GBP/USD corrects from 1.2600 as USD Index recovers strongly ahead of Fed’s policy – by Sagar_Dua24 GBPUSD Fed BOE Inflation Employment

S&P500 futures have turned choppy as investors have sidelined ahead of crucial United States economic events. The overall market mood is still upbeat as the odds of a neutral interest rate policy by the Fed are extremely solid. According to the CME Fedwatch tool, around 75% of chances are in favor of a neutral interest rate policy stance.

The USD Index has recovered firmly to near 103.50 as investors getting anxious ahead of US inflation. The pace in monthly headline Consumer Price Index is seen contracting to 0.2% vs. the former pace of 0.4%. While the velocity in core CPI that doesn’t includeAt the current juncture, easing US labor market conditions and weak economic activities have divided the street.

On the Pound Sterling front, investors are awaiting the release of the United Kingdom Employment data . As per the estimates, Claimant Count Change is seen declining by 9.6K vs. a sheer addition of 46.7K reported in April. The Unemployment Rate for three months is seen higher at 4.0% against the prior release of 3.9%.

In addition to that, the catalyst that will keep investors on their toes is the Average Earnings data including bonuses. Three months' earnings data is seen accelerating to 6.1% vs. the prior pace of 5.8%. Higher earnings could weigh more pressure on the Bank of England , which is already struggling to tame stubbornly high inflation. Apart from the UK labor market data, the speech from

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

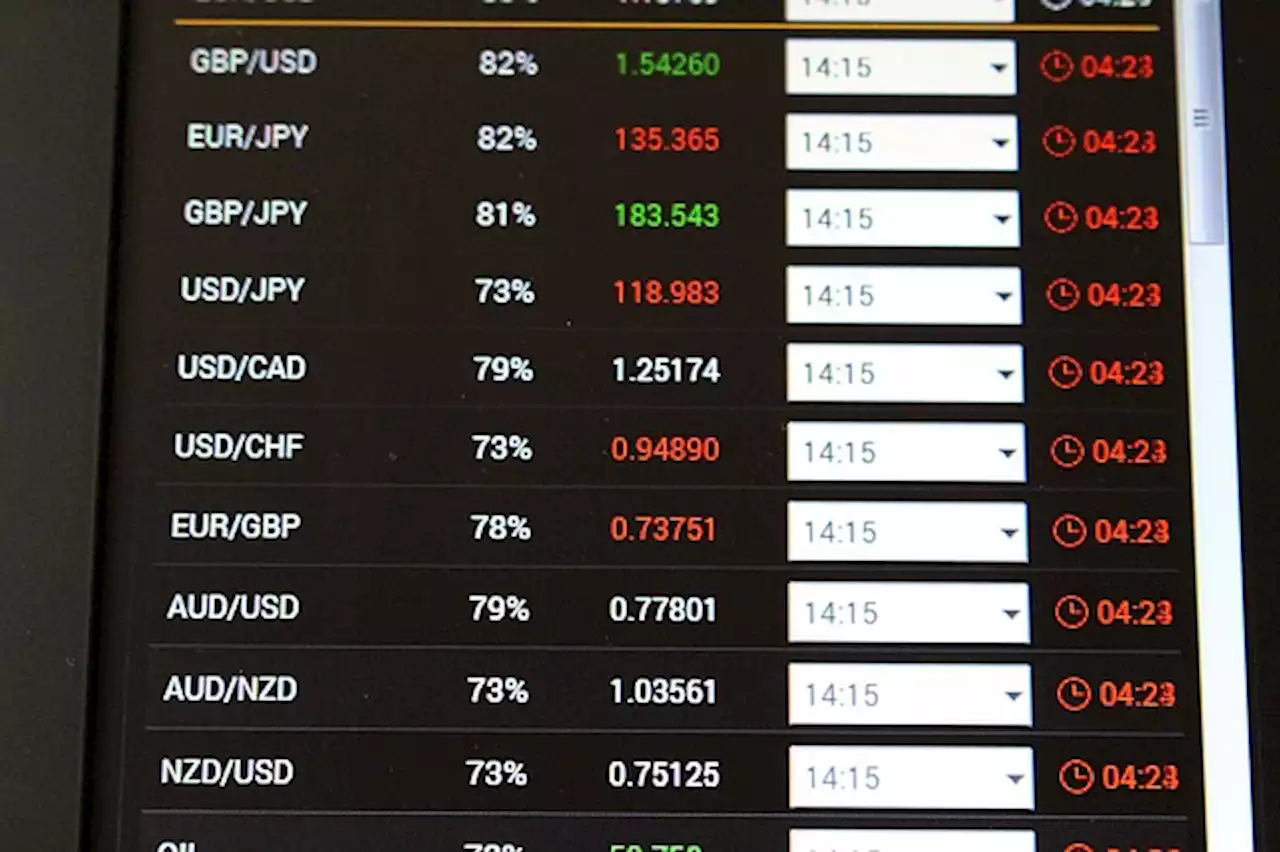

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, GBP/USDThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Weekly Forex Forecast \u2013 NASDAQ 100 Index, USD/JPY, GBP/USDThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Consulte Mais informação »

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, Gold, OilGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of June 11th, 2022 here.

Pairs in Focus This Week \u2013 EUR/USD, GBP/USD, Gold, OilGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of June 11th, 2022 here.

Consulte Mais informação »

GBP/USD: Weekly Forecast 11th June - 17th JuneOne month ago on the 10th of May the GBP/USD was trading near the 1.26780 vicinity.

GBP/USD: Weekly Forecast 11th June - 17th JuneOne month ago on the 10th of May the GBP/USD was trading near the 1.26780 vicinity.

Consulte Mais informação »

GBP/USD: Further gains in the pipeline - UOBIn the view of UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia, GBP/USD could advance further in the near term. Key

GBP/USD: Further gains in the pipeline - UOBIn the view of UOB Group’s Markets Strategist Quek Ser Leang and Senior FX Strategist Peter Chia, GBP/USD could advance further in the near term. Key

Consulte Mais informação »

GBP/USD gathers strength for a break towards 1.2600, US CPI and UK Employment eyedThe GBP/USD pair has turned sideways around 1.2580 after an upside move in the early London session. The Cable is making efforts for resuming its upsi

GBP/USD gathers strength for a break towards 1.2600, US CPI and UK Employment eyedThe GBP/USD pair has turned sideways around 1.2580 after an upside move in the early London session. The Cable is making efforts for resuming its upsi

Consulte Mais informação »

GBP/USD: Break below 1.2300 can lead to a deeper decline – SocGenEconomists at Société Générale analyze GBP/USD technical outlook. 1.2300 support is crucial to avert deeper pullback GBP/USD up move faltered near the

GBP/USD: Break below 1.2300 can lead to a deeper decline – SocGenEconomists at Société Générale analyze GBP/USD technical outlook. 1.2300 support is crucial to avert deeper pullback GBP/USD up move faltered near the

Consulte Mais informação »