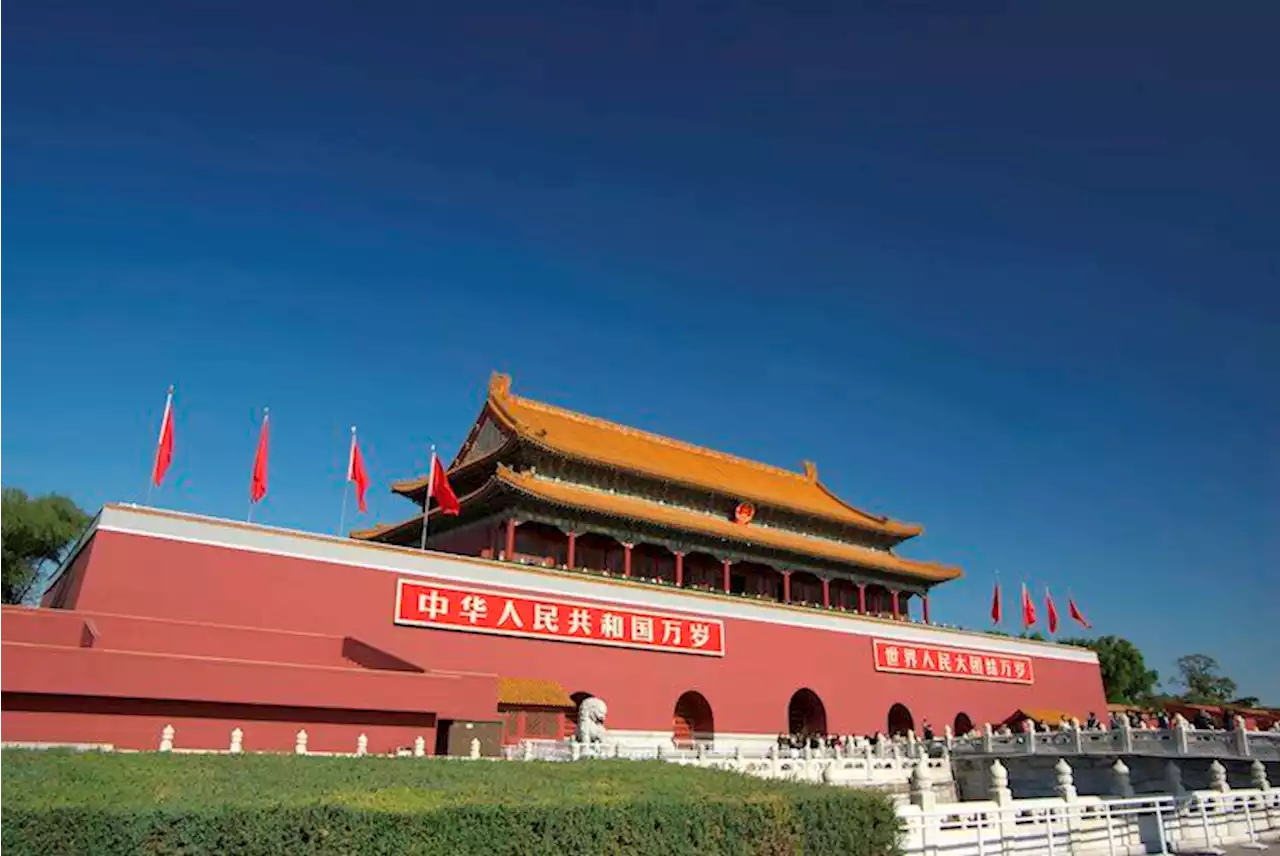

China: Reopening supports credit growth in January – UOB – by pabspiovano China Credit Banks

Key Takeaways

“Confidence in the household sector has remained weak, resulting in weaker home purchases as well as consumption loans. Notably for 2022, loans to households slowed sharply to account for just 18% of the new loans compared to 40% in 2020-21.” “As the economy continues to recover and normalise in 2023, we expect credit growth to pick up along with stronger corporate activities, infrastructure construction and private consumption. The PBOC may also need to further cut its interest rate and RRR to boost the“On a longer-term basis, the growth in TSF in China would likely remain below 10% as the GDP growth moderates which limits banks’ credit expansion.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

China: Inflation seen at 2.8% in 2023 – UOBEconomist at UOB Group Ho Woei Chen reviews the latest release of inflation figures in the Chinese economy. Key Takeaways “Headline inflation was in l

China: Inflation seen at 2.8% in 2023 – UOBEconomist at UOB Group Ho Woei Chen reviews the latest release of inflation figures in the Chinese economy. Key Takeaways “Headline inflation was in l

Consulte Mais informação »

USD/CNH keeps the positive outlook unchanged so far – UOBEconomist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group said the outlook for USD/CNH still points to further gains in the near term.

USD/CNH keeps the positive outlook unchanged so far – UOBEconomist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group said the outlook for USD/CNH still points to further gains in the near term.

Consulte Mais informação »

USD/JPY: Next level to watch is 135.00 – UOBThe continuation of the upside bias could propel USD/JPY to the 135.00 region ahead of 135.50, comment Economist Lee Sue Ann and Markets Strategist Qu

USD/JPY: Next level to watch is 135.00 – UOBThe continuation of the upside bias could propel USD/JPY to the 135.00 region ahead of 135.50, comment Economist Lee Sue Ann and Markets Strategist Qu

Consulte Mais informação »

GBP/USD risks extra losses near term – UOBIn the opinion of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, GBP/USD risks further retracements in the short term. Key

GBP/USD risks extra losses near term – UOBIn the opinion of Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, GBP/USD risks further retracements in the short term. Key

Consulte Mais informação »

NZD/USD could slip back to the 0.6220 region – UOBAccording to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, further selling pressure could drag NZD/USD to the 0.6220 in th

NZD/USD could slip back to the 0.6220 region – UOBAccording to Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at UOB Group, further selling pressure could drag NZD/USD to the 0.6220 in th

Consulte Mais informação »

EUR/USD risks a deeper drop below 1.0655 – UOBFurther decline in EUR/USD is likely on a sustained breach of the 1.0655 level, suggest Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at

EUR/USD risks a deeper drop below 1.0655 – UOBFurther decline in EUR/USD is likely on a sustained breach of the 1.0655 level, suggest Economist Lee Sue Ann and Markets Strategist Quek Ser Leang at

Consulte Mais informação »