'We need crypto tax management to get easier, not harder.' Opinion thebitcoincpa

for centralized crypto exchanges, effectively turning digital assets into securities for purposes of the Section 6045 reporting requirement. Stock trading firms issue tax forms 1099-Bs with sales of securities and capital gains and losses, so centralized exchanges will do the same thing for crypto trades on the new Form 1099-DA. Cash App and Robinhood Crypto, for example, have already been issuing crypto trades on 1099-Bs for several years..

Under the new rules, Alice would receive seven 1099-DAs in addition to her own universal calculation. Alice is no longer solely responsible for her crypto tax calculations and instead has eight parties, including herself, in on the calculation exercise. Bob and Alice have run headfirst into some of the numerous 1099-DA pitfalls. Now they must go through a rigorous exercise to reconcile all the 1099-DAs with their own universal calculation to double-check the exchanges correctly reported information. The challenge of managing crypto taxes just got magnified. In the absence of a thorough reconciliation and cross-checking exercise, taxpayers will otherwise double count and/or omit cost basis and therefore understate or overstate tax liabilities.

Cost-basis tracking on a per-wallet and exchange basis would help the reconciliation process but doesn’t come without its own issues. Several crypto tax software providers, such as Cointracker and Bitwave, are rolling out per-wallet and exchange tracking and some already had these features.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

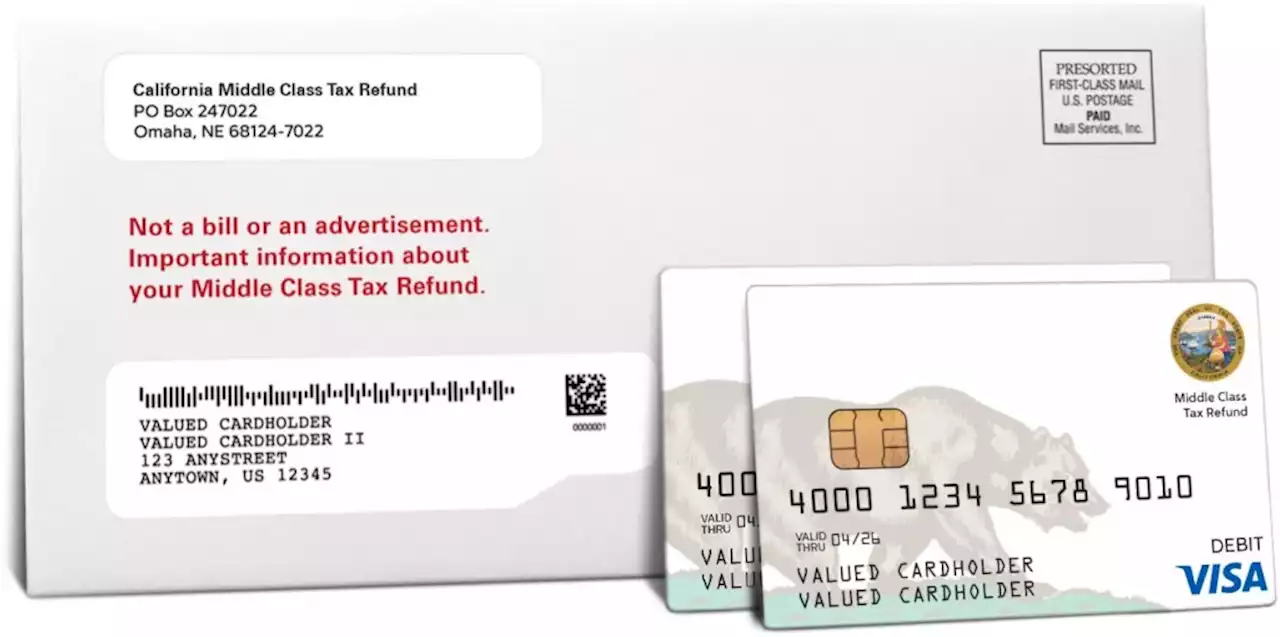

Middle Class Tax Refund: Early filers can amend 2022 returns to recoup taxes, IRS saysAnyone who included the refund as taxable income using a 1099 should consider refiling.

Middle Class Tax Refund: Early filers can amend 2022 returns to recoup taxes, IRS saysAnyone who included the refund as taxable income using a 1099 should consider refiling.

