Gary Gensler restates the SEC's authority to hold digital-asset firms accountable. DeFi protocol SushiSwap is facing a treasury deficit. $BTC dipped below $17K. JPRubin23 reports

Crypto Market Analysis: Bitcoin’s High Correlation to Copper Does Not Bode Well for Short-Term InvestorsAbsent a black swan or negative contagion event specific to a centralized entity, digital assets still seem very much connected to macroeconomic developments.

But, notably, yields for the federal funds rate, U.S. three-month and two-year Treasurys exceed the yield of 10-year Treasurys. This condition, called an inverted yield curve, has predated past economic recessions. If viewed in isolation, an inverted yield curve does not bode well for bitcoin, or copper prices for that matter. Increased short-term rates and slower economic growth lead to lower demand and prices for physical and digital assets.Coinbase Global CEO Brian Armstong

said the company’s revenue will be about half what it was last year as the crypto exchange struggles amid stark price drops in cryptocurrencies and continuing ripple effects from multiple bankruptcies this year, including the recent collapse of rival exchange FTX. Armstrong noted in an interview with Bloomberg’s David Rubenstein that Coinbase had done about $7 billion in revenue and $4 billion in positive EBITDA. “It's looking, you know, about roughly half that or less,” Armstrong said.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Crypto Markets Today: Fir Tree Suit Against Grayscale Adds to Industry’s Growing WoesFir Tree is suing Grayscale for details on GBTC. Crypto firm Orthogonal is now facing internal dissent. $BTC is trading at $17K. _jocelynyang_ reports

Crypto Markets Today: Fir Tree Suit Against Grayscale Adds to Industry’s Growing WoesFir Tree is suing Grayscale for details on GBTC. Crypto firm Orthogonal is now facing internal dissent. $BTC is trading at $17K. _jocelynyang_ reports

Consulte Mais informação »

Crypto Markets Today: FTX Fallout Hits Maple Finance; Bitcoin DeclinesOrthogonal Trading received a default notice for a $36M debt on Maple Finance. Nexo to depart from the U.S. after regulatory discussions hit a “dead end.” $BTC's price dropped below $17,000 while the S&P 500 index closed down 1.79%, _jocelynyang_ reports

Crypto Markets Today: FTX Fallout Hits Maple Finance; Bitcoin DeclinesOrthogonal Trading received a default notice for a $36M debt on Maple Finance. Nexo to depart from the U.S. after regulatory discussions hit a “dead end.” $BTC's price dropped below $17,000 while the S&P 500 index closed down 1.79%, _jocelynyang_ reports

Consulte Mais informação »

Why Decentralized Crypto Platforms Are Weathering the CrashIn the past year, crypto markets dropped from $2.9 trillion in value to around $800 billion. In the wake of the collapse, crypto lenders and exchanges have been accused of fraud and other wrongdoing. What went wrong? One factor is competition. In theory, competition should always benefit consumers. But in some situations, as competition intensifies, companies hide underlying costs and risks in order to offer attractive products and win customers. Because it’s so easy to move assets in crypto, competition incentivized this practice, and a lack of transparency in centralized crypto finance allowed unproductive companies to thrive by offering products that appeared attractive in the short run but were unsustainable in the long run. Unfortunately, these companies amassed significant assets before their business models eventually unraveled. This problem hasn’t affected all crypto markets, however: decentralized exchanges, which have more transparency, have held up while centralized exchanges have flamed out. Though generally smaller and less advanced than centralized exchanges, these decentralized protocols may offer a way forward for crypto markets.

Why Decentralized Crypto Platforms Are Weathering the CrashIn the past year, crypto markets dropped from $2.9 trillion in value to around $800 billion. In the wake of the collapse, crypto lenders and exchanges have been accused of fraud and other wrongdoing. What went wrong? One factor is competition. In theory, competition should always benefit consumers. But in some situations, as competition intensifies, companies hide underlying costs and risks in order to offer attractive products and win customers. Because it’s so easy to move assets in crypto, competition incentivized this practice, and a lack of transparency in centralized crypto finance allowed unproductive companies to thrive by offering products that appeared attractive in the short run but were unsustainable in the long run. Unfortunately, these companies amassed significant assets before their business models eventually unraveled. This problem hasn’t affected all crypto markets, however: decentralized exchanges, which have more transparency, have held up while centralized exchanges have flamed out. Though generally smaller and less advanced than centralized exchanges, these decentralized protocols may offer a way forward for crypto markets.

