Crude oil prices dropped for a second week amid Chinese Covid woes and increasing US production and inventory levels. Along with headwinds from a coordinated IEA release, prices may drag. Get your weekly oil forecast from FxWestwater here:

fell for a second week amid growing concerns over the global economic rebound. A more aggressive Federal Reserve outlook amplified the worry following the recent series of yield curve inversions. Federal Reserve Governor Lael Brainard triggered the slide in sentiment after suggesting the balance sheet reduction will be rapid. Ms. Brainard cited high inflation that may go higher as a serious risk to the economy. Oil prices fell, given their demand-sensitive nature.

The lockdown in Shanghai, China – now in its second week – is also putting a cloud over oil’s demand prospects. Shanghai is China’s largest city, making it of paramount importance to the economy. The longer Chinese policymakers hold onto the country’s Covid-Zero strategy, the worse the chance of hurting the global economic recovery.

On the supply side, the International Energy Agency announced it would move forward with a coordinated oil release with the United States. The IEA is set to release 120 million barrels over the next 6 months, which includes the 60 million US barrels, according to Fatih Birol, IEA Executive Director. The total will see over 1 million barrels of reserve oil hit the global market each day.

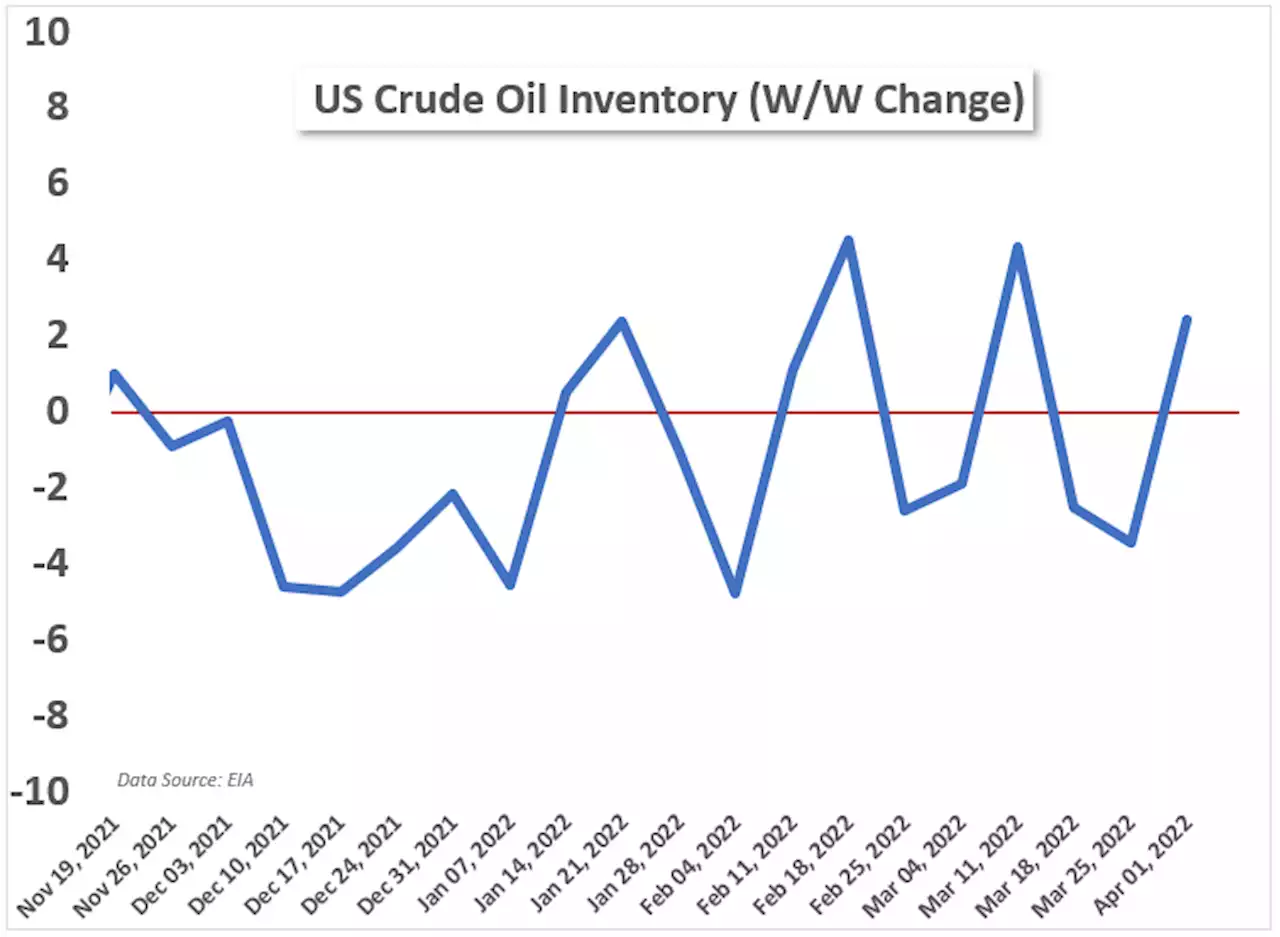

US production is expected to slowly but surely increase over the coming months. The US Energy Information Administration , not to be confused with the IEA, said that US crude oil production increased to 11.8 million barrels per day for the week ending April 1. That is near the pre-pandemic all-time high of 13.1 million bpd. Meanwhile, US inventory levels have surprised analysts’ expectations. The week-over-week change for the same period as production rose 2.4 million barrels .

Altogether, traders should continue to monitor global inventory levels, production and the on-the-ground situation in Shanghai. The American Petroleum Institute is set to report weekly oil stocks data on Tuesday, and the EIA will follow up with its data on Wednesday. Another set of storage increases would likely weigh on prices.To contact Thomas, use the comments section below or

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

U.S. believes Russia used short-range ballistic missile in railway station strike -U.S. officialThe United States believes Russia used a short range ballistic missile to strike a railway station in east Ukraine on Friday, a senior U.S. defense official said.

U.S. believes Russia used short-range ballistic missile in railway station strike -U.S. officialThe United States believes Russia used a short range ballistic missile to strike a railway station in east Ukraine on Friday, a senior U.S. defense official said.

