The administration's move to shield the banks' depositors — and let banks with profiles similar to SVB and Signature get pummeled by the stock market — carried significant risks.

The administration's move to shield the banks' depositors — and let banks with profiles similar to SVB and Signature get pummeled by the stock market — carried significant risks.

But by the market's close on Monday the trouble appeared to be limited to stock prices, and largely affecting medium-sized regional banks, rather than a systemic run on the U.S. banking system. In investor parlance, the damage was idiosyncratic, limited to a specific asset class.“We took sweeping action, powerful action, trying to prevent possible future bank runs,” a Treasury official told Axios.

Make sure that SVB and Signature account holders — which includes companies like Roku, a streaming platform, DocuSign, a cloud software vendor, andMove quickly to get ahead of Asian markets that were opening on Sunday.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

Consulte Mais informação »

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

Consulte Mais informação »

SVB Financial mulls strategic options, hires restructuring veteranDefunct startup-focused lender SVB Financial Group said on Monday that it was planning to explore strategic alternatives for its businesses including the holding company, SVB Capital and SVB Securities.

SVB Financial mulls strategic options, hires restructuring veteranDefunct startup-focused lender SVB Financial Group said on Monday that it was planning to explore strategic alternatives for its businesses including the holding company, SVB Capital and SVB Securities.

Consulte Mais informação »

Some Democrat-donor investors furious over Biden’s handling of SVBOne of the deep-pocketed venture capitalists told The Post that Treasury Secretary Janet Yellen’s statement Sunday throwing cold water on the possibility of a bailout was “pathetic.&82…

Some Democrat-donor investors furious over Biden’s handling of SVBOne of the deep-pocketed venture capitalists told The Post that Treasury Secretary Janet Yellen’s statement Sunday throwing cold water on the possibility of a bailout was “pathetic.&82…

Consulte Mais informação »

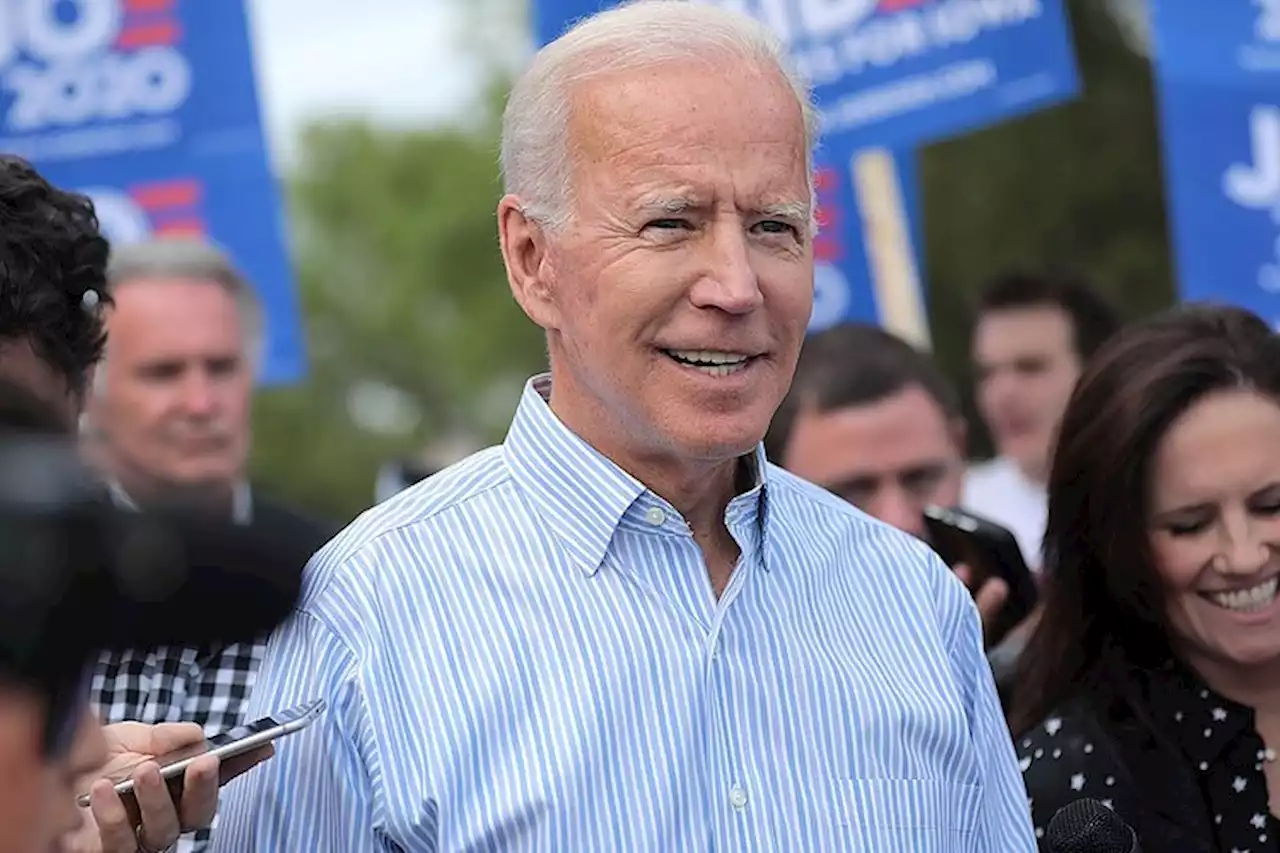

US President Biden on SVB rescue: Bank deposit solution avoids putting taxpayer dollars at riskCommenting on the Silicon Valley Bank (SVB) depositor rescue plan, US President Joe Biden said early Monday, the solution avoids putting taxpayer doll

US President Biden on SVB rescue: Bank deposit solution avoids putting taxpayer dollars at riskCommenting on the Silicon Valley Bank (SVB) depositor rescue plan, US President Joe Biden said early Monday, the solution avoids putting taxpayer doll

Consulte Mais informação »

Biden to defend US banking system after SVB, Signature collapsePresident Joe Biden will on Monday address a banking crisis that led U.S. regulators to step in with a series of emergency measures after the collapses of Silicon Valley Bank and Signature Bank threatened to trigger a broader systemic crisis.

Biden to defend US banking system after SVB, Signature collapsePresident Joe Biden will on Monday address a banking crisis that led U.S. regulators to step in with a series of emergency measures after the collapses of Silicon Valley Bank and Signature Bank threatened to trigger a broader systemic crisis.

Consulte Mais informação »