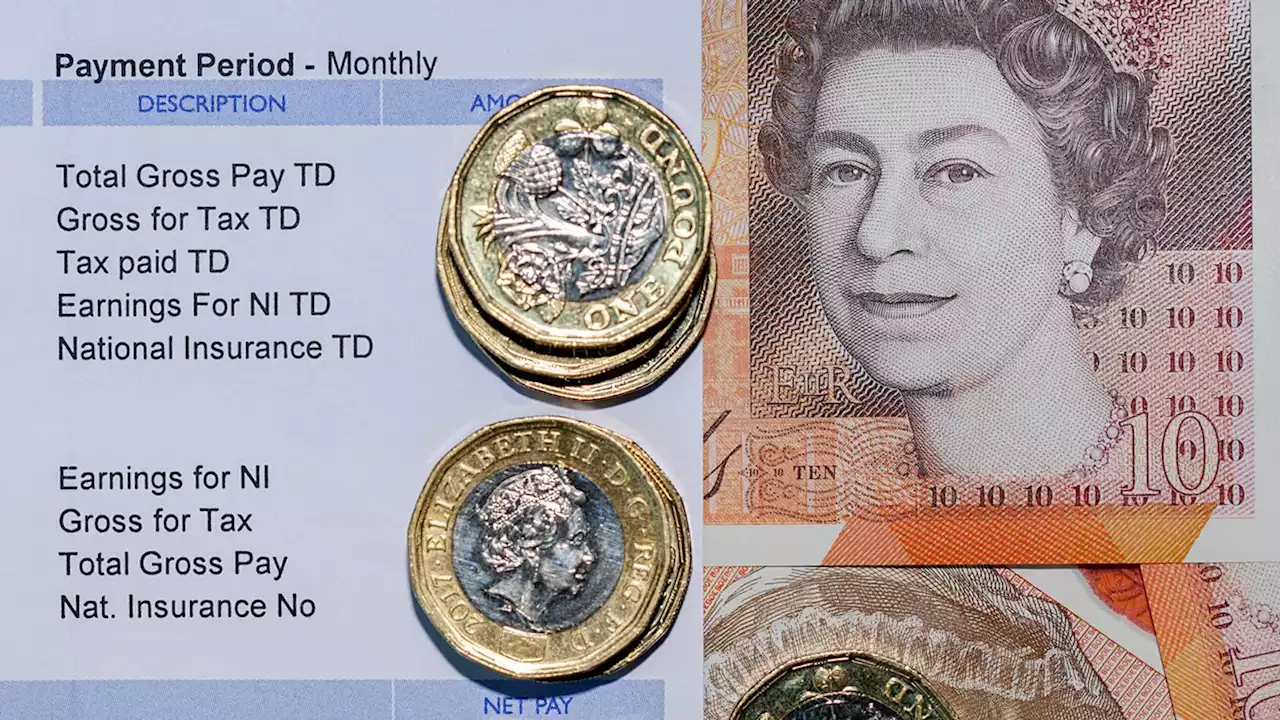

The threshold for paying National Insurance contributions rises to allow the average worker to keep £330 more of their earnings as the cost of everyday goods and services continue to shoot up.

That was brought in by Rishi Sunak, despite intense pressure to postpone the hike, to help pay for investment in health and social care.

Commentators have also recently highlighted how income tax thresholds, frozen until 2026, are pushing more people into paying higher tax bills. Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said:"Unfortunately, as time goes on, the tax burden is going to grow.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Cost of living live updates: Disbelief as cost of Lurpak hits £9.35 in major supermarketThe amount at which you start paying national insurance is to rise from £9,880 to £12,570 from tomorrow - with the changes meaning anyone who earns less than £41,389 will be better off; there is disbelief as one major supermarket prices a 1kg tub of Lurpak at £9.35.

Cost of living live updates: Disbelief as cost of Lurpak hits £9.35 in major supermarketThe amount at which you start paying national insurance is to rise from £9,880 to £12,570 from tomorrow - with the changes meaning anyone who earns less than £41,389 will be better off; there is disbelief as one major supermarket prices a 1kg tub of Lurpak at £9.35.

Consulte Mais informação »

Cost of living: Nottingham academy makes prom freePrincipal Marcus Shepherd says he did not want anyone to feel excluded if they could not afford a ticket.

Cost of living: Nottingham academy makes prom freePrincipal Marcus Shepherd says he did not want anyone to feel excluded if they could not afford a ticket.

Consulte Mais informação »

Fifteen years of stagnant incomes left British families 'brutally exposed' to cost of living crisis - reportIn the 15 years leading up to the pandemic, the average income of working age families grew by only 0.7% a year. This is far slower than in previous decades.

Fifteen years of stagnant incomes left British families 'brutally exposed' to cost of living crisis - reportIn the 15 years leading up to the pandemic, the average income of working age families grew by only 0.7% a year. This is far slower than in previous decades.

Consulte Mais informação »

Our deeply substandard politicians ignore the cost of England's ageing populationMore of us are reaching old age and living longer in old age. This has huge consequences that are not being seriously debated

Our deeply substandard politicians ignore the cost of England's ageing populationMore of us are reaching old age and living longer in old age. This has huge consequences that are not being seriously debated

Consulte Mais informação »