More homebuyers are taking out adjustable-rate mortgages, betting rates will drop in a few years. Getting one could save you thousands — but it's still risky.

Homebuyers seeking lower monthly payments are turning to adjustable-rate mortgages, or ARMs.Borrowers are betting rates will drop. Experts say taking out an ARM now isn't as risky as in 2008.

A few percentage points might not seem like a lot, but that difference can mean hundreds of dollars more in payments each month for a typical home.

And while ARMs have surged in popularity recently — they accounted for nearly 11% of mortgage applications during a week in mid-June, according to the Mortgage Bankers Association, despite never having passed the 4% mark in all of 2021 — they're still not nearly as prominent as they were in the early 2000s, when they sometimes made up more than a third of all mortgage applications, per the MBA.

First-time homebuyers, for example, can be ideal candidates for an ARM, particularly if they plan to stay in the home for only a few years, said Sarah Alvarez, a vice president of mortgage banking at William Raveis Mortgage in New York.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

San Antonio home sales, competition coolingSan Antonio's red hot housing market is showing signs of cooling as buyers contend with high prices and higher mortgage rates.

San Antonio home sales, competition coolingSan Antonio's red hot housing market is showing signs of cooling as buyers contend with high prices and higher mortgage rates.

Consulte Mais informação »

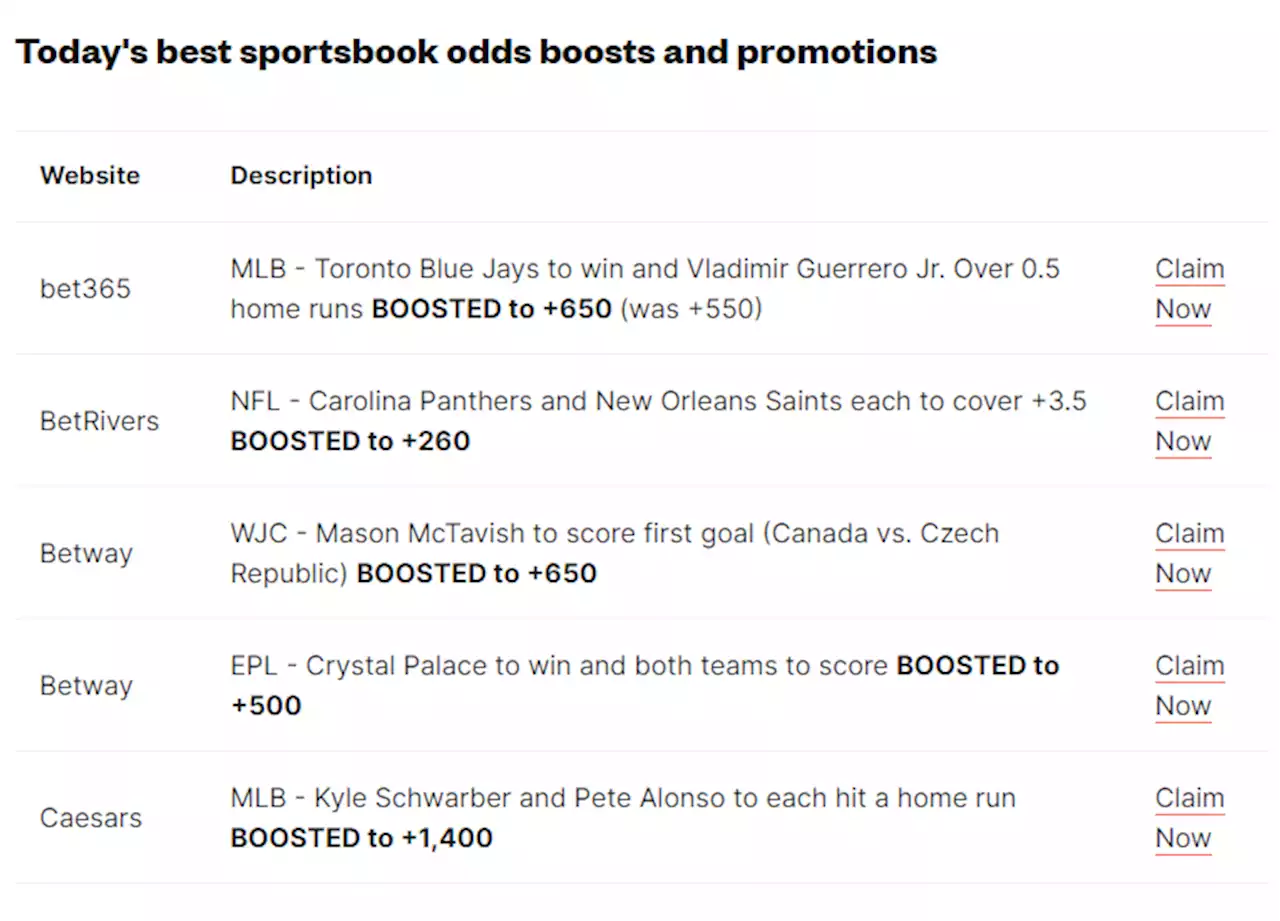

Best US Sportsbook Odds Boosts and Promotions — August 20While it can be tedious to go to every different sportsbook and search for the best bonuses of the day, we've got you covered — we've compiled a list of today's best odds boosts and betting promotions, tucked into one neat and tidy package.

Best US Sportsbook Odds Boosts and Promotions — August 20While it can be tedious to go to every different sportsbook and search for the best bonuses of the day, we've got you covered — we've compiled a list of today's best odds boosts and betting promotions, tucked into one neat and tidy package.

Consulte Mais informação »

Best US Sportsbook Odds Boosts and Promotions — August 19It can be tedious to go to every different sportsbook and search for the best bonuses of the day, we've got you covered — we've compiled a list of today's best odds boosts and betting promotions, tucked into one neat and tidy package.

Best US Sportsbook Odds Boosts and Promotions — August 19It can be tedious to go to every different sportsbook and search for the best bonuses of the day, we've got you covered — we've compiled a list of today's best odds boosts and betting promotions, tucked into one neat and tidy package.

Consulte Mais informação »

Housing market records sharpest decline in sales in almost two decades: reportThe sharp decline shows the lagging effect of the increased mortgage rate on the housing market, with prices still higher than the same time last year despite declining.

Housing market records sharpest decline in sales in almost two decades: reportThe sharp decline shows the lagging effect of the increased mortgage rate on the housing market, with prices still higher than the same time last year despite declining.

Consulte Mais informação »

7 Sweater Dresses Shoppers Are Obsessed WithWe found the highest-rated sweater dresses on the internet, according to the women who live in them from fall to spring.

7 Sweater Dresses Shoppers Are Obsessed WithWe found the highest-rated sweater dresses on the internet, according to the women who live in them from fall to spring.

Consulte Mais informação »

USAA lays off a 'triple-digit' number of workers as U.S. economy shows signs of slowingUSAA previously cut over 90 jobs from its mortgage department in March. SanAntonio SATX USAA

USAA lays off a 'triple-digit' number of workers as U.S. economy shows signs of slowingUSAA previously cut over 90 jobs from its mortgage department in March. SanAntonio SATX USAA

Consulte Mais informação »