Depositors withdrew savings, and investors broadly sold off bank shares as the federal government raced to reassure Americans that the banking system is secure following two bank failures

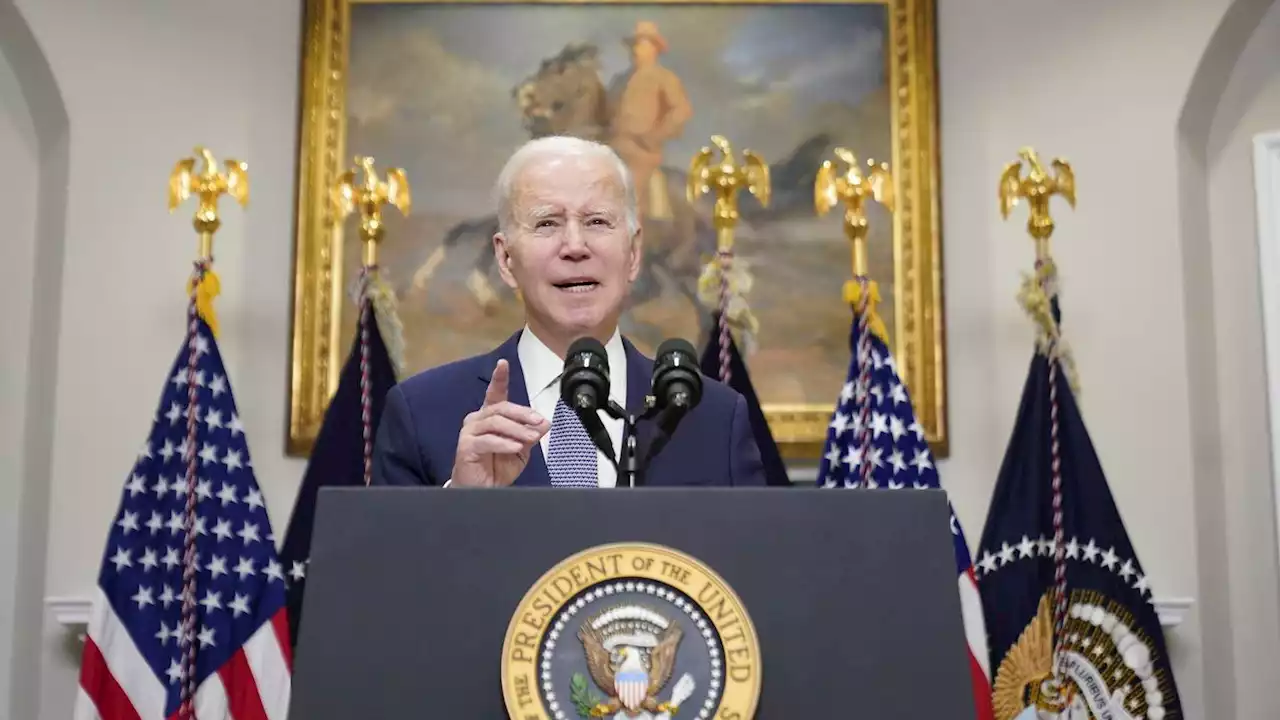

March 13, 2023 at 4:58 pm EDTPresident Joe Biden speaks about the banking system in the Roosevelt Room of the White House, Monday, March 13, 2023 in Washington.

The selloff happened in part because the country woke up to a new banking system and investors had to find the winners and losers, banking experts said. “Everything is now covered. That’s a fact. No matter how specialized or isolated your bank is, if there’s a risk of contagion, regulators have made it clear that they are going to intervene,” said Norbert Michel, a banking policy expert at the libertarian-leaning Cato Institute.

International regulators also had to step in to ease fears. The Bank of England and U.K. Treasury said they facilitated the sale of a Silicon Valley Bank subsidiary in London to HSBC, Europe’s biggest bank. The deal protected 6.7 billion pounds of deposits. “Our view was to make sure that the entire banking community here in New York was stable, that we can project calm,” Hochul said Monday at a news conference.

The two failed banks themselves have not been rescued, and taxpayer money has not been provided to them.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

![]() U.S. government moves to guarantee Silicon Valley Bank depositors' fundsThe U.S. government took extraordinary steps Sunday to stop a potential banking crisis after the historic failure of Silicon Valley Bank, assuring depositors at the failed financial institution that they would be able to access all of their money.

U.S. government moves to guarantee Silicon Valley Bank depositors' fundsThe U.S. government took extraordinary steps Sunday to stop a potential banking crisis after the historic failure of Silicon Valley Bank, assuring depositors at the failed financial institution that they would be able to access all of their money.

Consulte Mais informação »

New York’s Signature Bank taken over by state government, FDIC to protect depositors’ assets | amNewYorkSignature Bank, which held nearly $200 billion in assets and deposits as of the conclusion of 2022, has been taken over by the New York State Department of Financial Services (DFS) in a moved designed to protect depositors.

New York’s Signature Bank taken over by state government, FDIC to protect depositors’ assets | amNewYorkSignature Bank, which held nearly $200 billion in assets and deposits as of the conclusion of 2022, has been taken over by the New York State Department of Financial Services (DFS) in a moved designed to protect depositors.

Consulte Mais informação »

U.S. and U.K. regulators consider ways to help SVB depositors, FDIC auctioning assets - reportsThe U.S. Federal Deposit Insurance Corporation is reportedly holding an auction for the assets of failed Silicon Valley Bank of California this weekend,...

U.S. and U.K. regulators consider ways to help SVB depositors, FDIC auctioning assets - reportsThe U.S. Federal Deposit Insurance Corporation is reportedly holding an auction for the assets of failed Silicon Valley Bank of California this weekend,...

Consulte Mais informação »

Fed and FDIC discussing backstop to make SVB depositors whole and stem contagion fears: SourceFinancial regulators are discussing two different facilities to manage the fallout from the closure of Silicon Valley Bank.

Fed and FDIC discussing backstop to make SVB depositors whole and stem contagion fears: SourceFinancial regulators are discussing two different facilities to manage the fallout from the closure of Silicon Valley Bank.

Consulte Mais informação »

Fed and FDIC discussing backstop to make SVB depositors whole and stem contagion fears: SourceFinancial regulators are discussing two different facilities to manage the fallout from the closure of Silicon Valley Bank if no buyer materializes, according to a source close to the situation.

Fed and FDIC discussing backstop to make SVB depositors whole and stem contagion fears: SourceFinancial regulators are discussing two different facilities to manage the fallout from the closure of Silicon Valley Bank if no buyer materializes, according to a source close to the situation.

Consulte Mais informação »

Yellen 'concerned' about SVB depositors, trying to 'meet their needs'Janet Yellen says she's 'concerned' about Silicon Valley Bank depositors and is trying to 'meet their needs'

Consulte Mais informação »