EUR/USD needs to hold key support at 1.0483/63 to avoid a top– Credit Suisse EURUSD Banks

stays on course for a test of key price & 38.2% retracement support at 1.0483/63 which needs to hold to avoid a top, analysts at Credit Suisse report.“EUR/USD is seen on course to break its 1.0532 recent low for a test of key support from the 38.2% retracement of the 2022/2023 rally and early January YTD low at 1.0483/63 and our bias remains for this to hold for a broad range.”

“Above 1.0806 remains needed to reassert an upward bias for strength back to the 50% retracement of the 2021/2022 fall at 1.0944.”Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

One of Credit Suisse's largest shareholders sells its stake after two-decades of holding: reportOne of Credit Suisse’s biggest shareholders, Harris Associates, has sold off its entire position in the beleaguered bank after two decades at the helm, The...

One of Credit Suisse's largest shareholders sells its stake after two-decades of holding: reportOne of Credit Suisse’s biggest shareholders, Harris Associates, has sold off its entire position in the beleaguered bank after two decades at the helm, The...

Consulte Mais informação »

Credit Suisse shareholder Harris Associates exits entire stakeLong-time Credit Suisse shareholder Harris Associates reportedly sold its entire stake in the embattled bank

Consulte Mais informação »

Credit Suisse says this biotech stock can surge 100%, citing an opportunity in obesity-related hypertensionCredit Suisse says this stock can surge 100%, citing an opportunity in obesity-related hypertension

Credit Suisse says this biotech stock can surge 100%, citing an opportunity in obesity-related hypertensionCredit Suisse says this stock can surge 100%, citing an opportunity in obesity-related hypertension

Consulte Mais informação »

Credit Suisse obtains key approval to launch wealth business in ChinaCredit Suisse has received regulatory green light from China after years of waiting to launch a full-fledged wealth management business in the world's second-biggest economy, according to a company memo reviewed by Reuters.

Credit Suisse obtains key approval to launch wealth business in ChinaCredit Suisse has received regulatory green light from China after years of waiting to launch a full-fledged wealth management business in the world's second-biggest economy, according to a company memo reviewed by Reuters.

Consulte Mais informação »

Credit Suisse equities business under the microscope after revenue crashAt the grandiose Fontainebleau Miami Beach hotel, Credit Suisse hosted its top clients in October amid growing doubts it was still in the securities trading game after a series of high-profile blunders.

Credit Suisse equities business under the microscope after revenue crashAt the grandiose Fontainebleau Miami Beach hotel, Credit Suisse hosted its top clients in October amid growing doubts it was still in the securities trading game after a series of high-profile blunders.

Consulte Mais informação »

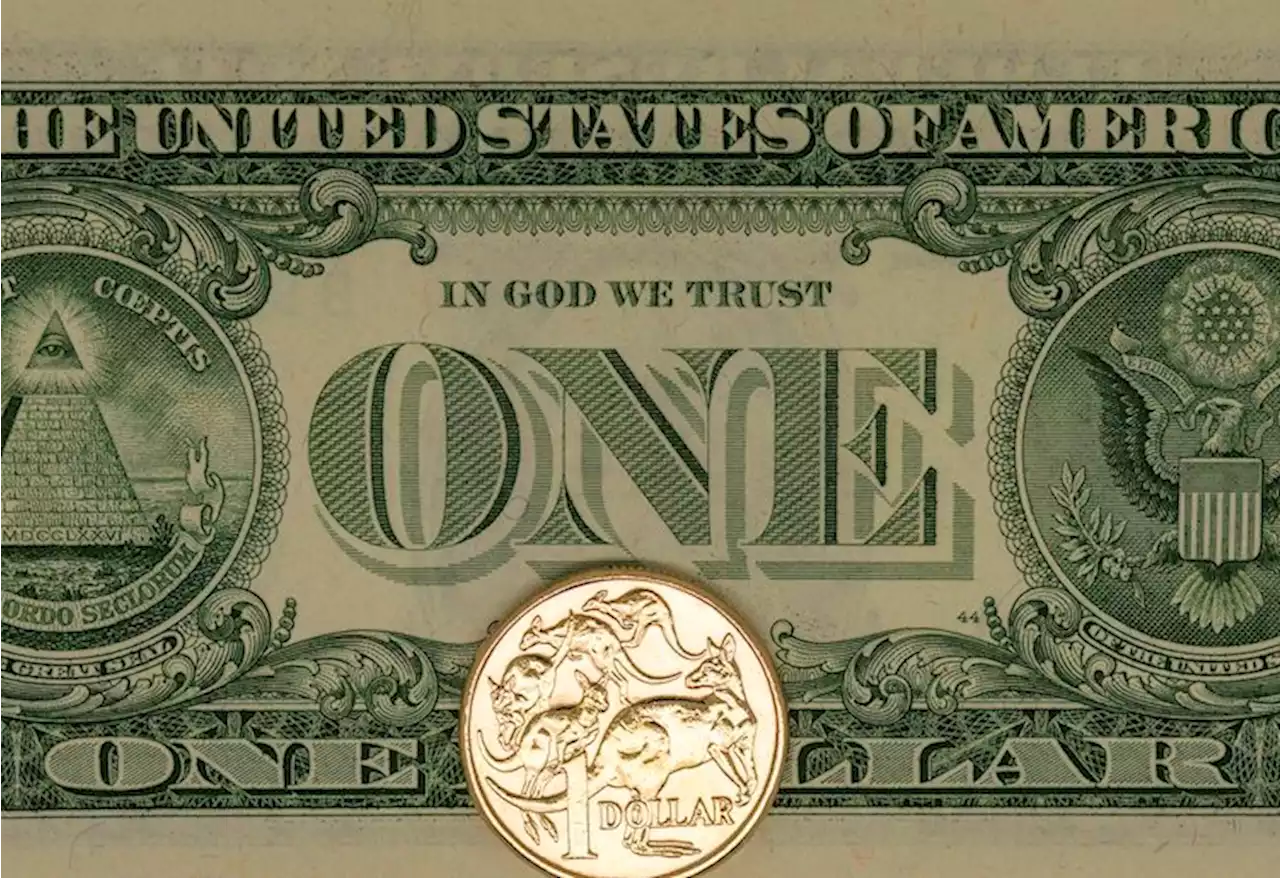

AUD/USD to extend its slide toward 0.6400 by end Q1 – Credit SuisseThe RBA’s decision to walk back its hawkish shift points to credibility issues ahead: economists at Credit Suisse now drop their bullish AUD bias and

AUD/USD to extend its slide toward 0.6400 by end Q1 – Credit SuisseThe RBA’s decision to walk back its hawkish shift points to credibility issues ahead: economists at Credit Suisse now drop their bullish AUD bias and

Consulte Mais informação »