The UK is trying to do something about its dwindling listings. Britain’s financial watchdog wants to spur domestic IPO markets by weakening shareholder protections. Yet making London appealing to fast-growing foreign firms requires wider reforms, and lower standards are only a good idea if investors punish bad governance.

The Financial Conduct Authority isn’t the only watchdog to water down its listing rules, but it has more reasons than most to up its game. The UK prides itself on being a financial hub, but accounted forof global IPOs between 2015 and 2020. Britain is even losing ground in Europe: in 2021, it made up just over a quarter of regional listings by value, according to Breakingviews calculations using PwC data, compared with over half 10 years earlier.

Yet IPO red tape is far from the only stumbling block. There are wider reasons why UK stocks trade at a discount to U.S. ones. Deeper U.S. markets assign higher values to fast-growing technology companies, while regional bourses in the Middle East or Asia are growing. The UK is also making unforced errors: the Conservative government’s messy exit from the European Union means the volumes of shares traded in London is falling, hurting liquidity.

Meanwhile, the new FCA-endorsed weakening standards may lead to bigger shareholder losses and scandals. They may deter some investors, actually hurting liquidity. The UK lacks the same litigious culture in the U.S. that helps inhibit executive excess. Ideally, the FCA’s looser stance will need to be offset by more vigilant investors, but that requires the recent vogue for environmental, social and governance investing to do a lot of heavy lifting.

As such, the new rules may not create a bonanza of London IPOs. To stand up to New York, the UK domestic market will need a deeper pool of sophisticated investors, able to nurture companies before they go public, and follow them afterwards. That will probablyfewer, bigger pension funds for example, more heavily invested in growth equities. Stock market investors may even have to swallow their opposition to U.S.-style executive pay.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Breakingviews - China’s Midea regains outbound deal appetiteMidea , a $58 billion Chinese white goods champion, made waves in Europe in 2016 when it bought German robot maker Kuka for nearly $5 billion. Seven years later, the company is eyeing Sweden’s home appliance brand Electrolux , a complementary asset currently worth around $7 billion including debt. A successful tilt could mark the beginning of a revival in outbound M&A by Chinese firms after offshore deals touched a historic low of $29 billion in 2022, per EY estimates.

Breakingviews - China’s Midea regains outbound deal appetiteMidea , a $58 billion Chinese white goods champion, made waves in Europe in 2016 when it bought German robot maker Kuka for nearly $5 billion. Seven years later, the company is eyeing Sweden’s home appliance brand Electrolux , a complementary asset currently worth around $7 billion including debt. A successful tilt could mark the beginning of a revival in outbound M&A by Chinese firms after offshore deals touched a historic low of $29 billion in 2022, per EY estimates.

Consulte Mais informação »

Breakingviews - Jamie Dimon bails out First Republic – and FDICJamie Dimon is back at the bailout rodeo. After buying Bear Stearns 15 years ago left a bad taste in his mouth, JPMorgan’s CEO said he’d never ride to the rescue again. In the wee hours of Monday morning, however, he agreed to take mid-sized First Republic Bank out of receivership from the Federal Deposit Insurance Corp. It relieves pressure on taxpayers for now and should benefit his mega-bank’s shareholders, but suggests U.S. authorities don’t have a handle on how to rescue collapsing lenders without further entrenching a risky too-big-to-fail mentality.

Breakingviews - Jamie Dimon bails out First Republic – and FDICJamie Dimon is back at the bailout rodeo. After buying Bear Stearns 15 years ago left a bad taste in his mouth, JPMorgan’s CEO said he’d never ride to the rescue again. In the wee hours of Monday morning, however, he agreed to take mid-sized First Republic Bank out of receivership from the Federal Deposit Insurance Corp. It relieves pressure on taxpayers for now and should benefit his mega-bank’s shareholders, but suggests U.S. authorities don’t have a handle on how to rescue collapsing lenders without further entrenching a risky too-big-to-fail mentality.

Consulte Mais informação »

Breakingviews - Tech groupthink could hinder AI competitionEveryone wants a piece of OpenAI, the startup behind artificial intelligence-powered chatbot ChatGPT. After raising $10 billion from technology giant Microsoft , the company has raked in another $300 million from venture capital’s leading lights, including Andreessen Horowitz and Sequoia Capital, TechCrunch reported. Its competitors may struggle to find backers with deep enough pockets to help them unseat the reigning leader.

Breakingviews - Tech groupthink could hinder AI competitionEveryone wants a piece of OpenAI, the startup behind artificial intelligence-powered chatbot ChatGPT. After raising $10 billion from technology giant Microsoft , the company has raked in another $300 million from venture capital’s leading lights, including Andreessen Horowitz and Sequoia Capital, TechCrunch reported. Its competitors may struggle to find backers with deep enough pockets to help them unseat the reigning leader.

