When baseball fans turn their caps backwards or inside out it’s a kind of prayer their team can turn its fortunes around. Commercial real estate has a different kind of backward cap, which is also a sign of a losing streak. TheRealLSL explains.

Anxiety over U.S. commercial property has been heightened by the collapse of two banks, one of which – Signature Bank – was an active real estate lender. Building-related debt has been the cause of crises before. Lehman Brothers’ purchase of apartment company Archstone in 2007 was one reason for its eventual bankruptcy.

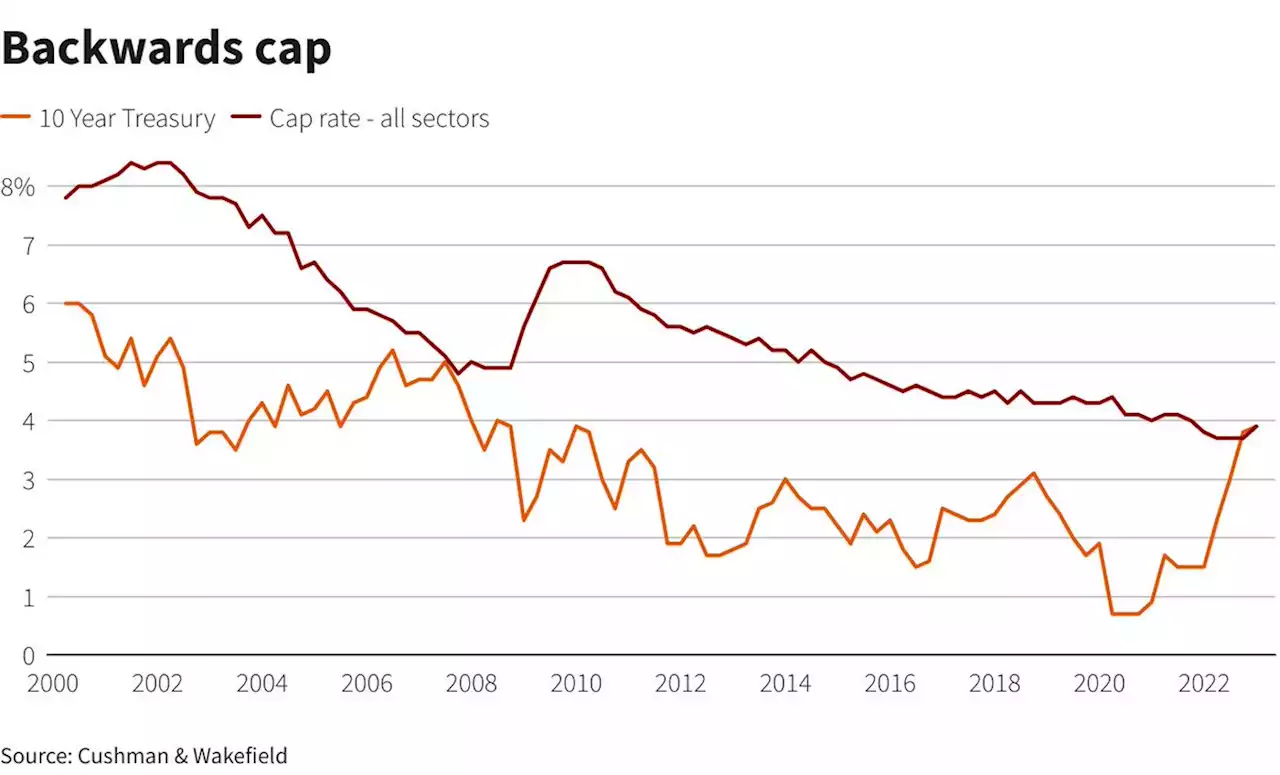

The problem this time is a key real estate metric called the “cap rate.” Nothing to do with headgear, this rate reflects the yield on a property, comparable with the yield on a bond. The cap rate comes from dividing a property’s net operating income in any given year – money from rent minus associated costs – by the asset’s value. Ideally, and almost always, it’s higher than the rate at which the owner can raise debt to fund their purchase.

For more than 10 years, that gap remained positive even though cap rates were falling in virtually all real estate subsectors, from shopping malls to apartments. That was mostly a consequence of low interest rates. And the spread made it possible for asset prices to keep rising even though rents, a major driver of net operating income, weren’t going up much. As recently as 2020, the spread was as high as three percentage points.

That narrowed suddenly when the U.S. Federal Reserve turned course and started putting interest rates up with unprecedented speed. For the first time since just before the financial crisis, the baseline cost of debt – the 10-year Treasury – is higher than the yield the owner will get on a building – a situation known in the industry as “negative leverage.” When a new investor risks getting a yield that’s less than the cost of debt, the obvious thing is for them to demand a steep price cut.

