LAZERSON: A year-old 15-basis point surcharge adds to the cost of using a broker rather than borrowing directly from a lender’s retail outlet.

As a mortgage broker, I’m clearly biased in favor of my profession.

I’ve been unable to locate an explanation for this fee. I reached out to Fannie Mae, Freddie Mac, the Federal Housing Finance Agency and to Mark Calabria, FHFA’s director at the time the fee was proposed. I’ve yet to get a response.Soon after the mortgage meltdown and housing crash of 2008, new rules took effect to ensure there’s no favoritism or pricing penalties based on the type of loan originator, according to Dave Stevens, retired Mortgage Bankers Association president.

So, that’s a fee of $971 on a $627,200 “conforming loan” in Riverside and San Bernardino counties; and a fee of $1,456 on a $970,800 “conforming loan” in Los Angeles and Orange counties. For the most part, mortgage brokers cannot directly pass this fee on to their clients.This fee “leads to unintended and inappropriate pricing distortions, which creates an unlevel playing field among lenders and simultaneously harms borrowers,” a statement by the MBA-affiliated Mortgage Action Alliance said.

If a bank or other mortgage provider did anything like this, it would be tarred and feathered, shamed, cited and fined by regulators for having a disproportionate impact on protected groups.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Celsius CEO plans to restructure firm to focus on crypto custody: ReportCelsius' Alex Mashinsky and Oren Blonstein reportedly aimed to revive the company using a project named Kelvin — storing users’ crypto and charging fees on certain transactions.

Celsius CEO plans to restructure firm to focus on crypto custody: ReportCelsius' Alex Mashinsky and Oren Blonstein reportedly aimed to revive the company using a project named Kelvin — storing users’ crypto and charging fees on certain transactions.

Consulte Mais informação »

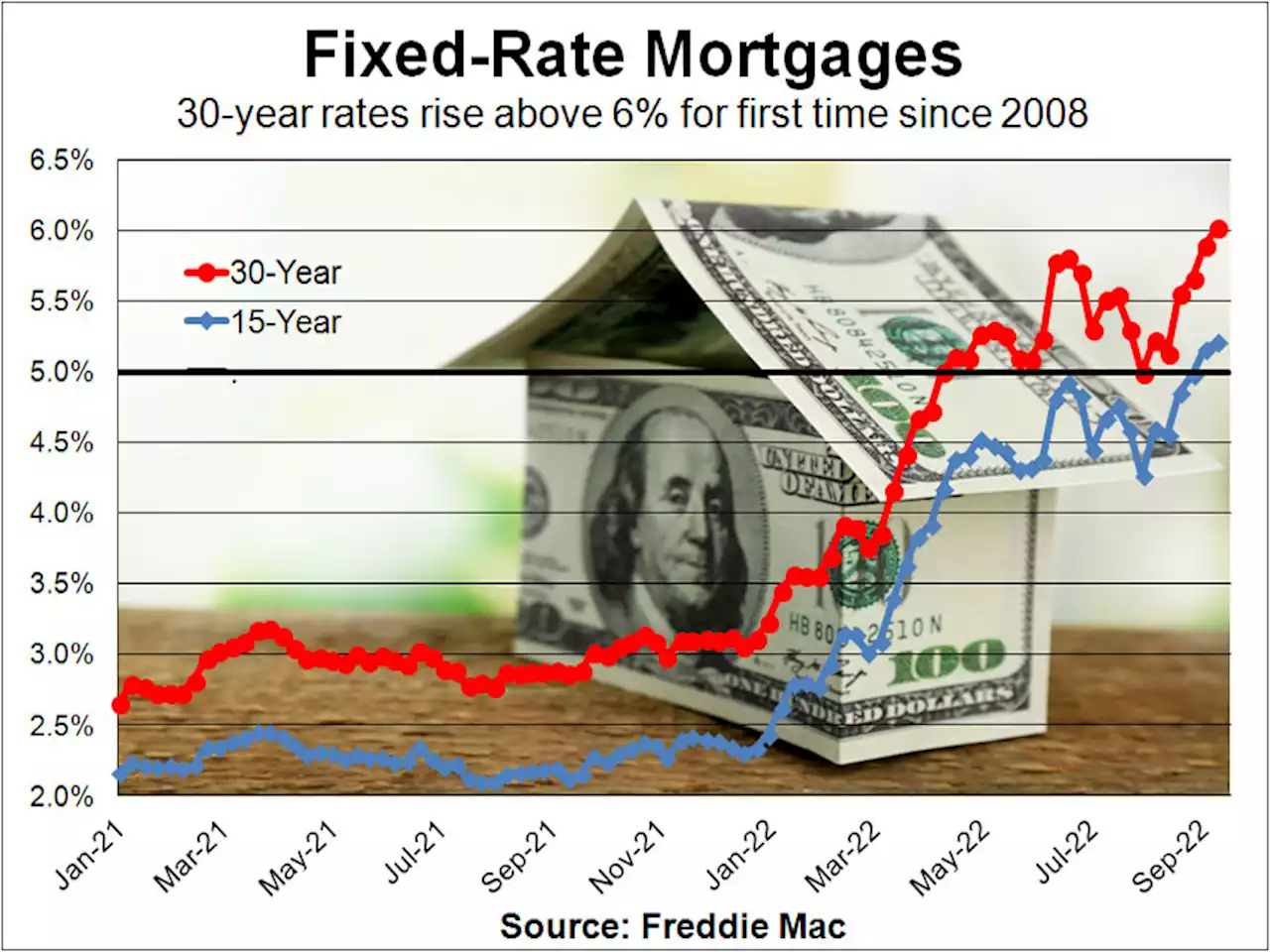

Average interest rate for 30-year fixed-rate mortgage hits 6% for first time in 14 yearsThe average rate for 30-year fixed mortgages reached the 6%-mark for the first time in 14 years, according to the most recent Mortgage Bankers Association survey.

Average interest rate for 30-year fixed-rate mortgage hits 6% for first time in 14 yearsThe average rate for 30-year fixed mortgages reached the 6%-mark for the first time in 14 years, according to the most recent Mortgage Bankers Association survey.

Consulte Mais informação »

Aave: Understanding the Crypto Lending PlatformAave is a decentralized finance lending platform that allows you take out instantaneous loans of cryptocurrency using other cryptocurrency you own as collateral. Rob_Stevens_ explains how it works:

Aave: Understanding the Crypto Lending PlatformAave is a decentralized finance lending platform that allows you take out instantaneous loans of cryptocurrency using other cryptocurrency you own as collateral. Rob_Stevens_ explains how it works:

Consulte Mais informação »

Union strike vote ups the pressure as White House scrambles on railroadsOne of the first unions to reach a tentative agreement with freight railroads is back at square one after some of its members voted to instead authorize a strike. The Biden administration is rushing to broker a deal ahead of a midnight Thursday deadline.

Union strike vote ups the pressure as White House scrambles on railroadsOne of the first unions to reach a tentative agreement with freight railroads is back at square one after some of its members voted to instead authorize a strike. The Biden administration is rushing to broker a deal ahead of a midnight Thursday deadline.

Consulte Mais informação »

Yankees’ Gerrit Cole victimized by long ball againYankees ace Gerrit Cole was hurt by the long ball, then saved by the long ball.

Yankees’ Gerrit Cole victimized by long ball againYankees ace Gerrit Cole was hurt by the long ball, then saved by the long ball.

Consulte Mais informação »