OPINION: “Your ability to earn a guaranteed rate of return on risk-free investments, regardless of what happens to inflation, actually went up,” BrettArends writes.

Retirees and those seeking secure income got two items of very good news this week, though you may only have heard about one.

So-called TIPS bonds, Treasury bonds protected against inflation, fell slightly in price this week. And as a result the interest rates available for new buyers went up. Could they be right? President Joe Biden boasted this week that the inflation rate was now down to 0%, on a month-to-month basis, but at the same time he pointed out, on Twitter, that the jobs market is booming and workers have the bargaining power that they haven’t had in decades — meaning their wages are likely to go up.

That includes anyone owning regular or nominal Treasury bonds. If you are a retiree or a low-risk investor, and you own a standard sort of lower-risk or balanced portfolio, that probably includes you.Also: Stock-market euphoria meets bond-market pessimism as ‘strange week’ comes to end I have written here before about so-called break-evens, a technical measure in the bond market that effectively anticipates future inflation. Right now the 5-year break-even is about 2.7%, and the 10-year is about 2.5%. What this means is that anyone owning a 5-year regular Treasury bond, instead of a 5-year TIPS bond, is unwittingly making a bet that inflation over the next five years will average less than 2.7% a year.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

McDonald's discontinued this new item. Good riddance.'This news may be disappointing news to some fans of the burger, but as a mostly-vegetarian, I say good riddance.'

McDonald's discontinued this new item. Good riddance.'This news may be disappointing news to some fans of the burger, but as a mostly-vegetarian, I say good riddance.'

Consulte Mais informação »

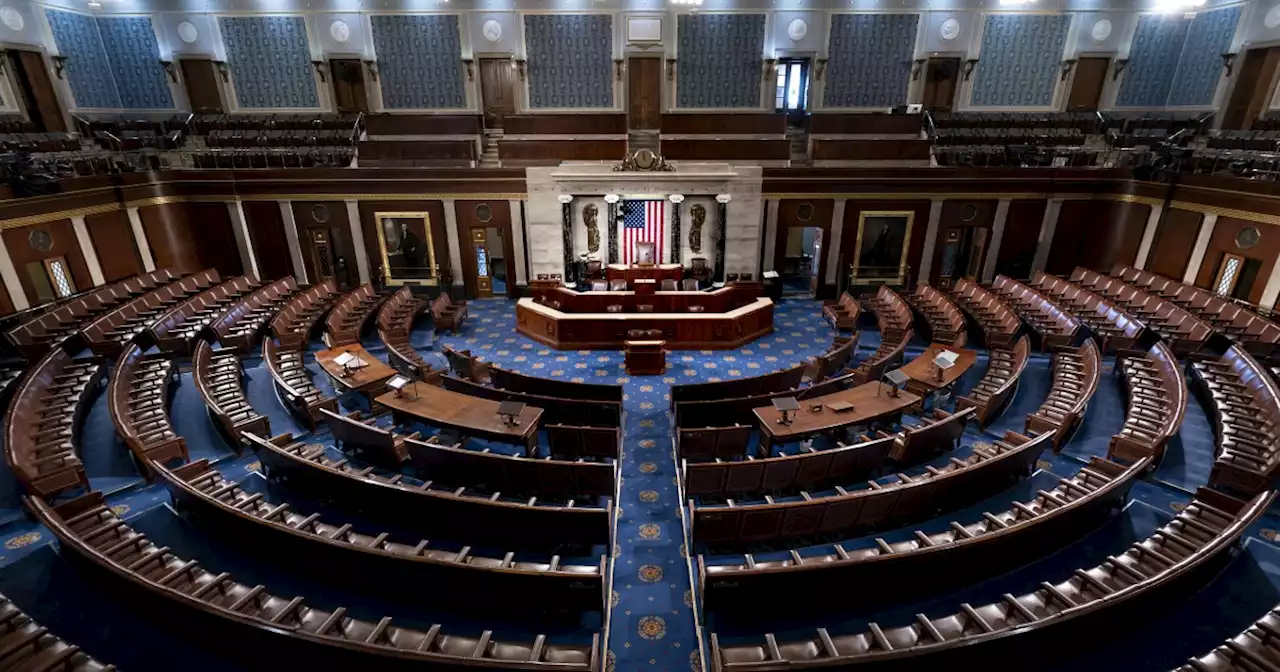

Inflation Reduction Act may have little impact on inflationWith inflation raging near its highest level in four decades, the House gave final approval to President Joe Biden’s landmark Inflation Reduction Act.

Inflation Reduction Act may have little impact on inflationWith inflation raging near its highest level in four decades, the House gave final approval to President Joe Biden’s landmark Inflation Reduction Act.

Consulte Mais informação »

Inflation Reduction Act may have little impact on inflationWASHINGTON (AP) — With inflation raging near its highest level in four decades, the House on Friday gave final approval to President Joe Biden’s landmark Inflation Reduction Act. Its ti…

Inflation Reduction Act may have little impact on inflationWASHINGTON (AP) — With inflation raging near its highest level in four decades, the House on Friday gave final approval to President Joe Biden’s landmark Inflation Reduction Act. Its ti…

Consulte Mais informação »

Inflation Reduction Act may have little impact on inflation in the immediate futureThe legislation, which was headed for final approval on Friday and will then be signed into law, won't directly address some of the main drivers of surging prices.

Inflation Reduction Act may have little impact on inflation in the immediate futureThe legislation, which was headed for final approval on Friday and will then be signed into law, won't directly address some of the main drivers of surging prices.

Consulte Mais informação »

Inflation Reduction Act may have little impact on inflationWill the measure actually tame the price spikes that have inflicted hardships on American households?nEconomic analyses of the proposal suggest that the answer is likely no — not anytime soon, anyway.

Inflation Reduction Act may have little impact on inflationWill the measure actually tame the price spikes that have inflicted hardships on American households?nEconomic analyses of the proposal suggest that the answer is likely no — not anytime soon, anyway.

Consulte Mais informação »