Consulte Mais informação »

Breakingviews - Hot money is cold comfort for China sharesMoney flowing into the People's Republic is getting uncomfortably hot. Chinese equities enjoyed renewed foreign interest since the start of 2023. Yet recent reversals in New York, Hong Kong and Shanghai suggest that is driven by fickle short-term funds – exactly what Beijing doesn’t want.

Breakingviews - Hot money is cold comfort for China sharesMoney flowing into the People's Republic is getting uncomfortably hot. Chinese equities enjoyed renewed foreign interest since the start of 2023. Yet recent reversals in New York, Hong Kong and Shanghai suggest that is driven by fickle short-term funds – exactly what Beijing doesn’t want.

Consulte Mais informação »

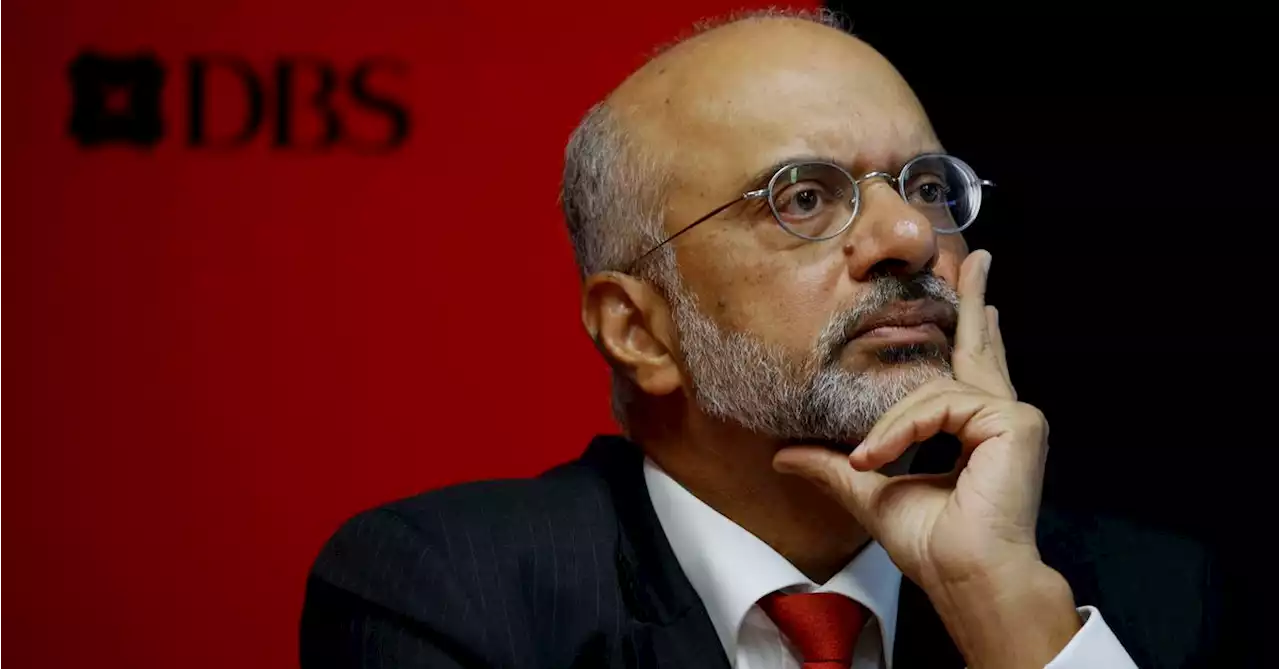

Breakingviews - DBS' safe profit haven nears its peakTop Singapore-based bank DBS on Tuesday released first-quarter numbers that will make rivals envious. The top line jumped 8% from the three months to the end of December. Expenses fell, meaning the bank used just 38% of its revenue to cover costs compared to 59% at JPMorgan . As a result, the firm run by Piyush Gupta earned almost $2 billion, with an annualised return on equity of 18.6%: both are record highs.

Breakingviews - DBS' safe profit haven nears its peakTop Singapore-based bank DBS on Tuesday released first-quarter numbers that will make rivals envious. The top line jumped 8% from the three months to the end of December. Expenses fell, meaning the bank used just 38% of its revenue to cover costs compared to 59% at JPMorgan . As a result, the firm run by Piyush Gupta earned almost $2 billion, with an annualised return on equity of 18.6%: both are record highs.

Consulte Mais informação »

Breakingviews - Ending the retailers’ crisis has a high price tagHigh-street retailers are facing a heavy bill to weather the cost-of-living crisis. Executives and investors attending the World Retail Congress in Barcelona last week laid out a relatively grim outlook for the sector, where cost-conscious customers are buying sparingly and favouring engaging shopping experiences. Turning the tide requires a big spend that only the strong can afford.

Breakingviews - Ending the retailers’ crisis has a high price tagHigh-street retailers are facing a heavy bill to weather the cost-of-living crisis. Executives and investors attending the World Retail Congress in Barcelona last week laid out a relatively grim outlook for the sector, where cost-conscious customers are buying sparingly and favouring engaging shopping experiences. Turning the tide requires a big spend that only the strong can afford.

Consulte Mais informação »