Fed faults Silicon Valley Bank execs, itself in bank failure.

WASHINGTON — Silicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

“The Federal Reserve did not appreciate the seriousness of critical deficiencies in the firm’s governance, liquidity, and interest rate risk management. These judgments meant that Silicon Valley Bank remained well-rated, even as conditions deteriorated and significant risk to the firm’s safety and soundness emerged,” the report said.

The report also looks at the role social media and technology played in the bank’s last days. While the bank’s management was poor and ultimately that was the reason the bank failed, the report also notes that social media caused a bank run that happened in just hours, compared to days for earlier bank runs like those seen in 2008.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

![]() Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve says in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month. The report issued Friday takes a critical look at what the Fed missed as Silicon Valley Bank grew quickly in size in the years leading up to its collapse. The Fed finds that while poor management ultimately doomed Silicon Valley Bank, watered down regulations and social media's ability to rapidly hasten a bank run also contributed.

Consulte Mais informação »

![]() Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Fed faults Silicon Valley Bank execs, itself in bank failureSilicon Valley Bank failed due to a combination of extremely poor bank management, weakened regulations and lax government supervision, the Federal Reserve said Friday, in a highly-anticipated review of how the central bank failed to properly supervise the bank before it collapsed early last month.

Consulte Mais informação »

![]() Fed Faults Silicon Valley Bank Execs — And Itself — In Bank FailureThe report points out underlying cultural issues at the Fed, where supervisors were unwilling to be hard on bank management when they saw growing problems.

Fed Faults Silicon Valley Bank Execs — And Itself — In Bank FailureThe report points out underlying cultural issues at the Fed, where supervisors were unwilling to be hard on bank management when they saw growing problems.

Consulte Mais informação »

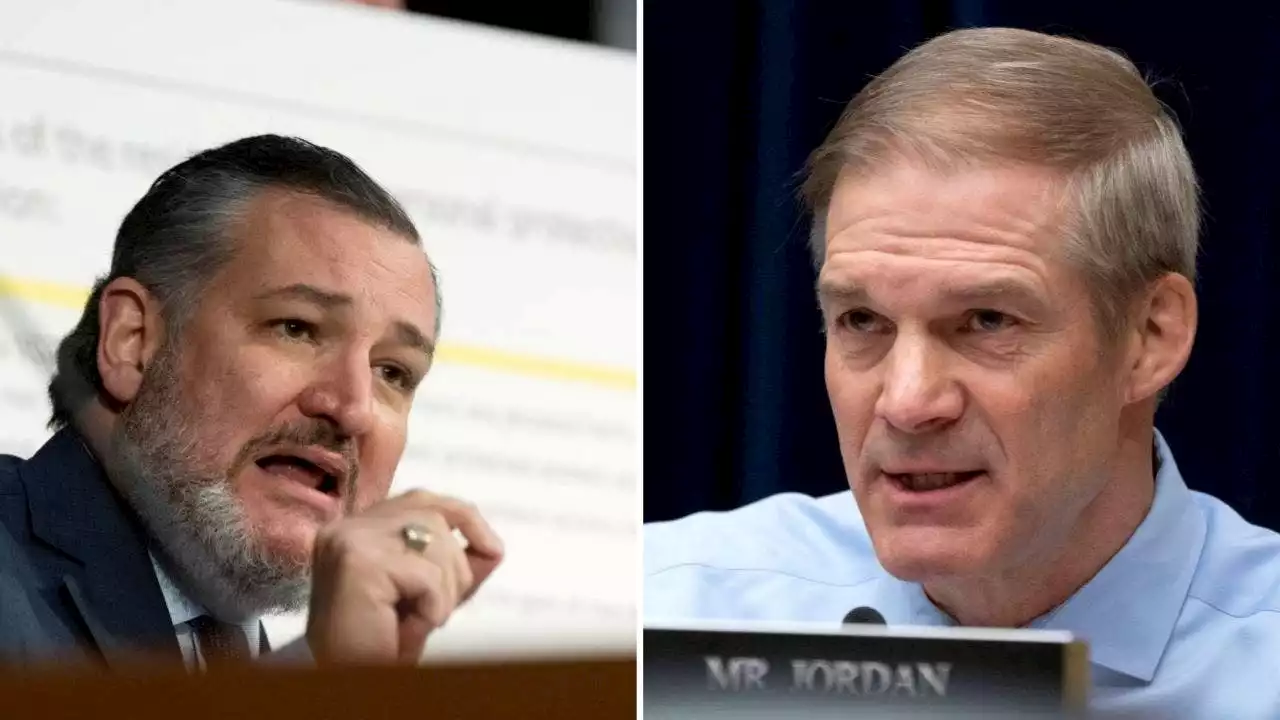

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Ted Cruz, Jim Jordan press San Francisco Fed on Silicon Valley Bank collapseSen. Ted Cruz and Rep. Jim Jordan wrote to San Francisco Federal Reserve Chair Mary Daly to request information on the Fed's supervision of Silicon Valley Bank prior to its failure.

Consulte Mais informação »

![]() Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Fed's review of role in Silicon Valley Bank collapse due outThe Federal Reserve is scheduled Friday to release a highly-anticipated review of its supervision of Silicon Valley Bank, the go-to bank for venture capital firms and technology start-ups that failed spectacularly in March, setting off a crisis of confidence for the banking industry.

Consulte Mais informação »

Fed Says It Failed to Act on Problems That Led to Silicon Valley Bank CollapseMichael Barr, the Fed’s vice chair for supervision, said supervisors didn’t fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity. He also called for revamping a range of rules for midsize banks.

Fed Says It Failed to Act on Problems That Led to Silicon Valley Bank CollapseMichael Barr, the Fed’s vice chair for supervision, said supervisors didn’t fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity. He also called for revamping a range of rules for midsize banks.

Consulte Mais informação »