Low liquidity in bitcoin and ether markets has traders worried that the crypto market could become more susceptible to shocks. Reports godbole17.

worsen and the situation is now more alarming than it was three months ago. That has traders worried about abrupt price swings in the crypto market.

"Funds trying to trade size are forced to TWAP over longer periods hence why it looks like some charts have recently been 'walked up' such as STX," Dibb added. "Realistically though, dwindling market depth has also meant that most large funds have not been participating at the same level as previous due to the amount of slippage associated," Dibb noted, adding that any large institution that offloads coins now is going to have a deeper effect on the market.The latest decline in the market depth comes amid dwindling volatility expectations in the bitcoin market.

"An environment conducive to high volatility is being created," Ardern said."And because the depth is low, it only takes a small amount [buy/sell order] to influence the price, and the resulting hedging activity of market makers to amplify market volatility through hedging."

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Crypto lawyers flame Gensler over claims that all crypto are securitiesSEC chair, Gary Gensler, stated all cryptocurrencies besides Bitcoin (BTC) are securities under his agency’s jurisdiction, but crypto lawyers have quashed the claim saying it's up to the courts to decide.

Crypto lawyers flame Gensler over claims that all crypto are securitiesSEC chair, Gary Gensler, stated all cryptocurrencies besides Bitcoin (BTC) are securities under his agency’s jurisdiction, but crypto lawyers have quashed the claim saying it's up to the courts to decide.

Consulte Mais informação »

Crypto Broker Voyager Digital Sends $121M in Crypto to Exchanges, Sells Ether, Shiba Inu HoldingsBlockchain transaction data by Arkham Intelligence shows that Voyager Digital transferred some $121 million of crypto assets to exchanges in February and received some $150 million in USDC stablecoins in the last four days, likely proceeds from sales.

Crypto Broker Voyager Digital Sends $121M in Crypto to Exchanges, Sells Ether, Shiba Inu HoldingsBlockchain transaction data by Arkham Intelligence shows that Voyager Digital transferred some $121 million of crypto assets to exchanges in February and received some $150 million in USDC stablecoins in the last four days, likely proceeds from sales.

Consulte Mais informação »

What the Ethereum Shanghai Upgrade Will Mean for ETH LiquidityEthereum's Shanghai upgrade in March could boost liquidity for $ETH and drive competition between staking protocols. But there are also concerns about centralization in the staking industry.

What the Ethereum Shanghai Upgrade Will Mean for ETH LiquidityEthereum's Shanghai upgrade in March could boost liquidity for $ETH and drive competition between staking protocols. But there are also concerns about centralization in the staking industry.

Consulte Mais informação »

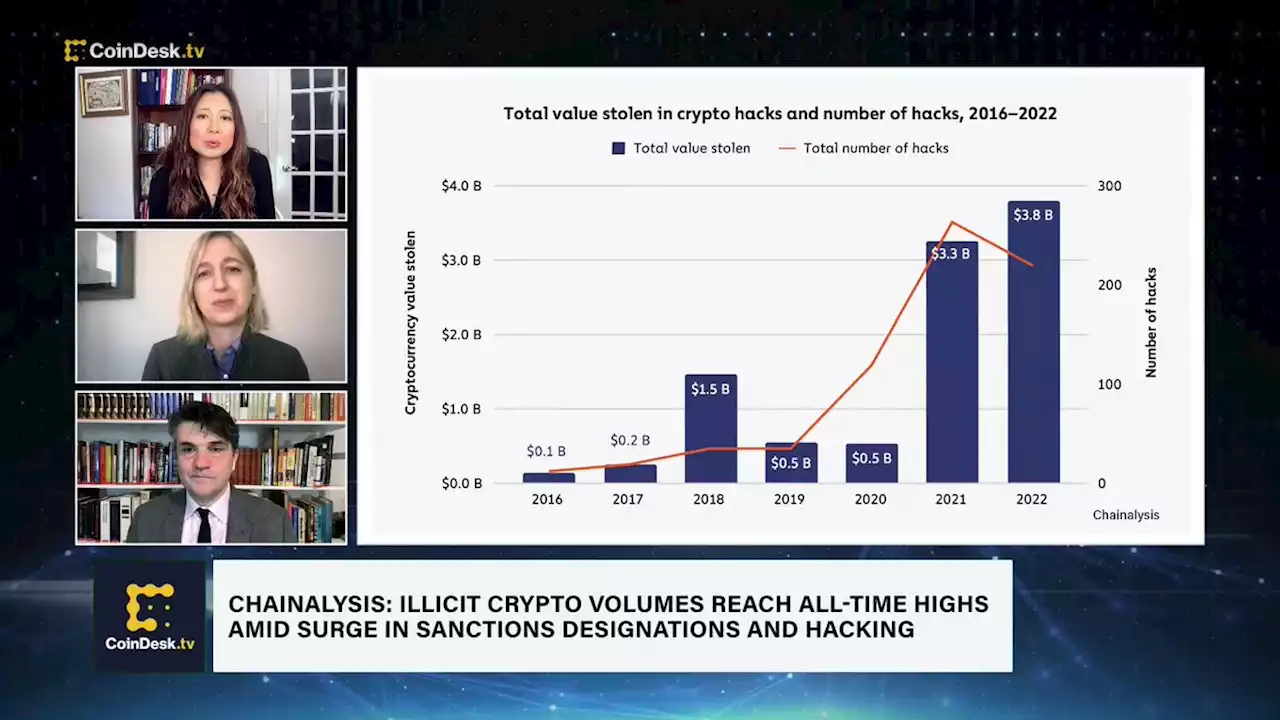

Illicit Crypto Volumes Hit All-Time Highs: ChainalysisThe new 'Crypto Crime Report' from blockchain analytics firm Chainalysis reveals that illicit crypto transaction volume increased for the second straight year, hitting an all-time high of nearly $21 billion. Chainalysis Director of Research Kim Grauer discusses crypto crime trends in 2023. Plus, fresh insights on crypto hacking activity and money laundering.

Illicit Crypto Volumes Hit All-Time Highs: ChainalysisThe new 'Crypto Crime Report' from blockchain analytics firm Chainalysis reveals that illicit crypto transaction volume increased for the second straight year, hitting an all-time high of nearly $21 billion. Chainalysis Director of Research Kim Grauer discusses crypto crime trends in 2023. Plus, fresh insights on crypto hacking activity and money laundering.

Consulte Mais informação »