'Throughout the Trump presidency, his appointees eviscerated banking regulation. The collapse of Silicon Valley Bank was the predictable result.' Column by hiltzikm:

Demands by the tech industry’s most vocal libertarians for a government bailout of Silicon Valley call to mind the old saw: The goal in business to privatize profits and socialize losses., were issues that “have the potential to pose significant risk to the safety and soundness” of the bank, could cause “significant consumer harm,” were repeat complaints, or that deviated from the law. MRA notices involved problems that needed correcting, but only over time.

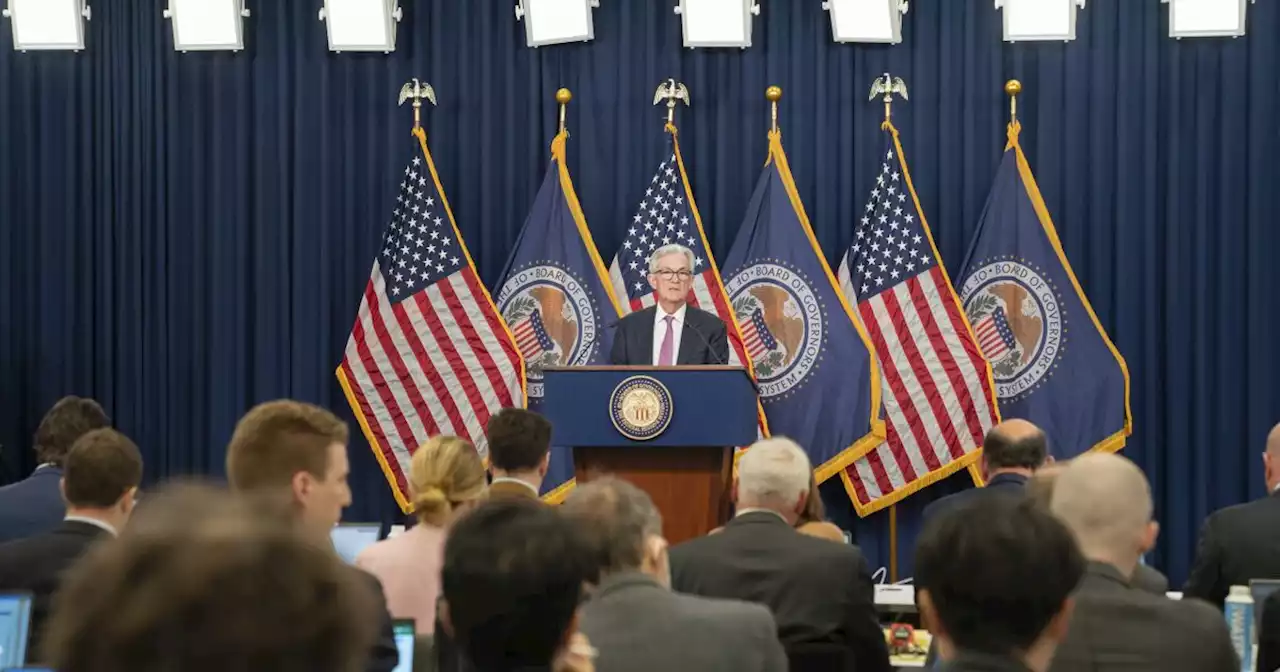

Powell’s rule change cut boards out of the loop. This had a subtle but important effect, for it eliminated the only internal layer of oversight of management activities. Just as important, it eliminated a crucial avenue of contact between supervisors and boards. Just as a reminder: SVB’s fundamental problem was that it had a huge number of skittish depositors, most of whose money was uninsured by the FDIC and could be withdrawn on demand, and had invested those deposits in treasuries and bonds that were generally safe, but wouldn’t mature in less than 10 years. After a series of interest rate hikes, the bonds were showing immense losses on paper.

Another initiative by the Fed, FDIC, OCC and other federal regulators also cut the legs out from under the supervisors. This was a joint notice stating that “supervisory guidance” — the process used by examiners to force banks to rein in risky activities — couldn’t be used unless they could identify a specific law or regulation that the activities violated.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

![]() Don't let Silicon Valley Bank's financial catastrophe spill over to these crucial banksCommunity banks may pay a heavy price for the collapse of Silicon Valley Bank and Signature Bank. But the nation's smallest banks bear no responsibility for recent financial fiasco.

Don't let Silicon Valley Bank's financial catastrophe spill over to these crucial banksCommunity banks may pay a heavy price for the collapse of Silicon Valley Bank and Signature Bank. But the nation's smallest banks bear no responsibility for recent financial fiasco.

Consulte Mais informação »

5 things we learned from the Senate hearing on the Silicon Valley Bank collapseA top federal regulator called the failure of Silicon Valley Bank a 'textbook case of bank mismanagement' during a Senate hearing about what led to its spectacular collapse Here are five takeaways from Tuesday's hearing:

5 things we learned from the Senate hearing on the Silicon Valley Bank collapseA top federal regulator called the failure of Silicon Valley Bank a 'textbook case of bank mismanagement' during a Senate hearing about what led to its spectacular collapse Here are five takeaways from Tuesday's hearing:

Consulte Mais informação »

![]() Key takeaways from first major Silicon Valley Bank collapse hearingIt's the first hearing about Silicon Valley Bank's collapse that sparked panic about the health of the financial system.

Key takeaways from first major Silicon Valley Bank collapse hearingIt's the first hearing about Silicon Valley Bank's collapse that sparked panic about the health of the financial system.

Consulte Mais informação »

![]() Biden to push new banking rules after Silicon Valley Bank collapseWhite House plans are still in flux. A House panel will examine SVB’s failure on Wednesday.

Biden to push new banking rules after Silicon Valley Bank collapseWhite House plans are still in flux. A House panel will examine SVB’s failure on Wednesday.

Consulte Mais informação »

STOCK MARKET NEWS: UBS, Macy’s names CEO, Lululemon shares soar, Silicon Valley Bank hearingsInvestors will hear more on Silicon Valley Bank’s collapse in the second day of hearings, this as UBS hires a new CEO to help stabilize the bank with Credit Swisse under fire. Macy’s also names new CEO and former Starbucks CEO Howard Schultz will testify on labor issues at the coffee giant. Lululemon shares jump after results. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

STOCK MARKET NEWS: UBS, Macy’s names CEO, Lululemon shares soar, Silicon Valley Bank hearingsInvestors will hear more on Silicon Valley Bank’s collapse in the second day of hearings, this as UBS hires a new CEO to help stabilize the bank with Credit Swisse under fire. Macy’s also names new CEO and former Starbucks CEO Howard Schultz will testify on labor issues at the coffee giant. Lululemon shares jump after results. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Consulte Mais informação »