Consulte Mais informação »

Dogecoin surges, and how the FTX scandal could affect Wall Street crypto adoption: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what's ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today's show, Crypto World speaks to Wall Street executives who made the jump to crypto to learn how they're weathering the latest downturn.

Dogecoin surges, and how the FTX scandal could affect Wall Street crypto adoption: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what's ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today's show, Crypto World speaks to Wall Street executives who made the jump to crypto to learn how they're weathering the latest downturn.

Consulte Mais informação »

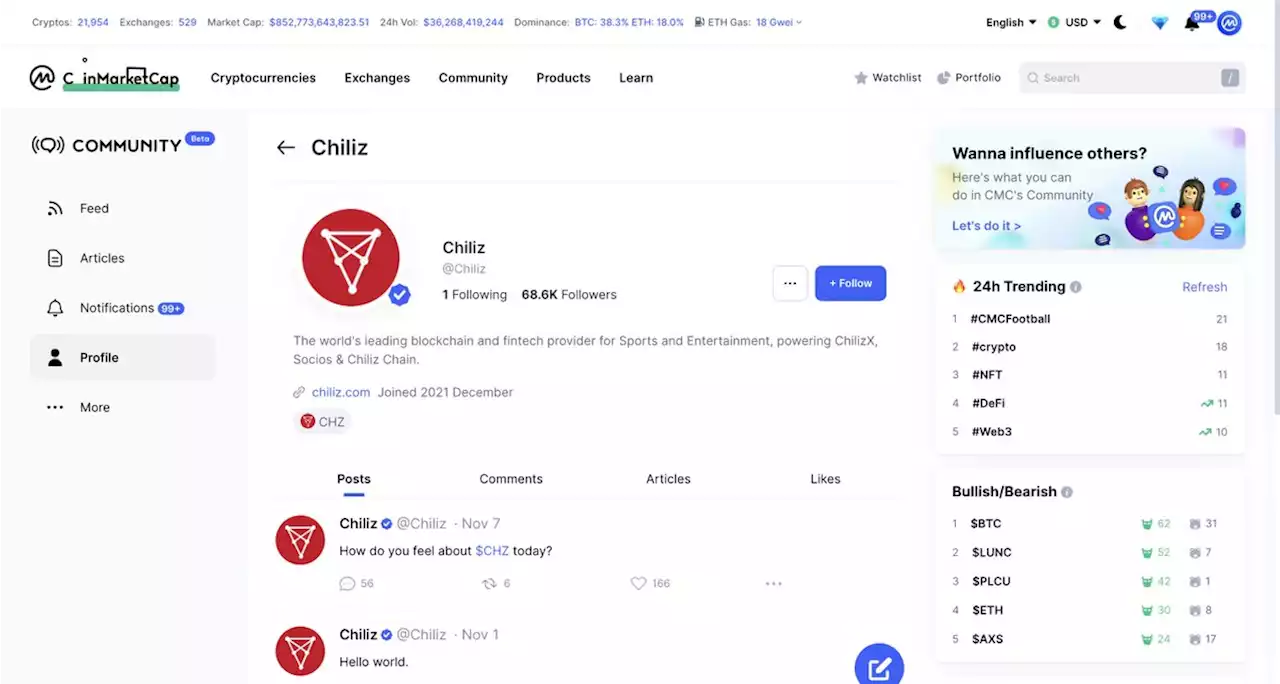

Join The Crypto Message Board At Community TodayJoin in the conversation on CoinMarketCap’s crypto message boards today. See comments and alerts posted by leading projects and people in cryptocurrency.

Join The Crypto Message Board At Community TodayJoin in the conversation on CoinMarketCap’s crypto message boards today. See comments and alerts posted by leading projects and people in cryptocurrency.

Consulte Mais informação »