CPI, which showed that consumer prices rose in December instead of falling as previously estimated. Separately, the University of Michigan survey's one-year inflation expectations climbed to 4.2% in February from the 3.9% previous.

This raises the risk of higher inflation print for January and dashes hopes for an imminent pause in the Fed's rate-hiking cycle. Hence, the market focus will remain glued to the crucial US CPI report on Tuesday. Heading into the key data risk, traders might refrain from placing aggressive bets around the NZD/USD pair in the absence of relevant economic data on Monday.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

NZD/USD Price Analysis: Bears approach five-week-old support near 0.6280NZD/USD Price Analysis: Bears approach five-week-old support near 0.6280 NZDUSD Technical Analysis ChartPatterns SupportResistance TrendFollowing

NZD/USD Price Analysis: Bears approach five-week-old support near 0.6280NZD/USD Price Analysis: Bears approach five-week-old support near 0.6280 NZDUSD Technical Analysis ChartPatterns SupportResistance TrendFollowing

Consulte Mais informação »

GBP/USD trades with modest losses around mid-1.2000s, lacks follow-through sellingGBP/USD trades with modest losses around mid-1.2000s, lacks follow-through selling – by hareshmenghani GBPUSD Fed Inflation Recession Currencies

GBP/USD trades with modest losses around mid-1.2000s, lacks follow-through sellingGBP/USD trades with modest losses around mid-1.2000s, lacks follow-through selling – by hareshmenghani GBPUSD Fed Inflation Recession Currencies

Consulte Mais informação »

AUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtickAUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtick – by hareshmenghani AUDUSD Fed Inflation Recession Currencies

AUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtickAUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtick – by hareshmenghani AUDUSD Fed Inflation Recession Currencies

Consulte Mais informação »

WTI fails to justify OPEC’s Oil demand optimism around $79.00 amid risk-off moodWTI crude oil pares the previous day’s gains around $79.00, down 1.22% intraday during early Monday, as energy buyers fail to ignore the broad risk-of

WTI fails to justify OPEC’s Oil demand optimism around $79.00 amid risk-off moodWTI crude oil pares the previous day’s gains around $79.00, down 1.22% intraday during early Monday, as energy buyers fail to ignore the broad risk-of

Consulte Mais informação »