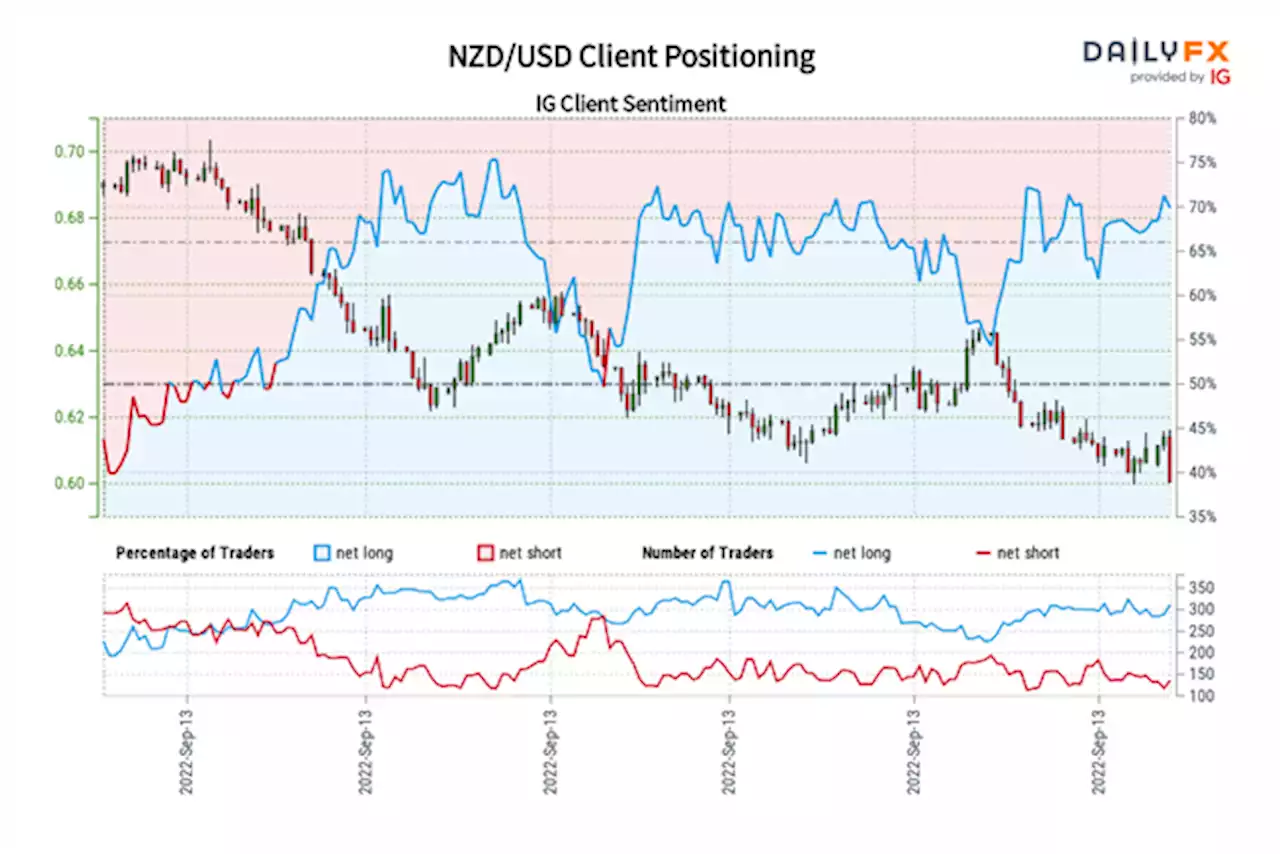

The New Zealand Dollar sank in the worst day since March 2020 as US CPI data beat estimates. Retail traders boosted NZD/USD long bets, is this a sign more pain is ahead for the Kiwi? Get your market update from ddubrovskyFX here:

. The headline rate of inflation clocked in at 8.3% y/y versus 8.1% estimated, a slower-than-expected weakening from 8.5% recorded in July.

More worryingly for the Federal Reserve, the stickier core gauge unexpectedly strengthened to 6.3% y/y from 5.9% prior. A 6.1% outcome was estimated by economists. The divergence between headline and core gauge could be explained by falling energy prices in recent months. Meanwhile, shelter prices accelerated amid soaring rents.

All this is translating into a potentially more aggressive Fed. According to the CME FedWatch Tool, the odds of a 75-basis point rate hike this month stand around 66%. A full 100-basis point surge is seen with a near 33% probability. This continues to make the Fed the most aggressively hawkish developed central bank, pressuring the New Zealand Dollar as the US Dollar surged.