Consulte Mais informação »

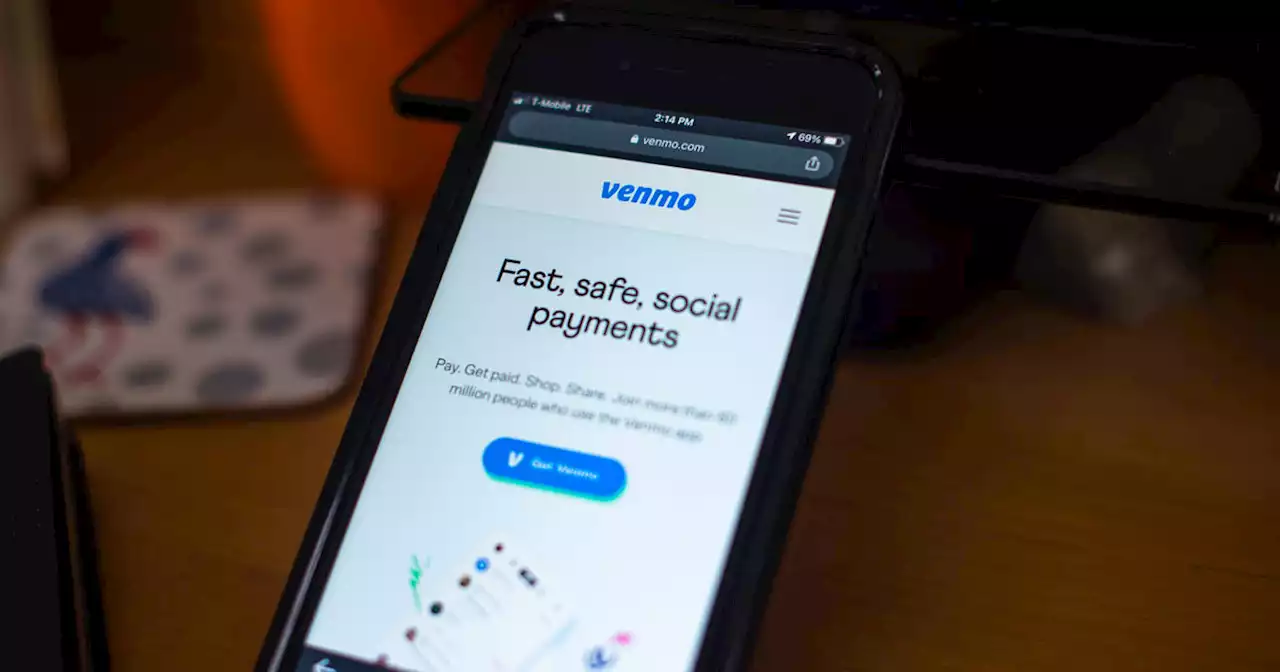

New tax rule on apps like Venmo, PayPal could spell confusion for small businessesStarting next year, a new IRS rule will require anyone who earned over $600 on payment apps in 2023 to file a 1099-K form.

New tax rule on apps like Venmo, PayPal could spell confusion for small businessesStarting next year, a new IRS rule will require anyone who earned over $600 on payment apps in 2023 to file a 1099-K form.

Consulte Mais informação »

TPD seeing complaints about speeding and unsafe lane changing on new online reporting toolTraffic Watch is the Tucson Police Department's online reporting tool to submit complaints about unsafe driving.

TPD seeing complaints about speeding and unsafe lane changing on new online reporting toolTraffic Watch is the Tucson Police Department's online reporting tool to submit complaints about unsafe driving.

Consulte Mais informação »

Credit reporting complaints ‘skyrocket’ to new record, report findsConsumer watchdog group uspirg finds complaints against credit reporting agencies are on the rise. InvestigateTV Consumer Investigator CaresseJ shares the major concerns people are reporting and how you can avoid running into the same problems.

Credit reporting complaints ‘skyrocket’ to new record, report findsConsumer watchdog group uspirg finds complaints against credit reporting agencies are on the rise. InvestigateTV Consumer Investigator CaresseJ shares the major concerns people are reporting and how you can avoid running into the same problems.

Consulte Mais informação »

New Lego Ideas 'Tales of the Space Age' set creates out-of-this-world displays'Now we've got our minds wondering about outer space.'

New Lego Ideas 'Tales of the Space Age' set creates out-of-this-world displays'Now we've got our minds wondering about outer space.'

Consulte Mais informação »

Earn a bank bonus or interest last year? Don’t forget to pay taxes on itJust because you didn’t receive a form like a 1099-INT from your bank doesn’t mean you don’t owe taxes on interest income.

Earn a bank bonus or interest last year? Don’t forget to pay taxes on itJust because you didn’t receive a form like a 1099-INT from your bank doesn’t mean you don’t owe taxes on interest income.

Consulte Mais informação »