Credit Suisse's head of regulatory compliance, Julian Gooding, is leaving Switzerland's second-biggest bank as part of a sweeping overhaul involving thousands of job cuts, people with knowledge of the departure told Reuters.

Credit Suisse is cutting 9,000 jobs as part of a restructuring plan announced in October to restore profitability after a series of scandals and losses that have drawn regulatory scrutiny and undermined investors confidence.

Last year, the Swiss bank posted its biggest loss since the global financial crisis of 2008 and warned of more pain to come after customers pulled an unprecedented 110 billion Swiss francs . Gooding's tasks will be assigned to Roger Senteler, chief compliance officer for the wealth management unit, and Alain Bieger, chief compliance officer for the Swiss bank division, the people said.Separately, Credit Suisse

it was delaying its annual report after a last-minute call from the United States Securities and Exchange Commission , which raised questions about its earlier financial statements and related controls.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Credit Suisse obtains key approval to launch wealth business in ChinaCredit Suisse has received regulatory green light from China after years of waiting to launch a full-fledged wealth management business in the world's second-biggest economy, according to a company memo reviewed by Reuters.

Credit Suisse obtains key approval to launch wealth business in ChinaCredit Suisse has received regulatory green light from China after years of waiting to launch a full-fledged wealth management business in the world's second-biggest economy, according to a company memo reviewed by Reuters.

Consulte Mais informação »

Credit Suisse equities business under the microscope after revenue crashAt the grandiose Fontainebleau Miami Beach hotel, Credit Suisse hosted its top clients in October amid growing doubts it was still in the securities trading game after a series of high-profile blunders.

Credit Suisse equities business under the microscope after revenue crashAt the grandiose Fontainebleau Miami Beach hotel, Credit Suisse hosted its top clients in October amid growing doubts it was still in the securities trading game after a series of high-profile blunders.

Consulte Mais informação »

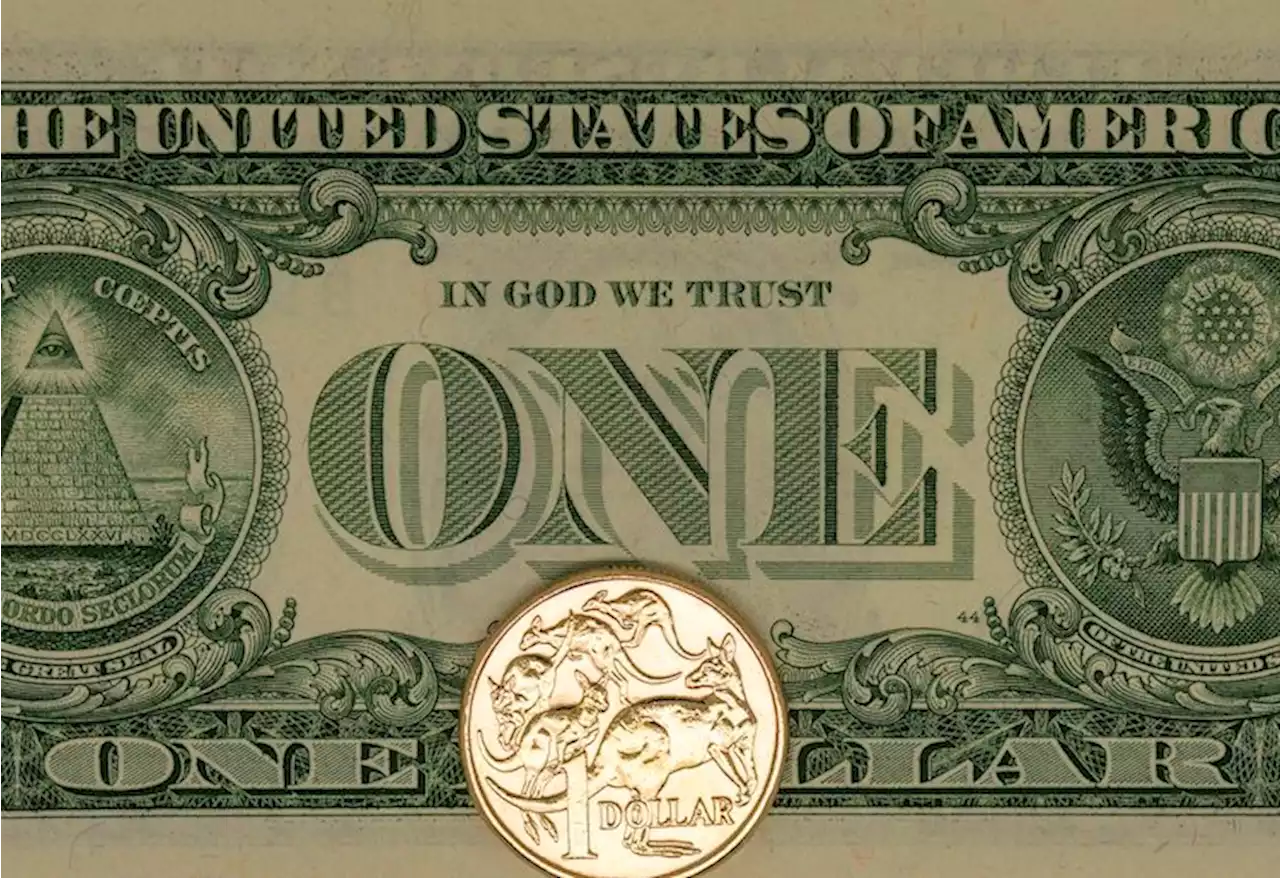

AUD/USD to extend its slide toward 0.6400 by end Q1 – Credit SuisseThe RBA’s decision to walk back its hawkish shift points to credibility issues ahead: economists at Credit Suisse now drop their bullish AUD bias and

AUD/USD to extend its slide toward 0.6400 by end Q1 – Credit SuisseThe RBA’s decision to walk back its hawkish shift points to credibility issues ahead: economists at Credit Suisse now drop their bullish AUD bias and

Consulte Mais informação »

Any signs of BoC complacency can drive USD/CAD to Oct highs near 1.4000 – Credit SuisseAs for today’s BoC decision, economists at Credit Suisse think markets can react to any signs of complacency in forward guidance by pushing USD/CAD to

Any signs of BoC complacency can drive USD/CAD to Oct highs near 1.4000 – Credit SuisseAs for today’s BoC decision, economists at Credit Suisse think markets can react to any signs of complacency in forward guidance by pushing USD/CAD to

Consulte Mais informação »

EUR/USD needs to hold key support at 1.0483/63 to avoid a top– Credit SuisseEUR/USD stays on course for a test of key price & 38.2% retracement support at 1.0483/63 which needs to hold to avoid a top, analysts at Credit Suisse

EUR/USD needs to hold key support at 1.0483/63 to avoid a top– Credit SuisseEUR/USD stays on course for a test of key price & 38.2% retracement support at 1.0483/63 which needs to hold to avoid a top, analysts at Credit Suisse

Consulte Mais informação »

USD Index: Rally to extend further toward key inflection point at 106.15/62 – Credit SuisseThe US Dollar Index (DXY) remains well supported and above the 55-Day Moving Average (DMA) at 103.47. Analysts at Credit Suisse look for DXY rally to

USD Index: Rally to extend further toward key inflection point at 106.15/62 – Credit SuisseThe US Dollar Index (DXY) remains well supported and above the 55-Day Moving Average (DMA) at 103.47. Analysts at Credit Suisse look for DXY rally to

Consulte Mais informação »