GBP/USD trades with modest gains above 1.2500 mark ahead of UK jobs data, US CPI – by hareshmenghani GBPUSD Fed Inflation Employment Currencies

The uncertainty over the Fed’s rate hike path and a positive risk tone undermines the Greenback.GBP/USD

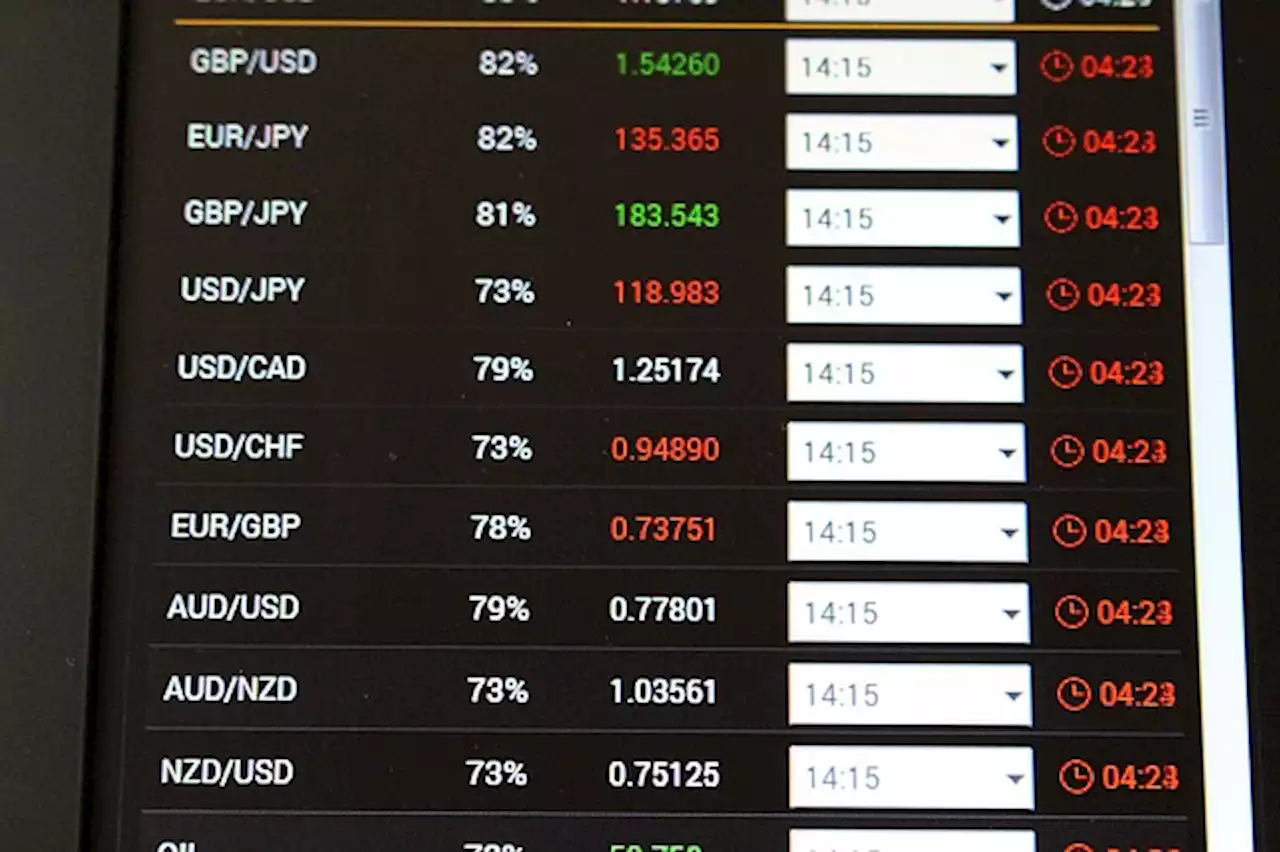

pair attracts some buying during the Asian session on Tuesday and reverses a part of the previous day's sharp retracement slide from the 1.2600 mark, or a one-month peak. Spot prices currently trade just above the 1.2500 psychological mark as market participants now look forward to the UK monthly employment details and the latest US consumer inflation figures for a fresh impetus.

In the meantime, expectations that the Federal Reserve will more likely skip a rate hike this month continue to weigh on the US Dollar and lends some support to the GBP/USD pair. It is worth recalling that a slew of FOMC members recently reaffirmed market expectations for an imminent pause in the US central bank's year-long policy tightening cycle. In contrast, the Bank of England is expected to be far more aggressive in policy tightening to contain stubbornly high inflation.

Investors on Tuesday will further take cues from the UK jobs data, which is expected to show that the number of people claiming unemployment-related benefits fell by 9.6K in May. Furthermore, the ILO Unemployment Rate is seen ticking higher to 4% during the three months to April, while Average Hourly Earnings likely accelerated during the reported period, pointing to growing signs of persistence in underlying price pressures.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

GBP/USD gathers strength for a break towards 1.2600, US CPI and UK Employment eyedThe GBP/USD pair has turned sideways around 1.2580 after an upside move in the early London session. The Cable is making efforts for resuming its upsi

GBP/USD gathers strength for a break towards 1.2600, US CPI and UK Employment eyedThe GBP/USD pair has turned sideways around 1.2580 after an upside move in the early London session. The Cable is making efforts for resuming its upsi

Consulte Mais informação »

GBP/USD: Further gains in the pipeline - UOBIn the view of UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia, GBP/USD could advance further in the near term. Key

GBP/USD: Further gains in the pipeline - UOBIn the view of UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia, GBP/USD could advance further in the near term. Key

Consulte Mais informação »

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, Gold, OilGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of June 11th, 2022 here.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, Gold, OilGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of June 11th, 2022 here.

Consulte Mais informação »

GBP/USD: Weekly Forecast 11th June - 17th JuneOne month ago on the 10th of May the GBP/USD was trading near the 1.26780 vicinity.

GBP/USD: Weekly Forecast 11th June - 17th JuneOne month ago on the 10th of May the GBP/USD was trading near the 1.26780 vicinity.

Consulte Mais informação »

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, GBP/USDThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, GBP/USDThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Consulte Mais informação »

GBP/USD: Break below 1.2300 can lead to a deeper decline – SocGenEconomists at Société Générale analyze GBP/USD technical outlook. 1.2300 support is crucial to avert deeper pullback GBP/USD up move faltered near the

GBP/USD: Break below 1.2300 can lead to a deeper decline – SocGenEconomists at Société Générale analyze GBP/USD technical outlook. 1.2300 support is crucial to avert deeper pullback GBP/USD up move faltered near the

Consulte Mais informação »