Goldman Sachs helped billionaires dodge taxes by selling stocks and replacing them with nearly identical investments. (via propublica)

Ballmer’s not-so-bad day, in fact, was carefully planned, part of a strategy by Goldman Sachs, which conducted the trades on Ballmer’s behalf, to wield the stock market’s natural volatility to the billionaire’s advantage. At Goldman, the hundreds of stocks in Ballmer’s “Tax Advantaged Loss Harvesting” accounts were selected to follow the movement of the broader markets. Over time, the markets, as they had historically, would buoy Ballmer’s investments upward.

” series. This trove includes not only some two decades of tax returns for thousands of the nation’s wealthiest citizens but also voluminous records of their trading., Goldman said it would halt transactions like Ballmer’s Shell and BHP trades. Goldman conducted a review, according to, and found that a “very small percentage” of its “tax investment solutions” trades were “inadvertently made in a manner inconsistent with our strategy.

Asset managers have used these advances to forge loss-harvesting accounts that boast hundreds of billions of dollars in assets. What the law sought to prevent — generating a tax loss without a substantial change in the investment — is now commonplace. For the rich, the “tax system is sort of like a rigged coin,” said David Schizer, a tax expert and professor at Columbia Law School: “If you win, you get to keep all of it, but if you lose, you can pass some of those losses on to the government.” The wash sale rule, he said, is easily skirted by “well-advised taxpayers.”

“I do not want to sell these stocks at the present market,” wrote R.H.T. “Would it be legal for me to sell these stocks and deduct the loss from this year’s income, even though I bought them in again the same day?” Yes, the Journal responded, the transaction was permitted under the law. In the mid-1990s, amid a historic market ascent, new strategies were forged to serve a new generation of superrich Americans. Asset managers began to emphasize post-tax returns. “Tax-aware investing is the challenge of the moment,” wrote Jean Brunel, the chief investment officer of JP Morgan’s global private bank, in the journal Trusts and Estates in 1997.

Brian Acton, a co-founder of WhatsApp, which a year before had been sold to Facebook for $19 billion, was one of those investors. He owned shares of Vanguard’s emerging markets ETF, which tracks an index of companies in China and elsewhere.IRS data, Acton sold $17 million in shares, resulting in a loss of $2.9 million. The same day, he bought $17 million worth of the emerging markets ETF offered by Blackrock.

In practice, however, there is only one scenario in which the wash sale rule is consistently enforced. IRS regulations require brokerages to mark a trade as a wash sale if, in the 60-day period around the sale, the investor buys, in the exact same account, the exact same security . The amount of the forbidden loss is then noted on a form, called a 1099-B, that brokerages send to the IRS each year to detail stock trades.

In these accounts, managers make decisions about what to buy as they would for a fund, but the investor owns the stocks directly. When the account mimics an index like the S&P 500, it’s called direct indexing. Such products have boomed in recent years. A In a direct indexing account, you don’t need to own all the stocks that compose the index, and it doesn’t really matter which specific stocks they are. Instead, what matters is that the collection of stocks closely tracks the index’s movements. This is achieved via a “thoughtful sampling of the underlying positions,” as a team of Morgan Stanley wealth managers put it in a recent issue of an investment journal.

Shell and BHP, both part of Ballmer’s loss-harvesting trade in 2015, each offered shares based in two different countries. Each company viewed these two versions as interchangeable in value. In fact, in 2022, both companies chose to merge their two classes into a single stock on a 1:1 basis.IRS data contained several hundred examples of these kinds of trades by Goldman clients dating back as long as 10 years ago.

The San Francisco-based firm manages about $13.2 billion for its 337 high-net-worth clients, according to a regulatory filing. Among them is Facebook co-founder Moskovitz, Zuckerberg’s old roommate at Harvard. Since the mid-2000s, when Moscovitz’s six-figure Facebook salary made up almost all his income — he’s now worth more than $7 billion — his financial life has grown considerably more complicated.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