Consulte Mais informação »

Crude Oil Futures: A deeper retracement looks not favouredConsidering preliminary readings from CME Group for crude oil futures markets, investors trimmed their open interest positions by more than 14K contra

Crude Oil Futures: A deeper retracement looks not favouredConsidering preliminary readings from CME Group for crude oil futures markets, investors trimmed their open interest positions by more than 14K contra

Consulte Mais informação »

Crude Oil Forecast: Oil Drills into Support- WTI Correction LevelsOil prices have plunged 27% off the highs and the correction may yet drill deeper in the days ahead. The technical trade levels that matter on the WTI weekly chart.

Crude Oil Forecast: Oil Drills into Support- WTI Correction LevelsOil prices have plunged 27% off the highs and the correction may yet drill deeper in the days ahead. The technical trade levels that matter on the WTI weekly chart.

Consulte Mais informação »

Price volatility and rising demand revive U.S. natural gas tradingNatural gas trading is seeing a renaissance in the United States with the return of price volatility, while market turmoil in Europe could keep gas demand and exports high for years, according to trading industry executives.

Price volatility and rising demand revive U.S. natural gas tradingNatural gas trading is seeing a renaissance in the United States with the return of price volatility, while market turmoil in Europe could keep gas demand and exports high for years, according to trading industry executives.

Consulte Mais informação »

Gold Price Forecast: XAU/USD steady around $1940s despite high US yields and hawkish FedGold Price Forecast: XAU/USD steady around $1940s despite high US yields and hawkish Fed By christianborjon Gold XAUUSD Macroeconomics Technical Analysis Fed

Gold Price Forecast: XAU/USD steady around $1940s despite high US yields and hawkish FedGold Price Forecast: XAU/USD steady around $1940s despite high US yields and hawkish Fed By christianborjon Gold XAUUSD Macroeconomics Technical Analysis Fed

Consulte Mais informação »

Gold Price Forecast: XAU/USD Holds Critical Support as US Rates SurgeTreasury yields have surged but Gold prices just continue to stick at a huge spot of support with long-term implications. Are bulls lurking around the next corner? Get your weekly gold forecast from JStanleyFX here:

Gold Price Forecast: XAU/USD Holds Critical Support as US Rates SurgeTreasury yields have surged but Gold prices just continue to stick at a huge spot of support with long-term implications. Are bulls lurking around the next corner? Get your weekly gold forecast from JStanleyFX here:

Consulte Mais informação »