Brasil Últimas Notícias, Brasil Manchetes

Similar News:Você também pode ler notícias semelhantes a esta que coletamos de outras fontes de notícias.

Breakingviews - Aussie central bank fix will paper over inflationAustralia’s central bank is getting the builders in – literally and figuratively. The Reserve Bank of Australia’s 1960s Sydney headquarters is currently clad in scaffolding, part of what is supposed to be a two-year, A$200 million-plus ($135 million) renovation. Next comes overhauling the institution’s interior workings.

Breakingviews - Aussie central bank fix will paper over inflationAustralia’s central bank is getting the builders in – literally and figuratively. The Reserve Bank of Australia’s 1960s Sydney headquarters is currently clad in scaffolding, part of what is supposed to be a two-year, A$200 million-plus ($135 million) renovation. Next comes overhauling the institution’s interior workings.

Consulte Mais informação »

Breakingviews - New EU debt rules have way to avoid past mistakesThe European Union’s new set of fiscal rules need to answer two simple questions: will they help the bloc’s economy grow? And will countries actually follow them?

Breakingviews - New EU debt rules have way to avoid past mistakesThe European Union’s new set of fiscal rules need to answer two simple questions: will they help the bloc’s economy grow? And will countries actually follow them?

Consulte Mais informação »

Breakingviews - Bank bail-ins, and how to prevent climate bailouts: podcastMark Carney helped design the post-2008 system for resolving bust lenders. In this episode of the Exchange, the ex-Bank of England governor tells George Hay what he makes of last month’s rescue of Credit Suisse, and how to limit future financial sector hits from climate change.

Breakingviews - Bank bail-ins, and how to prevent climate bailouts: podcastMark Carney helped design the post-2008 system for resolving bust lenders. In this episode of the Exchange, the ex-Bank of England governor tells George Hay what he makes of last month’s rescue of Credit Suisse, and how to limit future financial sector hits from climate change.

Consulte Mais informação »

Breakingviews - DeSantis wins with Disney co-dependencyFor Walt Disney Chief Executive Bob Iger, action speaks louder than words. During the Magic Kingdom’s annual shareholder meeting on Monday, Iger took a shot at Florida Governor Ron DeSantis, calling him “anti-business” for his retaliation involving Disney World. DeSantis, for those keeping score, signed a law in February that gives Florida control of Disney’s theme park district, stripping some of its autonomy. Disney had opposed Florida’s Parental Rights in Education Act.

Breakingviews - DeSantis wins with Disney co-dependencyFor Walt Disney Chief Executive Bob Iger, action speaks louder than words. During the Magic Kingdom’s annual shareholder meeting on Monday, Iger took a shot at Florida Governor Ron DeSantis, calling him “anti-business” for his retaliation involving Disney World. DeSantis, for those keeping score, signed a law in February that gives Florida control of Disney’s theme park district, stripping some of its autonomy. Disney had opposed Florida’s Parental Rights in Education Act.

Consulte Mais informação »

Breakingviews - Aesop deal spreads scent of stressed M&AThe scent of stress is wafting from the Brazilian backer of Aesop. Natura agreed to sell the luxury lotion maker to French cosmetics giant L’Oreal for about $2.5 billion. It offloaded the successful investment to shore up its balance sheet, an M&A motivation that probably will spread.

Breakingviews - Aesop deal spreads scent of stressed M&AThe scent of stress is wafting from the Brazilian backer of Aesop. Natura agreed to sell the luxury lotion maker to French cosmetics giant L’Oreal for about $2.5 billion. It offloaded the successful investment to shore up its balance sheet, an M&A motivation that probably will spread.

Consulte Mais informação »

Breakingviews - How FDIC dropped the ball and picked up the tabBank watchdogs don’t have a crystal ball when it comes to spotting bank runs. They nearly had something close, though. The Federal Deposit Insurance Corp, which insures Americans’ savings, launched a project in 2020 that would have used technology from outside companies to flag risks just like the ones that felled Silicon Valley Bank. The initiative fizzled because of skepticism from the regulator’s new leadership, and a culture wary of relying on private firms. Reviving it in some form could in future save the FDIC money, stature and time.

Breakingviews - How FDIC dropped the ball and picked up the tabBank watchdogs don’t have a crystal ball when it comes to spotting bank runs. They nearly had something close, though. The Federal Deposit Insurance Corp, which insures Americans’ savings, launched a project in 2020 that would have used technology from outside companies to flag risks just like the ones that felled Silicon Valley Bank. The initiative fizzled because of skepticism from the regulator’s new leadership, and a culture wary of relying on private firms. Reviving it in some form could in future save the FDIC money, stature and time.

Consulte Mais informação »