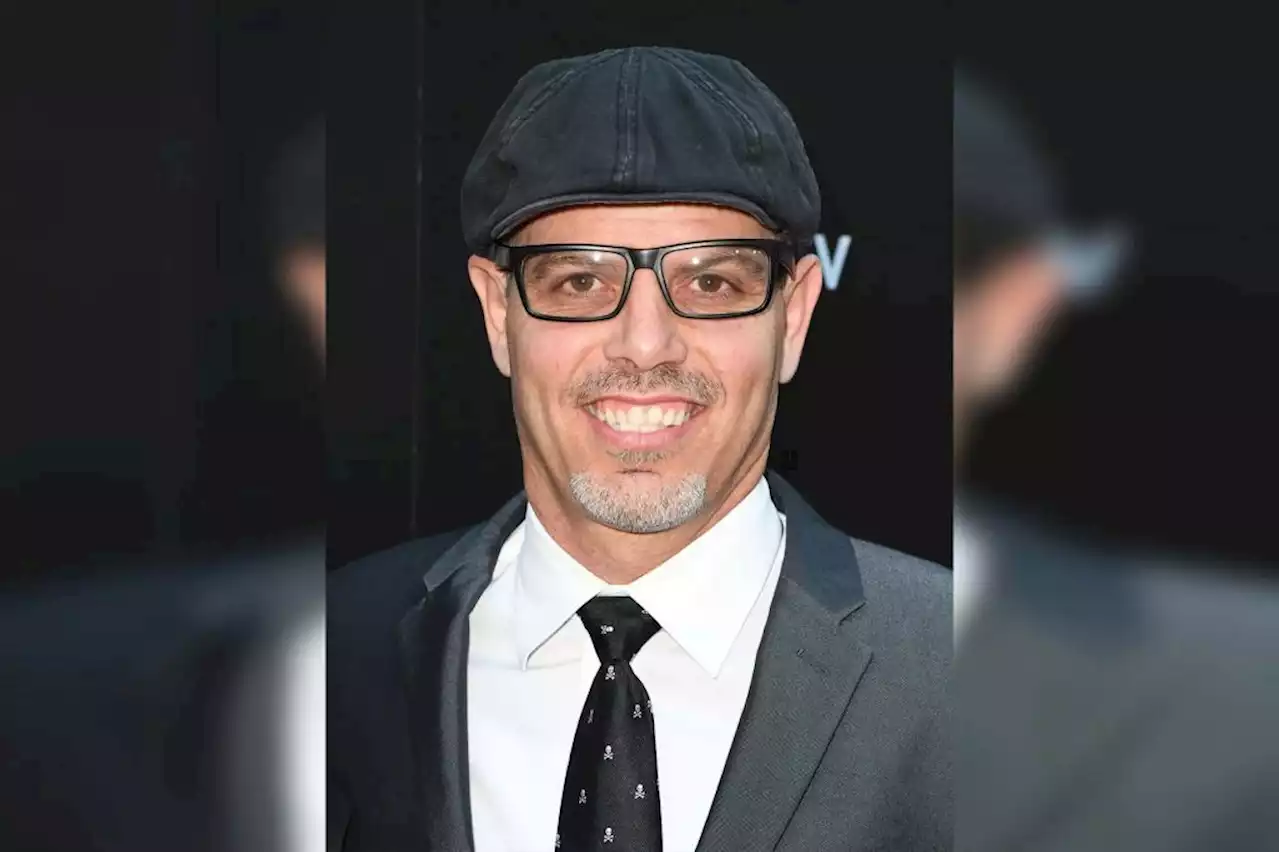

Crypto markets are undergoing a 'flight to quality,' says Goldman Sachs digital assets chiefMathew McDermott, who leads the digital asset unit at Goldman Sachs, lays out how blockchain technology could enable greater liquidity across the marketplace.

Crypto markets are undergoing a 'flight to quality,' says Goldman Sachs digital assets chiefMathew McDermott, who leads the digital asset unit at Goldman Sachs, lays out how blockchain technology could enable greater liquidity across the marketplace.

Consulte Mais informação »

Goldman Sachs Annoyed by CEO's Part Time Gig as a DJGoldman Sachs' board members are, apparently, mighty fed up with CEO David Solomon's increasingly problematic disc-jockeying hobby.

Goldman Sachs Annoyed by CEO's Part Time Gig as a DJGoldman Sachs' board members are, apparently, mighty fed up with CEO David Solomon's increasingly problematic disc-jockeying hobby.

Consulte Mais informação »

Feces smeared all over home of California official in wealthy beach town: policeThe city manager in Laguna Beach, California woke up Thursday to find that her house had been vandalized by an individual who smeared feces all over the property.

Feces smeared all over home of California official in wealthy beach town: policeThe city manager in Laguna Beach, California woke up Thursday to find that her house had been vandalized by an individual who smeared feces all over the property.

Consulte Mais informação »

Ether drops after SEC's staking crackdown, and Goldman outlines blockchain vision: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what's ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today's show, Mathew McDermott, global head of digital assets for Goldman Sachs, discusses big banks' strategy for crypto's underlying technology.

Ether drops after SEC's staking crackdown, and Goldman outlines blockchain vision: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what's ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today's show, Mathew McDermott, global head of digital assets for Goldman Sachs, discusses big banks' strategy for crypto's underlying technology.

Consulte Mais informação »

Millionaire Rep. Dan Goldman has racked up 84 tickets in 6 yearsHis enormous, gas-guzzling SUVs also raise questions about Goldman’s rhetoric as a Green New Deal champion.

Millionaire Rep. Dan Goldman has racked up 84 tickets in 6 yearsHis enormous, gas-guzzling SUVs also raise questions about Goldman’s rhetoric as a Green New Deal champion.

Consulte Mais informação »

Hollywood pimp sentenced to prison for running hooker ring that catered to actors, producersA Hollywood movie producer was sentenced to five years in prison Thursday for operating a sprawling prostitution ring that catered to the wealthy and powerful, including film producers, gamblers an…

Hollywood pimp sentenced to prison for running hooker ring that catered to actors, producersA Hollywood movie producer was sentenced to five years in prison Thursday for operating a sprawling prostitution ring that catered to the wealthy and powerful, including film producers, gamblers an…

Consulte Mais informação »